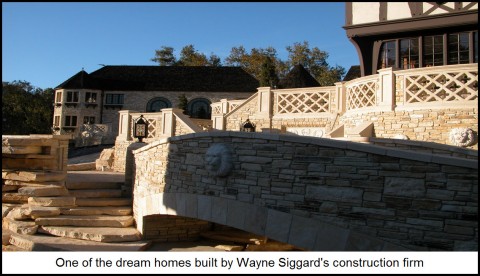

[All the government subsidies in the world will not revive the construction industry – only demand from increasing wealth will. The guest commentary below offers a vivid picture of the economic and regulatory factors weighing on homebuilders these days. The author is Wayne Siggard, who builds mansions for the super-rich. A UCLA law graduate, Wayne worked for Bechtel Financing Services and was self-employed as an investment banker doing private placements in oil and gas and alternative energy project financing. When oil hit $10/bbl in 1985, he went into the homebuilding business, turning an avocation into an occupation. His real estate operations, including land development, have primarily been in California and Utah. Wayne lived for several years in Italy and Switzerland and speaks many languages. RA]

Large estates are what I build. Nobody needs what I produce any more than they need a $70 million dollar Van Gogh painting. You can spend over $1million just on a theater, or hardscape and landscape. I spend more on appliances and lighting figures than the construction cost of a 2000-square-foot tract house. To ask what a house costs to build is akin to asking how much a car costs. Are we talking Yugo, Kia, Chevy, Cadillac, BMW, Rolls Royce or Bugatti?

The bottom line is this: There has been a demand for mansions and palaces since the beginning of recorded history, and there always will be. In the Roaring 20’s and 1974-2005, people bought big mansions because they anticipated making a million dollar profit on a $1.5 million dollar investment. Ego and prestige have always been factors for me, along with being a fanatic about architecture. Despite going to a top law school and working for ten years as an investment banker, I was one of those fanatics and made my passion my business. But the market might be so decimated for the next ten years that it will appear virtually non-existent. Even if the land were free, you could lose your shirt building a spec house today.

For the ten years between 1985 and 2002, the cost of copper varied between 70 cents and 95 cents per pound, as opposed to today’s price of around $3.50. When America was in recession, the cost of materials and labor fell. If the economy was booming, it rose. Starting in 2002, the demand from China for construction materials increased geometrically such that China currently consumes over 50% of the world’s lumber, cement, copper, steel, drywall, and other building materials. Construction costs are divided approximately 50/50 between materials and labor. Much of what China imports comes from Canada, the U.S., along with South America, Australia and Africa. China’s material costs are the same as what we pay in America plus the cost of transportation. If Chinese labor were free, they would have about a 40% edge in construction costs. The material market is now international and dominated by China, not the U.S.; more on this later.

Ten Million Underwater

Single-family housing starts fell from 1,715,800 in 2005 to 108,900 in 2009, and rose to 430,000 in 2011. According to Forbes magazine, as of August of 2012 there were ten million homeowners underwater and 1.5 million in shadow inventory. According to the U.S. Census Bureau, there are ten million empty houses, not including seasonal (vacation) homes. Fannie and Freddie funneled large blocks of REO houses to insider investors. Large blocks of REOs are mysteriously being sold to the same groups of investors by real estate brokers who handle REOs for the banks. These houses are then flipped for a profit. The current lack of inventory is causing s mini-frenzy among house buyers. But these are lower end houses. Anecdotally, there is one lot in Rancho Santa Fe which is for sale for $695,000 which was listed for sale at $2,500,000 in 2006. Five-acre lots in La Cresta which sold for $650,000 in 2006 are selling for under $100,000. Houses in these areas are selling for 40% of their 2006 value. If the land were free, a completed 5,000-square-foot house would cost twice what an REO is selling for.

