Over One Thousand Paid Subscribers Won’t Make A Trade Without Looking At Rick’s Picks First…

- Laser-accurate trading recommendations

- Real-time notifications whenever Rick updates trade advisories

- A round-the-clock chat room that draws veteran traders from around the world who share timely, actionable ideas

- Invitations to live, online events

- Take-Requests’ sessions. Join Rick live for real-time technical analysis that can help you mitigate risk and improve your profitability

- Timely links to the very best financial analysts and advisors

- Specific coverage of stocks, options, mini-indexes, gold, and silver

Rick's Free Picks

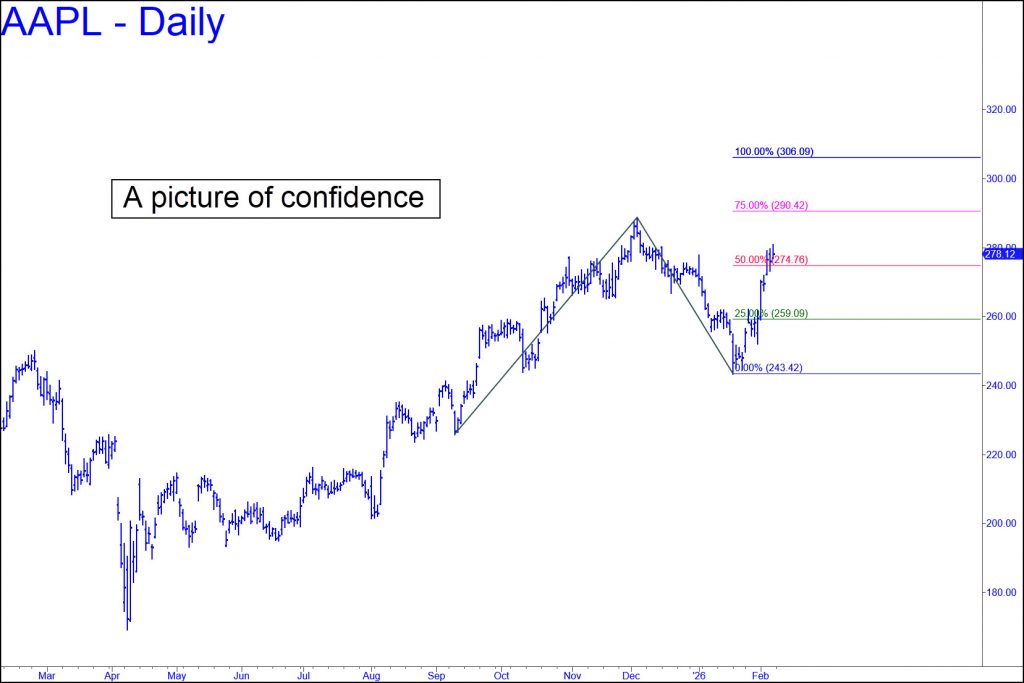

$AAPL – Apple Computer (Last:278.12)

I’ve returned AAPL to the list, since MSFT’s dirge is no longer representative of the animal spirits that have been moving the markets higher. The chart shown leaves room for a possible double top, but I’ve selected a lower point ‘A’ in order to project a likely move to new

