Rick’s Picks subscribers were in on the fun in real time yesterday when gold quotes went ballistic around mid-session. The strong rally may have come out of the blue for some traders, but not for us, since we’d prepared subscribers with a bullish trading “tout” the night before. We noted at the time that gold futures had looked “unintimidated” at the closing bell that day, and that they appeared ready to blast off. The best part was that we were able to watch – and trade – the anticipated surge as it occurred because we held ringside seats at an impromptu online “webinar.” Rick’s Picks frequently holds such sessions, alerting subscribers via e-mail when they are about to begin. Their purpose is to identify actual trading opportunities in real time, rather than merely talking about what the Hidden Pivot Method “might” have accomplished if only we’d used it.

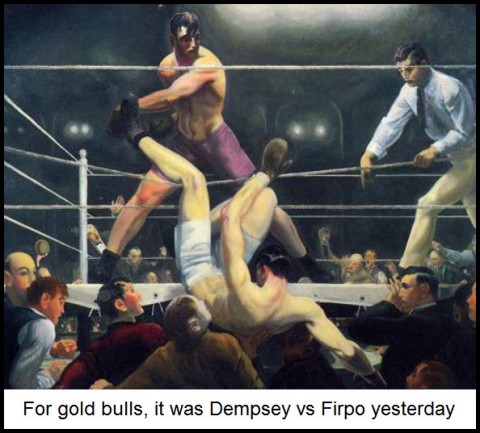

This time, our preparations paid off when gold behaved exactly as expected. The bullish target we’d identified Monday night was 1574.40, about $23 above where August Gold was then trading. In the actual event, buyers pushed the futures to an intraday high at 1574.70 — exactly three ticks from where we’d anticipated a short-term top. They then entered a shallow correction that was still going on as we went to press early Tuesday evening. However, if and when the ‘Auggies’ regain traction, we’ll be looking for a second-wind push over the near-term to as high as 1589.40. That target was included in the tout sent out Monday night and still looks like a good bet.

Most gratifying of all yesterday was the e-mail we received from a subscriber, John F., who jumped into a gold trade while the webinar was in progress. “As a piano tuner on vacation in Lake Placid, I joined the impromptu session today, fired off an e-mini gold trade during your commentary, and caught the move. I’ve been using the techniques learned during last month’s webinar and have already paid for the course – and it looks like I’ll be able to cover at least some of the costs of my ‘vacation/trading camp’ too.” Great going, John, but we hope your next report brings us word that you landed a 15” bigmouth. Meanwhile, readers who would like to be alerted when the next impromptu session is about to start should click here for a free trial subscription to Rick’s Picks. It will entitle you to all members’ privileges, including detailed and precise trading recommendations each day for some of the most popular vehicles, and access to a chat room that draws seasoned traders from all over the world 24/7.

***

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

Amazing, 1589.40 on the nose today.