Don’t expect all hell to break loose in Saudi Arabia when demonstrators hit the streets today in a planned show of strength. Protests are likely to be subdued, according to a Rick’s Picks subscriber who lives there. “You need to take what the news and Internet are saying with a grain of salt,” he wrote. “I am currently living in Saudi and have been talking to the locals the past few weeks. Everybody I have talked to does not believe anything will happen this weekend, nor do they want change. I am not saying nothing is going to happen, but that is the ground report. Everybody I have talked to, regardless of which Muslim religion they practice, loves the king and is grateful for what has occurred in thecountry over the past generation. You need to remember that these people were 98% nomads less than 30 years ago.”

The “experts” would indeed have us braced for the worst. “Although most political analysts predict any demonstrations to be swiftly – and perhaps bloodily – suppressed by the government,” the Financial Times reported, “any hint that the protests enjoy wider-than-expected support is likely to spook investors once again.” We suspect that even if Riyadh remains relatively peaceful, however, that crude oil prices will continue to head higher. A short while back, we wrote here that the spike in crude caused by mounting troubles in Egypt and Libya would seem relatively tame in comparison to what we might see if Saudi oil production were to come under threat. While we still think that’s true, we now expect a quiet weekend in Saudi Arabia to ultimately have little impact on energy markets that seem likely to remain in the grip of speculators. They are quite obviously determined to keep squeezing until the fever breaks, but will it? The Saudi demonstration is not the only one planned for today. There’s another in Bahrain, where Shia protestors are planning to march on the Sunni-dominated royal court in Riffa. That doesn’t sound like a very mellow mix. And in Libya, the battle could drag on indefinitely, perhaps turning even uglier if the country’s energy resources come under attack in an escalated conflict.

Prohibitive Air Fares

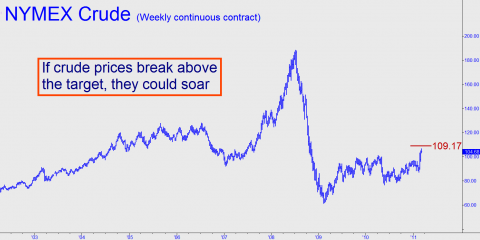

Concerning the technical picture for crude oil futures, we are currently using a Hidden Pivot target at 109.17 as a minimum upside projection for the NYMEX continuous contract. So far, it has gotten as high as 106.95. If the pivot fails to contain the rally, however, the breakout could go all the way to $151 before it hits a pocket of supply deposited on the charts as crude fell from a frenzied, all-time peak at $188 recorded in the summer of 2008. Even if this Middle East-driven short-squeeze does not break any price records, the persistence of tensions in the region is apt to keep quotes quite buoyant for the foreseeable future. Under the circumstances, we should tune out the ostentatious sighs of relief on Wall Street whenever stocks rise on a day when oil prices have fallen. The two are connected, for sure, but any bullishness based on cheaper crude is bound to be short-lived. Fuel costs have already pushed air fares so high that airports are going to seem relatively deserted this summer. How will the stimulus-addled stock market react if gasoline is headed toward $5 a gallon, as seems plausible?

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

Question: as a casual reader of your email/website, I have long associated your view of the American economy/stock market as being a perma-bear and outright deflationist–to the point that you see Manhattan condos droping in price by 95% etc. Am I correct? If so, I never have understood what time frame you place this in–5 years or 30 years into the future. Moreover, I somehow have the impression that you think the best long term (10 years?) buy and hold strategy is the long Treasury bond as any true deflationist cum depressionist would do. Is all this correct or have I really misunderstood your position. I am by the way one of the old time gold bugs (and have been in the gold market since the early 1970s), and I am Canadian. However, I do think that gold is now fully valued and widely recognized by the markets. Your comments please.