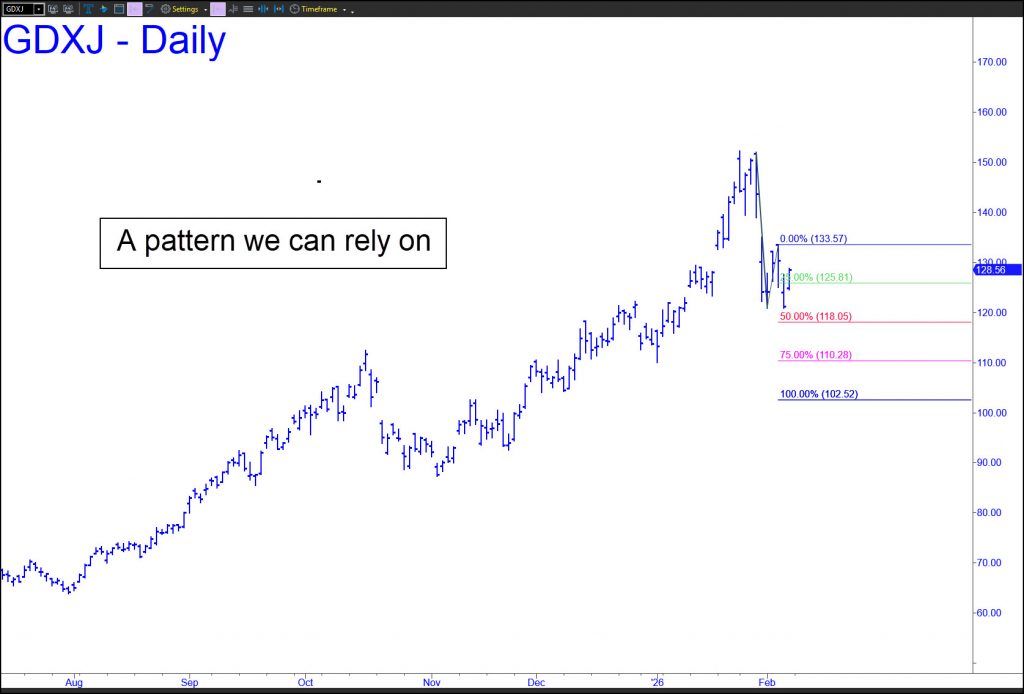

$GDXJ – Junior Gold Miner ETF (Last:128.56)

I’ll spare you the boring details, but the pattern shown, wih a 202.52 target that lies 20% below, has everything I look for. It tripped a conventional sell signal when it touched the green line last Wednesday, and the choppy downtrend since should be presumed bound for a minimum 118.05

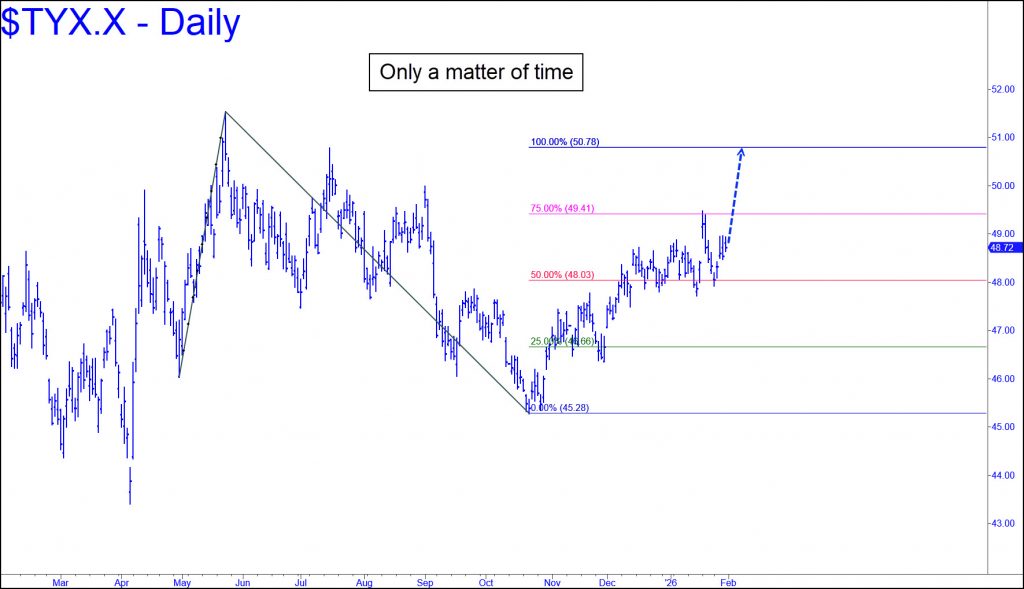

$TYX.X – 30-Year T-Bond Rate (Last:48.72)

TLT has done nothing to alleviate a dismal picture on the long-term charts. I am switching the view this week to a chart of long-term Treasury rates which points toward 5.078%. It would be the first time they’ve traded above the psychologically important 5% level since July, when a peak

