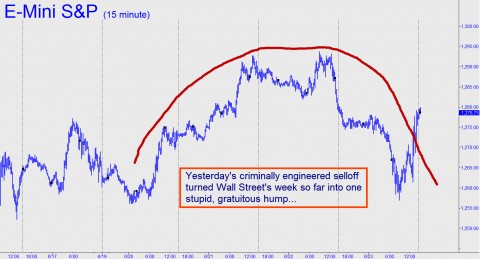

Stocks performed a fright-mask swoon yesterday as traders collectively demonstrated yet again that one morning’s perfect knowledge does not necessarily a perfect afternoon make. It was tricky going for all of us, although in retrospect the selloff merely mirrored the flaky, gratuitous rally that occurred earlier in the week. Our own near-term expectations for stocks had been bullish Wednesday night, but that’s not to say we were surprised by yesterday’s quasi-criminal shakedown. Many widows and pensioners will have crashed on the tarmac, blowing out their portfolios at the lows — which in the case of the Dow Industrials amounted to a nearly 240-point deficit. A pity so many seniors probably took it in the shorts, since the Indoos recouped fully three-quarters of their losses by day’s end. Those who hung on for dear life are bound to feel better after yesterday’s adroitly engineered hoax has played out in full with a rally that could take the September E-Mini S&Ps back up to 1298.50 – equivalent to a Dow rally of about 320 points from Thursday’s bottom. Incidentally, you could learn to calculate these targets (and trade entry-points) yourself – and it’s not nearly as hard as you might imagine. Click here for details about the upcoming Hidden Pivot webinar on June 29-30.

Speaking of calculations, we can save Goldman some time where predictions for the price of Brent Crude are concerned. The dastardly firm’s “energy team” evidently was in a tizzy yesterday over the day’s Big Surprise, the release of 60 million barrels of oil from the strategic reserves of a bunch of countries. Whoever authorized this global distibution of swag, presumably to launch the U.S. dollar into the doomed trajectory of a bottle rocket, must have thought that crude oil was in danger of not falling by itself. They needn’t have worried, since we’ve had Texas crude falling to at least $85 since early May, when the futures ostensibly looked like they were getting second wind for a thrust above $100. At yesterday’s lows, the July NYMEX contract still had about $6 to fall. As for Brent, look for the August 2011 contract to ease to exactly $102.95 before DaBoyz flip the switch. The futures settled yesterday at 107.26, up from a $105.80 low, and although they ended the day on a weak upswing, we’d consider a rally to 111.46 a gift to bears wanting to short into strength. A stop-loss as tight as 30 cents can be used to initiate the trade.

Speaking of calculations, we can save Goldman some time where predictions for the price of Brent Crude are concerned. The dastardly firm’s “energy team” evidently was in a tizzy yesterday over the day’s Big Surprise, the release of 60 million barrels of oil from the strategic reserves of a bunch of countries. Whoever authorized this global distibution of swag, presumably to launch the U.S. dollar into the doomed trajectory of a bottle rocket, must have thought that crude oil was in danger of not falling by itself. They needn’t have worried, since we’ve had Texas crude falling to at least $85 since early May, when the futures ostensibly looked like they were getting second wind for a thrust above $100. At yesterday’s lows, the July NYMEX contract still had about $6 to fall. As for Brent, look for the August 2011 contract to ease to exactly $102.95 before DaBoyz flip the switch. The futures settled yesterday at 107.26, up from a $105.80 low, and although they ended the day on a weak upswing, we’d consider a rally to 111.46 a gift to bears wanting to short into strength. A stop-loss as tight as 30 cents can be used to initiate the trade.

***

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

Just Tweeted :

bot SPX puts and tightened trailing stop losses…