[We used to think Nobelist Paul Krugman was the Looniest Economist in America, but Rutgers professor James Livingston recently emerged as a solid contender with an absolutely dumbfounding op-ed piece in the New York Times that said, essentially, that America’s wealth has come mainly from Government spending and consumption, not from savings and investment. In the essay below, we give our friend Edward Furst, a member of Young Americans for Liberty, a rebuttal opportunity. RA]

We all know that the New York Times isn’t exactly a bastion of free-market thinking. But a recent op-ed by Rutgers Professor James Livingston, a guy who makes Paul Krugman look like Milton Friedman, went beyond the pale of economic sanity. His basic contention is that economic growth comes, not from private investment, but from “consumer debt and government spending.” Livingston points to the increase in per capita GDP over the last century despite the relative atrophy of private investment as a percentage of GDP, the growth in government spending, and the general increase in consumer debt. Here we encounter the age-old conundrum of historians unschooled in economic thought (Dr. Livingston has a bachelor’s degree in British and American literature, a masters degree in Russian history, and a doctorate in American History).

In a rebuttal to this op-ed, George Mason University Ph.D. economics professor Don Boudreaux aptly noted that “Because each dollar successfully invested raises GDP by multiple dollars, net-investment’s decline as a share of rising GDP… is evidence of the impressive success of private investment…” But even this analysis seems to take for granted the efficacy of Gross Domestic Product as a viable metric of economic performance.

Building Keynes Monument

Imagine for a moment that the Federal Government had embarked on a “stimulus” program to erect a giant obelisk commemorating the life’s work of John Maynard Keynes. Thousands of previously unemployed people would be given “jobs” and GDP would rise accordingly. But would the economy really improve? Would consumers get the benefits of cheaper products and higher living standards? Of course not. The project would eventually be finished, and the government (i.e., the taxpayers) would simply owe that much more to its lenders.

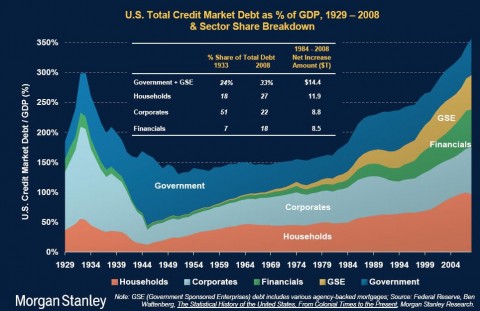

In a way, that is what happened to the economy. Government tried to approximate value, but instead created a glut of debt and malinvestments. Through the use of monetary policy, regulations, tax incentives, subsidies, GSEs, and implicit bailout guarantees, the government engineered a machine doomed to implode. While GDP and consumer spending are at nearly all-time highs, American productive capacity has been greatly dismantled and no amount of borrowing and consumption can fix it.

Bad Advice Always Available

Livingston does not seem to understand that debt eventually needs to be paid back nor the problems inherent to growing trade deficits. In this man’s mind, countries subsidizing American consumption will continue at their own expense without gripe. Indeed, he says “we should bank on consumer culture… we consumers need to save less and spend more in the name of a better future.” But this catabolic prescription is the exactly the opposite of what we need. Contrary to the Livingstonian delusion, savings, capital formation and investment are the foundations of real economic growth and productivity.

Unfortunately, people like James Livingston and Paul Krugman are always around to give bad advice that is all too often heeded by politicians. In 2002, Krugman advised that “Alan Greenspan needs to create a housing bubble to replace the Nasdaq bubble.” Now we’re being advised to go further into debt to buy consumer goods from China. At this point, if we continue to believe these guys, we deserve whatever we get.

***

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

One last shot–I’ve got to get this one out of my system :-). It may be that if we get the country back to a sound economic footing, there’ll be jobs for former public sector employees in the private sector. Don’t think, though, that those pub-s employees are in any hurry to switch over. Why would they want to give up their sinecures for jobs in the competitive marketplace? I speak as one who knows, having been employed on both sides. There is a huge difference between the two, believe me.