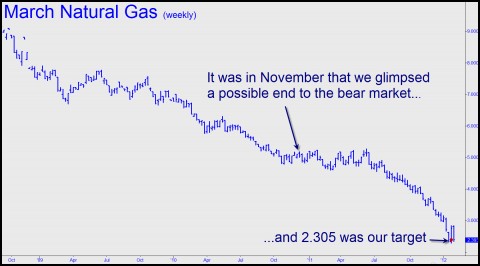

Natural Gas futures were trading for around 3.58 in November when we projected a possible bear-market low at $2.30. Imagine our excitement when, ten days ago, on January 23, the March futures contract trampolined from within exactly 1.6 cents of our target, shattering the despair and deathly calm of a relentless, multiyear sinking spell that had not seen respite since last spring. The initial leap was enormous, to 2.63, and anyone who bought down around the target would have reaped a $3400 profit per contract on the first day of the move. We had prepared subscribers for a potentially tradable bounce, reiterating our contrary stance on January 12 with this advice: The futures were barely able to muster a dead-cat bounce on that last effort. Even so, the 2.305 will remain a good place to try bottom-fishing aggressively with our habitual penny-ante stop-loss. At the time, the futures had been falling, falling, falling, but they were still well above our target, trading around 2.80. However, the next week saw them plunge, kamikaze-style, precisely to the Hidden Pivot support where we had anticipated a turn.

In tracking our own recommendations, we never assume subscribers are making money merely because a trade that we advised triggered. In this case, a subscriber reported in the Rick’s Picks chat room (click here to access this 24/7 service free for a week) that he had indeed bought some contracts at the 2.30 target. And so we established a “tracking position” to guide him and any other subscribers who had caught the low. In the ensuing days, the steep rally continued, peaking on January 26 at $2.84. At that point, each contract purchased would have racked up gains of about $5400 before commissions. We advised partial-profit taking that effectively reduced the cost basis on the 25% of the position remaining to 2.12 per contract. And then we sat back and waited for a fabulous new bull market to unfold in natural gas. The chart above tells what happened next, and you don’t need to be a trader or technician to see that bulls got suckered again. Which is not to say Rick’s Picks bulls lost money. On Tuesday, just before the futures dove anew, we advised exiting the remainder of the position if it traded down to 2.39. This it did, and then some. In theory, this gambit would have produced a theoretical profit of $2700 for traders who followed our advice from beginning to end.

As for natural gas, although the March contract has yet to breach the January 23 low, we would not lay odds that it will hold. Technical considerations aside, the vague impression one gets is that the bear market in this useful, clean but difficult to transport fuel will never end. As traders, however, because we know that this cannot possibly be so, we will continue to look for the elusive opportunity that could reward our efforts spectacularly.

***

(If you’d like to have these commentaries delivered free each day to your e-mail box, click here.)

“…other then survival necessities”

Well, I guess that means Apple is still a hold, if not a buy, because many many iPhoners out there would rather go naked, if not starve, before parting with their next gen toy!

I think you’re Greek comment is prob. on point, but somehow the notion that MF was used as a hit on those planning on removing gold and silver from the warehouses, is appealing. It’s not as though they are not aware of what Ted Butler or Antal Fekete have been saying, and it is something they have to keep from happening for as long as they possibly, and no matter how criminlly that is, they can.

It isn’t after all just the Comex or LBMA warehouses, it probably also includes the SLV and GLD, and perhaps much of unallocated storage, ex. at the Perth Mint and so on…..