Comic relief came yesterday in the novel form of a Colorado shootout that put the until-recently-unheard-of Dougherty Gang behind bars and left gun-moll and self-styled redneck stripper Lee-Gracey Dougherty with an exit wound in her leg. Only in America, as they say. As we went to press early Thursday morning following an all-day outage of Rick’s Picks (and a thousand other web sites served by a Dallas data center that was hit by a power blackout), the Bonnie-and-Clyde wannabees were still the top story on Google news, proving that timing is everything if you want to be an overnight sensation.

Wall Street in particular must have welcomed the entertaining story of the Dougherty siblings’ interstate armed robbery spree, since, without it, the evening news would surely have been dominated by video clips of trading-floor denizens puking their guts out following a 520-point plunge in the Dow. However, as of late Wednesday night, it would appear that the traders had lost little time trying to wrest back control of the headlines with their own brand of comic relief: a 200-point rally in Dow index futures that was continuing into the wee hours on Thursday. We wouldn’t be so churlish as to admonish them for their newly reinvigorated faith in America, but shouldn’t someone break the bad news to them about the dire condition of Spain and Italy?

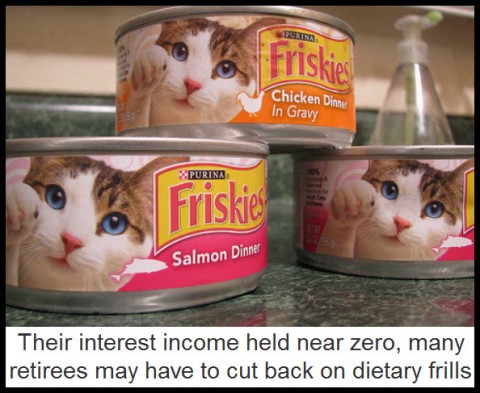

Meanwhile, the previous, huge dead-cat bounce, a 429-pointer on Wednesday, elicited in the Boulder, Colorado Daily Camera what may have been the most clueless headline concerning the economy that we’ve seen all year: Fed Pledge Boosts Stocks. So, did yesterday’s 520-point reversal perhaps occur because somebody discovered the Fed had crossed its short, slimy little fingers when it made that promise? The sub-headline was just as bad: Market Soars After Reserve Vows to Maintain Low Rates into 2013. Just what we needed: another couple of years of interest-free borrowing by speculators from the nest eggs of grandma, grandpa, and 75 million Baby Boomers who until a few years ago actually believed they’d be able to retire at 65. They still can, of course, provided they’re willing to subsist on the cat food, senior-center shuffleboard and afternoon matinées that the interest on a million dollars buys these days.

Generational Blame is an interesting concept. No-one likes to think they have benefitted at the expense of another generation. We all have benefitted from the efforts of previous generations but the youth of today can certainly point to the 40-85 crowd and claim that they perhaps lived off the fat of the land when it was plentiful.

I can look at my own parents and see a 55 fold increase in the value of a house purchased in 1961. Not likely to be repeated without Weimar consequence now. Tax laws, at least here in Canada have been a one way street in favour of my parents generation first, and my own second. Ditto with regard to our equivalent of social security, which allowed many seniors here to collect all that they ever paid in within a few years or less. One could point out that when I went to university it was heavily subsidized and our version of medicare was not. Today, it is the other way around. Two incomes mandatory today, not so in my parents time. ….and so on