Gin up a garden-variety short squeeze in the index futures Sunday night, add a dollop of surprisingly less-than-horrific news from Europe, and before you know it the Dow Industrials are in an upthrust that could carry another 900 points, topping 13,000. That’s not the way things were supposed to play out. The story had it that the Fed would do everything in its power to force stocks sharply lower so that investors would flee into the dubious safety of Treasury paper. That in turn would strengthen the dollar, paving the way for yet more promiscuous monetization after this afternoon’s expiration of the abortive QE2 program. Perhaps the Masters of the Universe are still planning to implement this scheme, but with stocks falling from a higher, giddier plateau? We should know within a few weeks. Meanwhile, in theory the central bank will have some time to play with, since the Fed’s budget allows for the purchase of Treasurys with the interest on Treasury paper already held in its portfolio. (Ah, yes: How can it be called “monetization” if the Fed is actually “paying” for the Bills, Bonds and Notes it buys?)

We’ll leave it to bloggers and the not-quite-ready-for-prime-time media to examine the Fed’s method of paying for whatever it must buy at the next auction. They’re likely to find elements of Ponzi, Rube Goldberg, and Bernie Madoff, but they’ll first need to get past the stench of it to peel away some layers. In the meantime, with sovereign banks, U.S. households, hedge funds and other would-be buyers becoming increasingly skeptical toward Treasury debt, it seems plausible the central bank will deplete its interest “income” more rapidly than policymakers might hope.

What to Look For

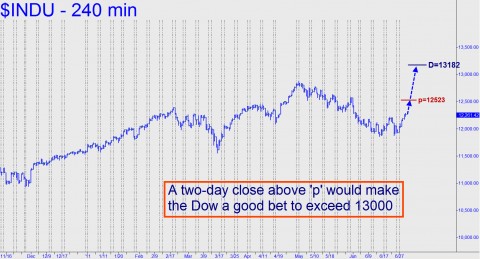

Concerning the stock market, lest our bullish forecast worry or frighten any right-thinking permabears, we would need to see the Dow, currently trading around 12,261, close for two consecutive days above 12523 before we infer that a powerful run-up to 13182 is likely. That last number is a Hidden Pivot target, and if you are skeptical about whether it will “work,” try asking a few denizens of the Rick’s Picks chat room yourself. With just a mouse-click and a few keystrokes, you can get a free subscription that includes access to a 24/7 chat room that draws veteran traders from around the world. Meanwhile, to put things in proper perspective, we’ll note that we don’t expect the Dow to get nearly as high as 13000. The 12523 “midpoint pivot” is probably as good as we’ll see, but we’d be eager to get short at those heights in any event.

***

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

US capital racket. Hey I am expecting Frank Acampuro coming back from the dead and predicting Dow Nazi Jones at 40,000. Fuck America and its Nazi stock racket. This makes so sense. Surreal indeed.