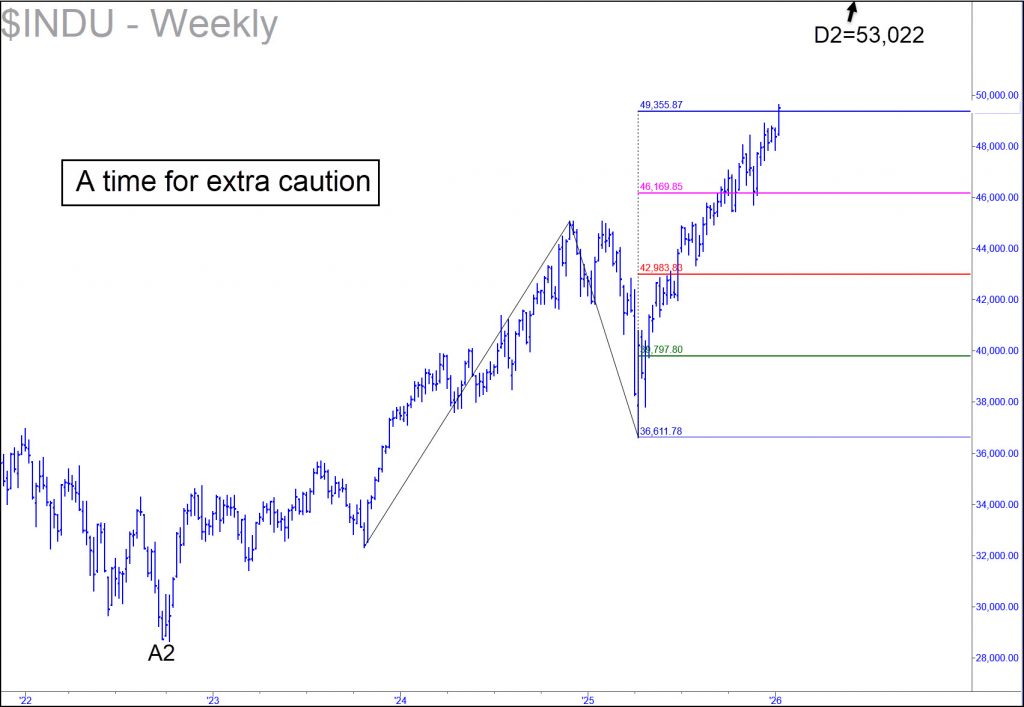

$DJIA – Dow Industrial Average (Last:50,115)

The chart is featured in the current commentary, but let me add a cautionary note for subscribers only. The 50K milestone that lies just a hair above Friday’s record settlement closely coincides with the 49,355 ‘D’ target of the pattern shown in the inset. My gut feeling is that the

Member Content

Unlock member content with a free trial subscription

THE MORNING LINE

Time to Jump on Miners

[The following commentary was written by Steve Houck. He is a longtime investor in bullion and knows the markets well. He is also a friend and former business partner. RA ]

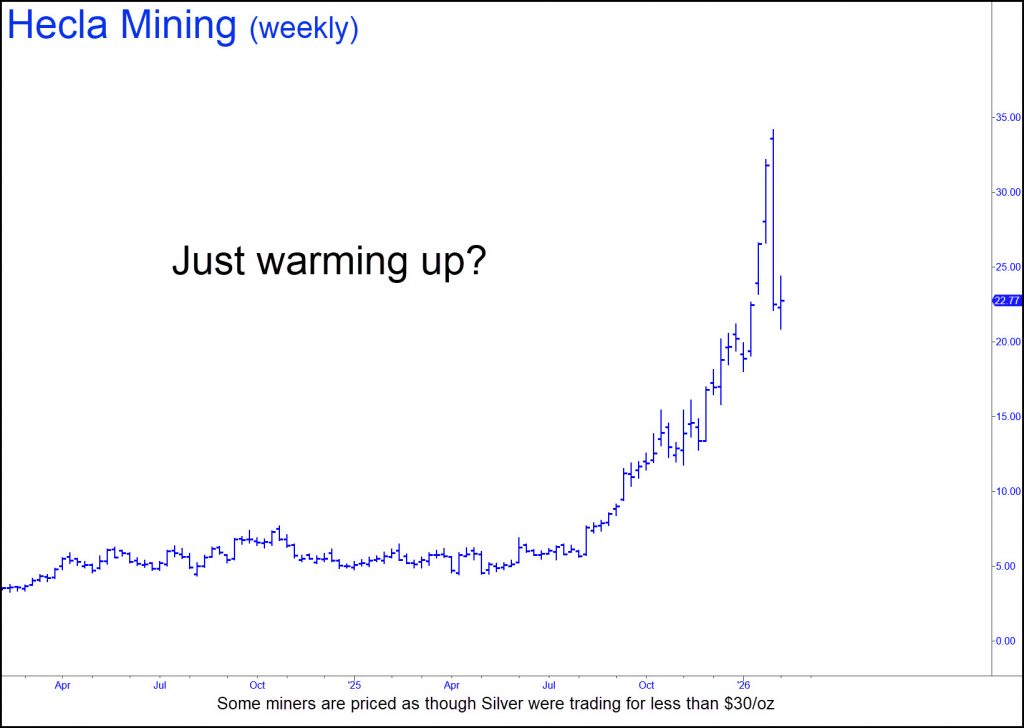

Looking at the froth in silver, it became apparent it was time to rotate from overvalued to undervalued once again. Selling precious-metal ETFs like SLV and AGQ meant cash was available for the next trade, but where to go? While silver has been on a relentless tear, the miners have only grudgingly moved higher. Yes, there have been good moves in many of the miners, but quite a few trade with a ball and chain weighing them down in the form of fear. That’s because the last two times silver surpassed $50, in 1980 and 2011, it collapsed and went into long, grinding bear markets. Silver mining stocks get caught up in this because the public doesn’t believe prices will hold, and that silver will fall back to earth.