There are several government programs which affect the affordability of constructing new houses. The government decided to throw money at housing because you cannot export those jobs. The Home Affordability Modification Program subsidizes banks for reducing the principal amount owed on houses. This subsidizes those who were profligate in their purchases and made bad decisions. So what is your neighbor who is upside down and making payments likely to do? Quit paying the mortgage. What is the responsible person who paid a large down payment or paid cash for a house going to do? He’s going to subsidize the fool, but most of those fools have lost their houses even after a modification.

OSHA Obstacles

The Fed is giving the banks 0% money. Mortgage rates are the lowest they have ever been. This encourages the purchase of existing houses and new construction, but it can’t continue. The only reason large public home builders can take advantage of this is because they purchased developed lots at 20% of development costs (i.e., land was free) during the recession. But the number of new house sales is still less than 25% of the peak. They have gotten “cheap” down to a science and have enormous efficiencies, such as production line-type methods in labor and bulk material purchases.

After Arizona Gov. Janice Brewer wagged her finger at President Obama, hundreds of OSHA inspectors were sent from the Northeast to Arizona. Builders now had to scaffold any wall over six feet high. Every single-story building needed complete scaffolding for stucco. The scaffold was actually in the way. Anyone ascending a ladder needed someone else to steady it. Labor costs rose 15%. Beware the government.

FHA gives loans with minimal down payments. This encourages home purchases, but increases the likelihood of foreclosure. It subsidizes one industry at the expense of others. It creates false demand, and yet new construction is still moribund. CEQA and NEPA create enormous costs and time delays (time is also money for) for environmental reports. In the last six years, the federal government has paid environmental groups $4.6 billion in legal fees to sue ourselves. When the existing completed lots are exhausted, the price of completed lots will quintuple, and there will be time frame when they will not be available.

China’s Bubble

China’s consumption has increased demand manyfold. It has built a system of bullet trains which don’t produce enough income to pay operating costs, let alone the billions of yuan interest on the bonds. They have created cities with over a million residential units which are 10-15% occupied. Their buildings decay at incredible rates and collapse in earthquakes because of shoddy materials and building practices. There are enough see-through buildings to satisfy demand for 20 years. Nobody and no country can expand at 11% compounded for twenty years without paying the price. Carlo Ponzi’s scheme lasted a year. Madoff’s scheme lasted almost 30 years. The USSR lasted almost 60 years. When will China’s bubble burst? Who knows? When it does, materials should decrease about 50%. Construction labor has decreased up to 50% in the last 3 years. At that point, buyers will be paying about a 10-20% premium for a custom home as opposed to a tract house. And I may be able to quit practicing law, which produces nothing, and drains productive capital from the system, and go back to my passion. I’m sure you all need a house like the ones I design and build – if the feds and California Prop. 30 don’t suck you dry.

***

[Click here for a free trial subscription to Rick’s Picks that includes access to a 24/7 chat room and the recently launched ‘Harry’s Place’.]

Gary,

” If so than President Bush did a great job reading to those kindergarten kids and pretend not to know what to do, or what was going on.”

Gary, that is a perfect description of W’s Presidency!

If there were any evil goings on it was Darth Cheney calling the shots.

As far as who or what brought down those towers, I feel that issue will lead you down the wrong path, just like arguing over who had JFK liquidated.

The important issue is, what were the results that followed 9/11?

Congress passed the Patriot Act in a heartbeat without reading it and trashed the Constitution and the Bill of Rights. And that Patriot Act was ready and waiting for the main chance to ram it through.

Just like the Enabling Acts after the Reichstag fire.

Exactly like the Enabling Acts.

And you have all read Goering’s remarks to Gustave Gilbert at Nuremberg:

“Voice or no voice, the people can always be brought to the bidding of the leaders. That is easy. All you have to do is tell them they are being attacked, and denouce the peace makers for lack of patriotism and exposing the country to danger. It works the same in any country.”

“That is easy”

Looks like the Reichsmarschall wasn’t kidding.

And if you google “images for Reichsmarschall” the first image you see is Dick Cheney’s head photoshopped

onto H G’s uniformed torso!