Now that was impressive! An earthquake, of all things, shakes the Big Apple yesterday as it hasn’t been shaken since 9/11, and Wall Street never even breaks stride. Early reports suggested that some denizens of the Bowery were fearful the city might be under attack again. They may have breathed a sigh or relief, however, when it became clear that the tremor was “only” a magnitude 5.8 earthquake, not a suitcase nuke. Before the Virginia-centered quake hit shortly after 2 p.m., a strong rally was already in progress from the night before, propelled by who-knows-what. The temblor had no discernible on the markets, but it rattled big cities up and down the Middle Atlantic coast. Breaking news pushed Hurricane Irene temporarily off the front page even as the mounting storm, with sustained winds above 90 mph, threatened to wreak havoc on the East Coast this weekend. Traders were unfazed by it all, however, and by day’s end the buying spree had become a runaway freight train, sending the Dow up 322 points. The mania steepened in the final hour, sellers evidently having realized that resistance was futile.

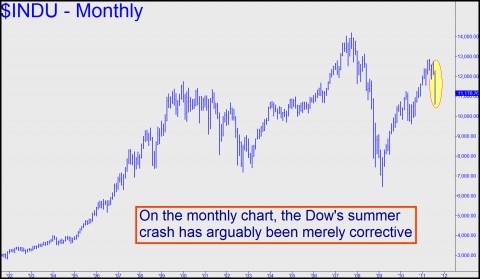

At the same time, Gold and Silver were getting pummeled, as so often occurs when the stock market behaves as though all were right with the world. December Gold came off its overnight high by $93, hitting a low of $1819 in the late afternoon, while September Silver was off a whopping $2.78, or a little more than six percent. As the Great Recession tightens its grip, we look forward to a resumption shortly of the buying in bullion and the continuation of the stock market’s penitent decline. Even so, we are forced to acknowledge that there is nothing in the technical picture that would preclude a very strong bounce here – to new highs, even. We said as much in a Hidden Pivot analysis of the Dow Industrials disseminated to subscribers on Monday: “The summer’s powerful selloff is still merely corrective on the monthly chart. I mention this not because I think the market is likely to come roaring back to new highs, but to remind you that we must always interpret the signs disinterestedly. If we do so here, it forces us to acknowledge that the second phase of the Mother of All Markets, begun a little more than a year ago, exceeded the required “internal” and “external” peaks to create a bullish A-B leg of monthly-chart degree. Although it has recently given way to a less powerful bearish one suggestive of a ‘duel,’ this dynamic, strictly speaking, implies that the bulls still hold a slight edge.”

Heavy Insider Buying

Cutting to the chase, the charts could be interpreted as saying the so-far 2147-point selloff in the Dow Industrials since July 21 is just a normal, healthy correction in a still-breathing bull market. We should note as well that our astute colleague Steven Jon Kaplan, The True Contrarian, has been acquiring stocks aggressively of late, in part because of insider buying that he says has reached “incredible extremes.” It sounds surreal to us that stocks would be embarking on a major bull leg just as the economy is beginning to weaken noticeably. Stranger things have happened, though, especially in the lunatic world of stocks and bonds, and so we can only resolve to be more diligent than ever in reading the technical runes with cold objectivity. If you want to closely follow our analysis, which is updated round-the-clock, consider taking a free trial subscription to Rick’s Picks. It will give you access not only to timely analysis and detailed trading recommendations, but to a 24/7 chat room that draws savvy traders from around the world.

***

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

Robert, very good points indeed. I should tell you I turned bullish on gold in 2000. These past two weeks I have reduced exposure substantially since it went so pabolic (in linear graph terms). If you have visited the FOFOA pages you will see some other arguments over the superiority of physical over stocks. Yes, storage is a problem and every gov’t has the “right” to steal it from citizens. Gold in the ground is also easy to confiscate, although it is easier to store! I will watch your trade with ineterst and I wish you success. Personally I am going to wait for a larger correction