But what if the new floor is $55 to $70, and not the $15 to $25 range that obtained for decades? This silver run-up is different because it’s about one thing: physical metal. Just look what;s happening: China, the U.S. and the rest of the world are hoarding and trying to secure metals. That puts the miners in the catbird seat, because they produce and control the supply. Their shares, however, are still being priced as though silver were selling in the $20s even though it averaged close to $50 for the entire fourth quarter 2025. The miners wil start to report earnings next week, beginning on February 16. Because many of them will announce blowout earnings, now is the time to capitalize!

How to Play It

How to play this? Over the last two decades of investing in silver miners, the most important lesson I’ve learned is to stick with producers and developers with projects slated for the near-term. I want the companies I invest in to be extracting metal from the grown now, or within no more than 1-2 years. I start with the major producers and such crowd favorites as Coeur Mining (CDE), Hecla (HL), and Pan American Silver (PAAS). Once I have a good group of the majors, I’ll move to junior producers whose stocks have the potential to appreciate by 500% to 1000%. My largest junior positions are Avino Silver & Gold (ASM), Americas Silver (USAS) and Santacruz Silver Mining (SCZM). These major and junior producers Guanajuato Silver (GVSRF). Silver Storm (SVRS: Vancouver); and Vizsla Silver (VZLA).

What our customers are saying about us...

Forecasts Delivered Before

The Morning Trading Bell Rings

As a Rick’s Picks subscriber, you will be getting this information the moment it’s posted on the membership site, usually shortly after midnight Eastern Standard Time… more than enough time to capitalize on Rick’s suggestions.

Then, throughout the day as Rick updates his forecasts with additional guidance based on market conditions, you’ll be instantly informed via email alerts… allowing you to take full advantage of breaking trends and market fluctuations.

These picks include a rotating basket of stocks, futures, indexes, and other hot issues, with a daily focus on precious metals. Rick’s Picks subscribers have their favorites, so Rick regularly covers Comex Gold & Silver, the NASDAQ, the Euro, and the E-Mini S&P in addition to the hot issues he believes will offer significant profit-taking opportunities for his subscribers.

Each specific pick is hand-selected by Rick, and includes actionable trading advice, specific price targets, and annotated Hidden Pivot charts with supporting data.

Your Free Subscription Includes:

- Laser-accurate trading recommendations

- Real-time notifications whenever Rick updates trade advisories

- A round-the-clock chat room that draws veteran traders from around the world who share timely, actionable ideas

- Invitations to live, online events

- ‘Take-Requests’ sessions. Join Rick live for real-time technical analysis that can help you mitigate risk and improve your profitability

- Timely links to the very best financial analysts and advisors

- Specific coverage of stocks, options, mini-indexes, gold, and silver

Your Satisfaction is Guaranteed

Once you see how powerfully accurate Rick’s forecasts truly are, we’re sure you’ll stay on as a full member. But if for any reason you’re not convinced, simply cancel before the two week’s end and you won’t owe us a single dime. Fair enough

Paid Subscriptions We Offer

Monthly

Annually

Rick’s Picks Subscription

If you are looking for trading recommendations and forecasts that are precise, detailed and easy to follow, look no further.-

‘Uncannily accurate’ daily trading forecasts

-

Real-time alerts

-

Timely commentary on the predictions of other top gurus

-

Timely links to the world’s top financial analysts and advisors

-

Detailed coverage of stocks, cryptos, bullion,

index futures and ETFs -

A 24/7 chat room where veteran traders from around the world share opportunities and actionable ideas in real time

Rick’s Picks Subscription

If you are looking for trading recommendations and forecasts that are precise, detailed and easy to follow, look no further.-

‘Uncannily accurate’ daily trading forecasts

-

Real-time alerts

-

Timely commentary on the predictions of other top gurus

-

Timely links to the world’s top financial analysts and advisors

-

Detailed coverage of stocks, cryptos, bullion,

index futures and ETFs -

A 24/7 chat room where veteran traders from around the world share opportunities and actionable ideas in real time

Mechanical Trade Course

A very simple set-up that will have you trading profitably quickly even if you have never pulled the trigger before, and even with a small account.-

Leverage violent price action for exceptional gains without stress

-

Select trading vehicles matched to your bank account and appetite for risk

-

Reap fast, easy profits by exploiting the ‘discomfort zone’ where most traders fear to go

-

Enter all trades using limit orders that avoid slippage, even in $2000 stocks

-

Learn how to read the markets so that you no longer have to rely on the judgment of others