What kind of batter crowds the plate after a pitcher has aimed a fastball at his head? “Batters” have been doing it routinely on Wall Street lately — most recently yesterday, when they held the broad averages buoyant while Google shares were getting pasted for 80 points. During this single-stock onslaught, the Dow Industrials were never down more than 50 points and closed off only slightly with GOOG still $53 in the hole. This wasn’t the first time bulls have leaned into the plate while “dusters” whizzed past their ears. A day earlier, they pushed the blue chip average to a small gain while IBM was getting savaged on earnings that only somewhat exceeded analysts’ expectations. Big Blue got schmeissed again yesterday along with Google, but the body blows that sent two corporate giants to the mat evidently weren’t enough to unsettle investors.

Invincible Buyers?

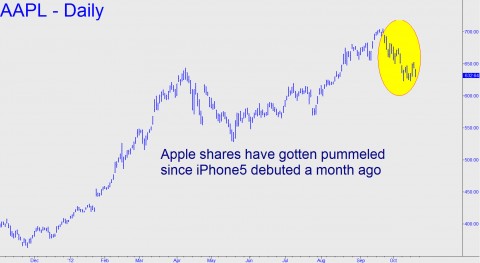

If bulls have been acting lately like they’re invincible, perhaps it’s because they appear to have shrugged off Apple’s nasty plunge in the last month. At its recent lows near $624, the stock had shed 11% of its value – a very big hit for portfolio managers, since the company is the world’s largest by capitalization. But so what? That seems to be the attitude on The Street, where the lotus-sniffing stewards of Other People’s Money have been curiously calm through it all. With three absolutely crucial bellwethers falling from the sky, the Dow currently sits a mere hundred points from new recovery highs.

It’s tempting to think DaBoyz are trying to fool widows and pensioners into believing things are hunky-dory while they distribute shares to the unwary by the trainload. As we know, however, individual investors deserted the stock market years ago, leaving only sharks to feed on chum limitlessly supplied by the Federal Reserve. Now, with the Dow Average acting as calm as a serial killer strapped to a polygraph, it beggars belief to think the sharks have not yet caught a whiff of blood from the likes of AAPL, IBM and GOOG. When the contagion of these bellwether stocks spreads to the broad averages, which could happen any day, don’t think you’ll have time to plot your escape. We’ve now got both feet out the fire-escape window, no longer persuaded by our own, purely technical and still-valid rally target at Dow 14969 that there’s a reason to stick around.

It’s tempting to think DaBoyz are trying to fool widows and pensioners into believing things are hunky-dory while they distribute shares to the unwary by the trainload. As we know, however, individual investors deserted the stock market years ago, leaving only sharks to feed on chum limitlessly supplied by the Federal Reserve. Now, with the Dow Average acting as calm as a serial killer strapped to a polygraph, it beggars belief to think the sharks have not yet caught a whiff of blood from the likes of AAPL, IBM and GOOG. When the contagion of these bellwether stocks spreads to the broad averages, which could happen any day, don’t think you’ll have time to plot your escape. We’ve now got both feet out the fire-escape window, no longer persuaded by our own, purely technical and still-valid rally target at Dow 14969 that there’s a reason to stick around.

***

[Click here for a free trial subscription to Rick’s Picks that includes access to a 24/7 chat room and the just-launched ‘Harry’s Place’.]

As the worldwide Central Bank Ponzi scheme implosion progresses it seems to me that the producer areas want an existence separate from the welfare state. Flanders wants to divorce Belgium, Catalonia wants to divorce Spain, the north of Italy wants a divorce from the south of Italy.

(The old joke about the south of Italy is that it never recovered from the invasion of Hannibal 2200 years ago!)

And the Germans want to divorce the rest of Europe.

Is Feudalism returning to the world?

Will we devolve into small regions self sufficient in food and manufactured goods, walled off from the ubiquitous poverty and violence that is growing day by day?

China’s threats about dumping their trillion dollars in US Treasuries is becoming a big “so what/go ahead”.

If we don’t don’t just wash that out against the trillion in defaulted pre Mao Chinese bonds the US holds, I bet Pimco can make a phone call to the Fed and get a bridge loan to cover that trade at $.50 on the Dollar or less.

I think Easy Al is still on the payroll at Pimco, should be a slam dunk to absorb 500 billion with Fed help.

With 16 trillion in National Debt, the Fed and Social Security hold many times more than China’s one trillion.

I think there is 4 or 5 trillion sitting in FDIC insured bank deposits alone looking for some yield.

Uncle Sam would love to herd that cash into Treasuries at China’s expense.

My point in all this is that I believe the Globalization/Export Driven economic model is in the process of breaking down.

Ever more sophisticated robot technology means very few people can supply a populace with all the food and manufactured goods needed.

As long as the area has good farmland and abundant natural resources.

Which the US has both of.

Let’s see what becomes of the looming currency, trade, and actual warfare sweeping the globe more and more every day.

It looks like all the world producers that collectively make up “Atlas” are preparing to “Shrug” once and for all.