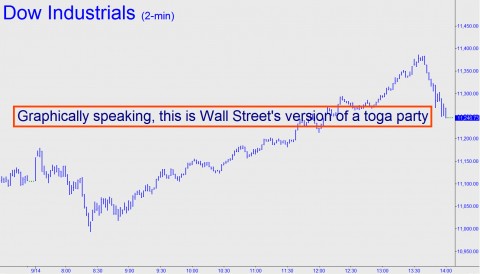

The Dow was up nearly 300 points at its highs yesterday, savaging bears who may have gloated over last week’s equally impressive decline. These short-squeeze rallies are usually catalyzed by economic headlines, and it doesn’t seem to matter whether the news is good or bad, since the markets have a mind of their own and can sometimes surge on the gloomiest data. U.S. markets actually seem to thrive on bad news as long as it does not emanate from Europe. But it is probably just force of habit that causes shares to rise at such times, since, for nearly a decade, ostensibly bearish stories came to be associated with a likelihood of further easing by the Fed. Easing is of course no longer possible with administered rates already at zero, but any news that might help us cling to the notion that things can’t get much worse is arguably a plus for stocks.

So what were the day’s headlines? The top stories could not have been much gloomier. For starters, we learned that the inflation-adjusted income of male workers has not increased since 1978. Nor have households fared so well in more recent years despite Keynesian and monetary stimulus amounting to many trillions of dollars. Even with all of those digital bucks flooding the financial system, however, the income of the typical American family appears to have dropped for a third straight year and is currently at 1996 levels after adjusting for inflation. A report on this in the Wall Street Journal noted delicately that the statistics showed “how devastating the recession was [our emphasis], and how disappointing the recovery has been.”

Rodney Dangerfield

That’s putting it mildly – not to mention, in a way that denies what we all know – i.e., that The Great Recession never left us…has been with us since the Great Financial Collapse of 2008-09. Statistically speaking, our 1930s-style wallow has been the Rodney Dangerfield of hard times, failing not only to get respect from the press, the Federal government and its statisticians, but mere acknowledgment. To the credit of the mainstream media, however, they have ceased to seize upon such rallies as yesterday’s as evidence of anything more than a random walk run temporarily amok. That’s progress of a sort, we suppose, although we’re not going to hold our breath waiting for the New York Times and their ilk to give us a market wrap-up that explains just how Fibonacci levels work.

***

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

That game is over, David. As I tried to make clear in Wednesday’s commentary, bank profits have been reduced to paltry transaction fees:

http://www.rickackerman.com/2011/09/bankings-titans-finally-get-their-comeuppance/

At this point, clearly, it is worth zero to “own the printing presses.” What can TBTB buy with the money — other, perhaps, than a little more time and a bigger crash?