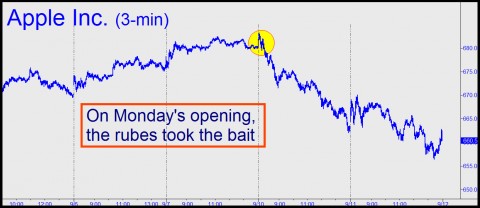

You’ve got to hand it to the arse bandits who make their living manipulating Apple shares each and every day. This week, they demonstrated yet again that they reign supreme in the hierarchy of quasi-criminals who populate Wall Street. For months, they’ve been goosing the stock repeatedly with short-squeeze rallies fueled by The Coming of iPhone5. Such shenanigans are to be expected in AAPL in particular because institutional traders, like that famed bank robber of yore, Willie Sutton, have gone where the money is, gaming the shares of the world’s largest company. With iPhone5’s high-profile introduction slated for this morning, how have Apple shares behaved? In a word, diabolically. On Monday, the rubes who bought the opening with market orders got crushed in a classic bull trap. The stock gapped up to $683 in the first moments of the session, but it was steeply downhill from there. By day’s end, Apple had fallen to $662, a 3% plunge; then, still lower on Tuesday, to a prospective bear-trap low of $656.

With the stock feinting toward hell, we should keep in mind not only that Apple Inc. is expected to sell as many as 53 million iPhones in the fourth quarter, and perhaps 266 million more in 2013, but that each and every device is priced to fully exploit Apple’s unique cachet among younger buyers in particular. For Apple, it’s like being able to sell Manolo Blahnik shoes or Vuitton handbags at ridiculous prices — but to buyers of many ages and both sexes, not just women. As a result, Apple’s margins are by far the best in the business, iPhone5 is destined to be a monster hit, and the stock itself has become all but impervious to pessimism. So what was it doing yesterday trading for $656, down $27 in the space of mere hours? Answer: Trying to scare the pants off any nervous Nellies who might still be induced to part with AAPL shares at distress prices.

A Trading Strategy

For our part, we’ve guided subscribers in constructing an option hedge that has made the stock’s engineered price swings painless thus far. Specifically, those who followed Rick’s Picks trading “touts” precisely would be short four September 615 puts @ 6.20 or better; long two October-September call spreads @10.00 or better; and long eight December-October 620 put spreads for no more than 14.00. Work the numbers and you’ll find that the position produces a theoretical gain over a wide range of prices, and that the wild swings we’ve been seeing lately would have caused little anxiety. If you want to follow our tactics for trading stocks, index futures and options in real time, click here for a free trial subscription.

***

Trading stocks, options and commodities in these treacherous times calls for great patience and skill. Click here if you’d like to see how Rick’s Picks approaches the challenge.

I don’t know where Apple’s stock price is going, but I know where my MacBook Pro will end up. I had a problem today while more than 1000 miles from home with no access to other computers. The Florida Mall store in Orlando had the part I needed, a 20 min fix. They refused to replace the touchpad. Said a 1 to 3 day fix, no specific time table allowed.

I said I needed it for business use, even said why and explained. They said they didn’t care. I got the same treatment as an 11 yr old wanting to play Angry Birds.

Called online, was told the same thing. Earning a living using their computer doesn’t give me priority.

The Millenium store in Orlando was willing to fix it but didn’t have the part.

My computer will soon be a one that can be repaired wherever I’m currently located.

I will also not be buying the new I-phone 5 in October, neither will my wife.

If this is how they intend to treat customers, Apple will soon be a short.