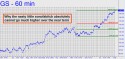

At least a dozen subscribers reported getting short in Goldman on Friday as instructed, but it wasn’t pretty. Because I had been unable to specify a limit on the bid for March 145 puts, your fills ranged from atrocious (i.e., 2.75) to fabulous (2.47). As is customary at Rick’s, I will use the worst price reported as our cost basis. I will also tack on 25 cents, since some of you stopped yourselves out when the puts traded down to 2.50 or so before I could update with advice to widen the stop to 2.25. You should stick with that stop-loss for now — and determine not to give a rat’s ass if Goldman forges still higher on Monday, as it well might. My gut feeling is that I would be absolutely dumbstruck if the stock were able to make much headway above the daunting Hidden Resistance I’d flagged at 149.42. No, as far as I’m concerned, Goldman shares absolutely MUST top somewhere near here if the market knows what’s good for it. Nevertheless, even though we “know” the stock can’t go “much” higher, at least not right away, we’ll use a stop-loss for the puts, since that’s the way we do things around here: always discipline, discipline, discipline.

At least a dozen subscribers reported getting short in Goldman on Friday as instructed, but it wasn’t pretty. Because I had been unable to specify a limit on the bid for March 145 puts, your fills ranged from atrocious (i.e., 2.75) to fabulous (2.47). As is customary at Rick’s, I will use the worst price reported as our cost basis. I will also tack on 25 cents, since some of you stopped yourselves out when the puts traded down to 2.50 or so before I could update with advice to widen the stop to 2.25. You should stick with that stop-loss for now — and determine not to give a rat’s ass if Goldman forges still higher on Monday, as it well might. My gut feeling is that I would be absolutely dumbstruck if the stock were able to make much headway above the daunting Hidden Resistance I’d flagged at 149.42. No, as far as I’m concerned, Goldman shares absolutely MUST top somewhere near here if the market knows what’s good for it. Nevertheless, even though we “know” the stock can’t go “much” higher, at least not right away, we’ll use a stop-loss for the puts, since that’s the way we do things around here: always discipline, discipline, discipline.

Speaking of which, it’s clear that the lazy-guy trades are the ones that most appeal to you all: buy puts/calls at predicted highs/lows in the underlying. That’s okay — I’m a lazy guy myself — but you should keep in mind that the forecast correctly called a powerful rally that you also could have traded while we were waiting, as it were, for the shorting opportunity to materialize. It’s never a bad thing to accumulate a little of the house’s money in that way when your goal is to jump in front of a rally powered by lunatics, con-men and, for good measure, child molesters. _______ UPDATE (11:48 a.m. EST):GS: With Goldman shares down $2.50 so far today, the trade is going our way. With the goal of legging into a free $5 vertical bear spread, offer March 140 puts short for 3.00 in whatever quantity you are long the March 145 puts. This order is g-t-c, and if it fills, you should cancel the sell-stop order on the March 145 puts. Click here to join the fun at Rick’s Picks free for a week.