[Rick’s Picks has never promised subscribers that we would make them rich. That takes hard work and discipline, as well as the understanding that it is impossible to succeed by blindly following someone else’s advice. Our goal is to give people the tools they need to trade confidently and with very tight control of risk. One subscriber, Dale P., has been hard at it for six years, diligently honing his expertise in applying the Hidden Pivot Method so that, he says, it now produces significant income for him. Dale, who work nights in the health care field and trades during the day, talks about the learning process in the guest commentary below. It is actually an excerpt from a recent discussion in the Rick’s Picks chat room. If you are interested in learning more about our proprietary method for trading and forecasting yourself, click here. RA]

“[In the chat room just now], Johnny asked if anyone was making money here, and I would like to give him my answer supported with facts that, for the most part, you can verify [by checking out trades I’ve signaled in here today]. Yes, we are making money here. Often, subscribers come in to thank Rick for helping pay off their subscription, or a loan or car note, etc. I have never blown my own horn, but today I will. I began following Rick six years ago when he was posting “black box” predictions on another website. Eventually he went to a fee-based subscription. I had lost thousands of dollars trading options, and my 401k’s were ravished. I had never ventured into the futures markets. I decided that I had to do something to stop the bleeding, so I subscribed to the new Rick’s Picks, and in the first month or two, took his course for $975. It was an eye-opener — the best market decision that I have ever made. Since then, I have made nearly seven figures using his Hidden Pivot system.

“Not convinced? I understand. Lets ‘follow the money.’ Keep in mind, that because JP Morgan’s Blythe Masters and other trading desks have sent their monkeys to monitor this chat room, sometimes I/we don’t give our precise buy and sell points. Nevertheless, just today, I have made several posts, but in particular, look at my posts at [various times during the day]. I don’t reveal the size of my trades, but you can assume they are multiples of one. The first trade [in June Gold], a short from 1594.5 to 1574.1, produced a gain of $2000 per contract. (See my posts at 03:02 and 03:26). At 03:13, I posted that I had covered my short (from 1594.5) and gone long at 1574.1; I covered the long at 1576.10 (or $200 per contract higher). My stop-loss was posted at 03:51; at 09:10, I posted a Hidden Pivot pattern that I used to get short at 1782.7 and listed targets that were determined using Rick’s system. I covered half for a gain of $410 per contract at the midpoint (posted at 09:32) and was stopped out on the other half, as posted at 09:42. So, on average I netted $205 per contract on that trade. At 10:53, I posted a short on the E-Mini S&P (at 1360) ; I’m still short and up $550 per contract as I type this. At 11:11, I shorted [June Gold] again at 1589, (current price 1580.80). but didn’t get it posted because [conversations in the chat room] had me tied up. So you can see (or should be able to see) that I am up a ‘multiple’ of $3775 [on the verifiable] trades listed above. Do we make money here? Yes.

‘I Tried and Lost’

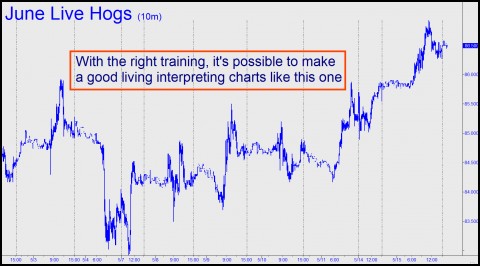

[In the chat room, ‘Doma’ responded: “Dale, I must agree. I tried a lot and lost a lot, but trading became safe and find with Rick’s magic Hidden Pivots.” Dale answered as follows: “Rick is a Master. Have a little faith and go for it. You’ll make your entry fee back in hours (days at most). Then make hay until Uncle Sam shuts it down. [Another trader in the room noted that “We are not all futures traders [with plenty of capital], to which Dale replied: “Neither was I when I took the Hidden Pivot course. You can open an account for as little as $5000. Initial margin requirements to trade the E-mini S&P is $4000 (day traders, $1250), Gold is $8500 (day traders, $5031). But the system works for E-minis, Natural Gas ($372 margin), 10-year bonds ($439), lean hogs ($743), Dollar Index ($1197), Corn ($1182), Soy Beans ($1688), and E-mini Crude Oil ($2530).”

If you’d like to join the chat room and ask traders yourself how they’re doing, click here for a free trial subscription to Rick’s Picks.

I’m sure someone makes money. I’m also sure someone loses money. Like gambling, it’s a zero-sum game. There’s an associated bell curve, so there will be a few that appear to make money consistently. However, I wouldn’t bet on their staying there for long.