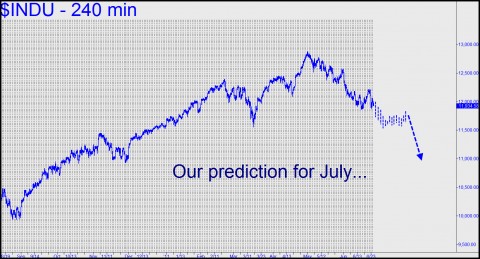

You don’t need to be a chartist to see that the stocks will need to test the key low made in mid-March before anything serious happens. For the Dow Industrials, that would imply a fall of 378 points from these levels to 11556, or about three percent. What then? Although a bounce seems likely, we wouldn’t expect it to last for more than a few days, if that long. Moreover, because the support is so obvious, we should expect the Indoos to dive toward it in the days ahead rather than approach it gingerly. After all, why would traders buy the blue chip average as it is falling if they “know” it’s going to fall at least to the support? We might expect such buying and for a bullish turn to come from somewhere above 11556 if the market had a reason to rally. In fact, The Great Recession seems to be edging toward another flirtation with Depression – one predicated on further, intractable weakness in the real estate sector, along with whatever psychological fatigue is about to hit as a result of QE2’s epic failure to stimulate much of anything.

With respect to the stock market, we would ordinarily employ the Hidden Pivot Method to forecast price action for this summer. (You can learn to do this yourself, and to do it impressively well, by clicking here). In this case, however, our target of 11506 only gets us halfway to the next logical low. Once again, you needn’t be a swami to see that the Industrial Average will fall to 11000 if the mid-March low gives way. The only question is, how quickly will it happen? Our hunch is, very quickly, especially given the prospect of a budget battle on Capitol Hill. Although until recently we had viewed the debt-limit issue as a red herring, it’s starting to look as though the Republicans, goaded by Tea Party stalwarts, will dig in their heels. As why should they not, considering that the Democrats are apparently serious about trying to balance the budget on the backs of America’s small businesses? Obama and the Democrats still seem to think that anyone grossing $250k is a fat cat, but in reality that is the threshold at which small businesses in this country begin to enjoy success — and with it, the prospect of hiring more workers. Leave it to Obama and the tax-and-spend crowd to pounce on the only sector of the economy with the potential to rejuvenate it.

With respect to the stock market, we would ordinarily employ the Hidden Pivot Method to forecast price action for this summer. (You can learn to do this yourself, and to do it impressively well, by clicking here). In this case, however, our target of 11506 only gets us halfway to the next logical low. Once again, you needn’t be a swami to see that the Industrial Average will fall to 11000 if the mid-March low gives way. The only question is, how quickly will it happen? Our hunch is, very quickly, especially given the prospect of a budget battle on Capitol Hill. Although until recently we had viewed the debt-limit issue as a red herring, it’s starting to look as though the Republicans, goaded by Tea Party stalwarts, will dig in their heels. As why should they not, considering that the Democrats are apparently serious about trying to balance the budget on the backs of America’s small businesses? Obama and the Democrats still seem to think that anyone grossing $250k is a fat cat, but in reality that is the threshold at which small businesses in this country begin to enjoy success — and with it, the prospect of hiring more workers. Leave it to Obama and the tax-and-spend crowd to pounce on the only sector of the economy with the potential to rejuvenate it.

Republicans are right to resist, even if it brings the U.S., ostenisbly, to the brink of default. And anyway, burdening the country’s most energetic and productive earners with stiff new taxes would raise a pittance in comparison with the trillions of dollars in debt The Guvvamint has run up in the name of stimulus. The impending fight on Capitol Hill isn’t going to be pretty, and we should therefore not be surprised if stocks fall hard in the weeks ahead.

***

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

@john

That is exactly what I was thinking. I must be dumb, if I can’t find a way to suck on someone else’s wealth.

Further, I must be dumb since I can not find any justification for income redistribution. To me, to violently take someone’s income and give it to someone else was always a crime. I always believe in “If one man can do it, another man can do it as well”.

But even beyond that, let us say that there is a man who makes more money than I do. Should I now lobby the government to violently take from him what is his, and give it to me?

Is this the “society” that you advocate for?

I can not agree. That is not a society, but a mob, albeit an organized one, for it simply replaced random highway robberies with an organized take by the biggest gang, the government, using the tax brackets.

If you and I have anything in common need, that probably would be the need for defense, and a court of justice. For that, I am willing to pay, but again, why should I pay any more than you do? It should be exact same amount, notice that I didn’t even say “an equal tax rate”.

What?

Did I hear you mentioning that since I have a bigger income to protect, then I shall pay more? Funny, but I do not hear you saying that the ones using subsidized public transportation should be paying more, that the ones using public schools should be paying more, the ones using welfare should bear the brunt of it, than those using it lightly or those never using it.

Oh yeah, and here is another one of communist arguments coming right back: why don’t you just create more income to protect, because it had been pointed out to me that I could use public schools if I wanted to?

This communism, this inability to keep the hands away from other people’s pockets is the reason we are going down, and not anything else.