Because stocks and commodities sometimes fluctuate for reasons too complex to speculate on let alone predict, we often look to our charts to tell us what diligent guesswork and informed reasoning cannot. At the moment, our attention is riveted on the 10-year Treasury Note, which has been flirting with a major rally target, and by implication, a potentially very important low in lending rates. If so, the implied shift in Treasury paper from bull market to bear is one that we cannot afford to take lightly, since nothing would hasten the country’s descent into economic depression as certainly as the ratcheting up, even slightly, of key lending rates. Try to imagine the impact of this on, for one, a residential real estate market that has already shed a third of its value since the beginning of the Great Collapse several years ago. Commercial real estate would be in fatal jeopardy as well, since the accounting tricks that have been used to mask its true condition rival in deviousness even those the Federal government has used to conceal the fact of America’s bankruptcy.

We have been predicting here for years that home values would ultimately decline by 70 percent and that the collapse in vacation properties would be even worse, hitting 90 percent. However, given the unprecedented weakness of these markets in the face of a failed multi-trillion dollar monetary stimulus and a dead-cat bounce in the stock market that has taken more than two years to play out, one shudders to think about how quickly the final phase of the collapse would unfold were the flimsy support of artificially suppressed interest rates to be removed.

Watching Dollar Closely

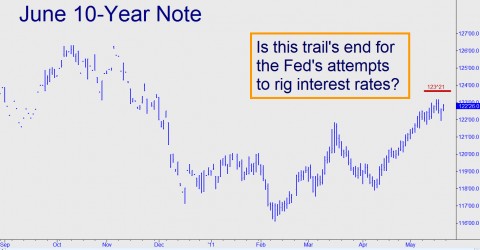

We first glimpsed the gathering storm in T-Notes during one of the impromptu webinars that we conduct from time to time during U.S. trading hours. (Click here if you don’t subscribe but would like free access the next such session.) The “Hidden Pivot” price target we identified for the June 10-Year Note lay at 123^21, a little less than two percent above the level that day. The futures have since gotten as high as 123^05 – close enough to put us on high alert for a possible downturn from just below the target. If so, it would be congruent with our bearish outlook for the dollar. Although some chartists we respect have been predicting a powerful, bullish reversal in the greenback, we see nothing that would augur such a turn, technically speaking. In fact, we’re looking for a washout in the Dollar Index to around 68.36 from a current level of around 75.66. A strong rally in the dollar would forestall a surge in real interest rates, of course, and although we remain open-minded to the possibility of this, we will wait for the charts to signal it before we get in gear with dollar bulls. A temporary and relative strengthening might result from the collapse of the euro that would occur if Spain’s financial house of cards crumbles. Although this could send the dollar soaring for a short while, we don’t see any factors that could long sustain such an anomaly as a “strong” dollar. More likely is that it is bullion that would launch into a powerful and sustained rally. If you are interested in our short- and long-term price targets for gold and silver, try a free trial to Rick’s Picks by clicking here.

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

You have to be a consumate cretin to buy bonds. Don’t have to go far away to see what happens when you make a religion of buying bonds. Greece, Ireland, Portugal. And now italian bonds are cracking. Certificates of confiscation. Bonds and bombs. They are in reality arms of mass destruction.