[Monday’s constipated price action changed nothing that was addressed in the commentary below. Perhaps with Veteran’s Day, a national holiday not observed on Wall Street, behind us, the markets will reveal a bit more about their post-election, pre-holiday mood as the week unfolds. RA]

The broad averages and some bellwether stocks that we track achieved some important correction targets very precisely on Friday. Now, however, shares will have to rally robustly from the lows to avoid a further, possibly nasty drop into year’s end. A week ago, we used Hidden Pivot Analysis to drum-roll a potentially important low in Google at 650.69. On Friday, the stock bottomed at 650.30, just 39 cents beneath our target, then trampolined $18. The powerful rally from exactly where we’d expected is a tentatively bullish sign. However, if GOOG should relapse beneath the support even slightly, more downside to at least 605.83 would become likely, according to our proprietary technical method. If this does indeed occur, the sooner it happens, the more bearish the implication would be for the remainder of 2012. Because Google is so heavily owned by institutions and carries such heft in the Nasdaq index, any weakness in the stock could drag everything else down with it.

We should mention that the S&Ps did almost exactly the same thing last week as GOOG. With the E-Mini S&Ps having traded as high as 1431.75 a few days earlier, we projected a swoon from 1408.00 to at least 1364.25 — a plunge equivalent to about 350 Dow points. This is in fact what occurred, just after we told subscribers to get short at 1399.25. The actual low at 1363.50 on Friday came at 8:10 a.m. EST, about 80 minutes before the opening bell. The futures subsequently catapulted to an intraday high of 1388.00 before easing moderately lower into the close.

Google Just Missed

Both of these forecasts were tradable with very tight stops. Indeed, we’d told subscribers to buy shares or call options in GOOG if it fell to within 20 cents of the 650.69 target. And in the E-Mini S&Ps, following the short from 1399.25, we’d recommended tightly-stopped bottom-fishing at 1366.00, just above the Hidden Pivot target at 1364.50 mentioned above. (Could you have followed our trading instructions yourself? Click here for a free trial subscription to see exactly what we’d advised – and are now advising.) We note that although Hidden Pivot Analysis is capable of predicting price reversals very precisely, it cannot divine the future. What that means with regard to Friday’s bounce is that we cannot yet predict whether it is likely to be the start of a six-month bull run, or just a fleeting upthrust destined to fade in mere days or even hours. However, clues will begin to emerge on the lesser charts as early as Monday morning, possibly allowing us to take speculative positions either with or against the trend.

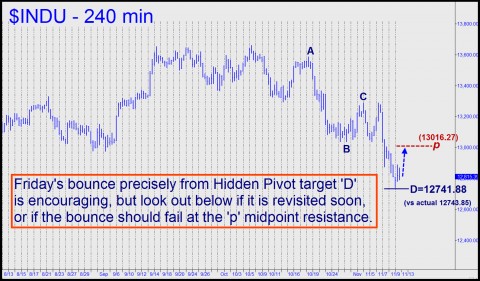

To give you the benefit of our current analysis, consider the chart above, of the Dow Industrial Average. As it happens, Friday’s intraday low at 12743.85 occurred just two points from an important Hidden Pivot target at 12741.88. We should expect the current bounce to at least reach 13016.27, a “midpoint” pivot labeled in red. If this “hidden” resistance point is easily exceeded, it would be a bullish sign. However, if the Dow should reverse and head lower without having reached it, that would be warning traders and investors to reef the sails. It would also offer an opportunity to stake out a tightly stopped, speculative short position ahead of any serious weakness. For your further guidance, nearly all of Rick’s Picks’ trading touts and forecasts from Friday can be viewed in snapshot form by clicking here. This is the first time the full subscriber page has ever been put on view publicly. The ‘CHAT’ tab at the top of the page provides access to a 24/7 chat room that draws traders from around the world.

To give you the benefit of our current analysis, consider the chart above, of the Dow Industrial Average. As it happens, Friday’s intraday low at 12743.85 occurred just two points from an important Hidden Pivot target at 12741.88. We should expect the current bounce to at least reach 13016.27, a “midpoint” pivot labeled in red. If this “hidden” resistance point is easily exceeded, it would be a bullish sign. However, if the Dow should reverse and head lower without having reached it, that would be warning traders and investors to reef the sails. It would also offer an opportunity to stake out a tightly stopped, speculative short position ahead of any serious weakness. For your further guidance, nearly all of Rick’s Picks’ trading touts and forecasts from Friday can be viewed in snapshot form by clicking here. This is the first time the full subscriber page has ever been put on view publicly. The ‘CHAT’ tab at the top of the page provides access to a 24/7 chat room that draws traders from around the world.

http://www.oftwominds.com/blognov12/Zeus-private-fiat11-12.html Thanks for that link, DG. Excellent essay, and I love when somebody else writes what I think so much better than I ever could.

The conclusion regarding community is great. I said a few days ago that the only vote we all have is how we spend our money. I know to most folks it seems trite, and I honestly do have to remind myself daily, but this is where it starts. I have people in my close proximity that raise and sell all manner of vegetable and animal products. I can see how these products are raised and processed. The quality is unquestionable, but the price is high; or so it seems. I pay more up front, but how much of that money recirculates straight back into my community, and perhaps back into my pocket? So I have to decide how important it is, but if I decide to go buy the product instead at a store, then I better not be complaining about GMOs or hormones or trade imbalances, or illegal immigrants, etc.. The same can be said for most other things. There are great producers of all kinds quietly doing their thing in this country, and the best learned it from their parents (Gary’s idiots). They are not getting rich, because our society does not reward quality through micro production, in fact our society works to snuff it out. Our society rewards low price almost exclusively. Most departments in most stores stock cheap shit because Americans, red and blue, want cheap. We will buy three cheap stereos in 6 years rather than one good one every 10. And then we feel we have the right to complain about cheap Chinese shit; taking our jobs; goddamn lead painted toys; mother f ing Mexican laborers… But who and what do we support?