[Our friend Rich Cash, a seasoned trader who has been through many bull and bear markets, has come up with some eye-popping numbers below for some of our favorite trading vehicles. Silver at $10 an ounce when the Great Recession becomes something much worse? It’s just speculation now, but the point of the exercise is to mentally and psychologically prepare us for…anything. Read on for an old pro’s take on shifting paradigms. RA ]

In August 1987, inspired by fellow Merrill Lynch Alum Arch Crawford and Harmonic Convergence bullish market hysteria, we commissioned a high net worth productive enterprise conclave at the Chemical Club, with its downtown view of the World Trade Centers and Statue of Liberty, all overlooking what was one of the busiest harbors in the world, since displaced by central planning mercantilist Shanghai, Singapore, Hong Kong and 9-11. Our topic was the unpopular if accurate one: The End of the Trend? Our turnout was less than the recent Buffett Obama Wall Street fundraiser at Four Seasons, “Tax Hikes for the Rich.”

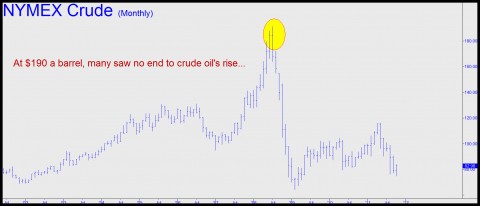

At the end of the trend, no one wants to hear about the end of the trend. No one believes it and few bring themselves to trade it. So what if we are in decade-plus equity bear market, gold commodity bull market and three-decade bond bull-market trends? Is there anyone on the street who thinks it even remotely possible that currently profitable paradigm trends will end? No? And we are unanimous in that. What about a Gedankenexperiment (thought experiment) financial fantasy just for fun and profit? Suppose Long Treasury interest rates, 2.694% as this is written, actually continued down to their current target of 0.8%, dead-as-a-doornail depression levels? Would it be fair to say there might be some changes in other asset prices? No man nor market is an island in Abu Dhabi. Would this matter to a world apparently running out of affordable fuel, housing and healthcare, clean air, constitutional rights, fresh water, healthy food, private communications and safe travel?

At the end of the trend, no one wants to hear about the end of the trend. No one believes it and few bring themselves to trade it. So what if we are in decade-plus equity bear market, gold commodity bull market and three-decade bond bull-market trends? Is there anyone on the street who thinks it even remotely possible that currently profitable paradigm trends will end? No? And we are unanimous in that. What about a Gedankenexperiment (thought experiment) financial fantasy just for fun and profit? Suppose Long Treasury interest rates, 2.694% as this is written, actually continued down to their current target of 0.8%, dead-as-a-doornail depression levels? Would it be fair to say there might be some changes in other asset prices? No man nor market is an island in Abu Dhabi. Would this matter to a world apparently running out of affordable fuel, housing and healthcare, clean air, constitutional rights, fresh water, healthy food, private communications and safe travel?

Adapt or Die

Suppose Silver prices, in April as high as $49.82, continued down toward their depression target of $10, ten times the silver dollars some of us collected as kids? Will people sell their silver to return to bank dollar deposits if 10% fractional reserve financial institutions ran out of cash, were forced to mark mortgage loans down to market value to stay in business, while government revenues collapsed? By this time, certain Rick’s Picks readers are no doubt extremely uncomfortable with these trends and what they may mean for our future financial welfare.

No one has a crystal ball, but it is worth noting trends do change and we traders adapt or die. Meanwhile, we were 99.65 percentile yesterday with the CNBC Contest, just trailing the trend stopping changes in and out. Maybe the paradigms shift soon, so let’s resolve here now to do more of this profitable, simple trend following while stopping changes in and out, no matter where markets go this fall.

****

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

Just caught an error in the essay for which I apologize. Silver outperformed bonds and stocks the last decade, not the last 30 years. Thanks all…