Goldman Sachs called the Cyprus bank bailout a big deal, according to someone who posted in the Rick’s Picks chat room yesterday morning. Whether true or not, as far as Wall Street is concerned the bailout and the punitive measures it will bring against depositors barely even merited a yawn. The Dow Industrials fell a meaningless 62 points yesterday in response to the news. The close was up sharply from overnight lows that equated to a 180-point drop in the blue chip average. We were braced for a 250-point plunge ourselves, but buyers came after index futures so aggressively early Monday morning that it seemed a foregone conclusion that they were treating Cyprus’ banking problems not as a crisis, but as an opportunity to gorge themselves on stocks at temporarily reduced prices.

We editorialized yesterday about how the bailout, by slapping a tax of 6% to 10% on depositors, was setting a bad precedent that could send European deposits scurrying for the ostensible safety of U.S. Treasurys and even gold. Both got a small pop, but certainly not enough of one to suggest investors are the least bit spooked. T-Bond futures rallied about three-quarters of a point while Comex April Gold rose $12. It wasn’t urgent buying that pushed bullion higher, but rather the vague feeling that the crime syndicate that holds gold prices down had simply pulled their offers and were allowing quotes to drift, unmolested, as high as the news was going to take them.

Old News

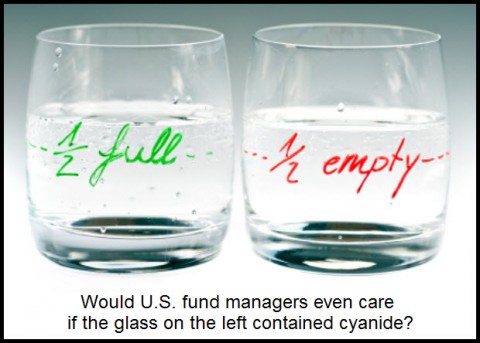

Meanwhile, the airwaves were filled with reports critical of Europe’s (i.e., Germany’s) decision to squeeze $7.8 billion from depositors to unlock emergency loans. A Washington Post story, Markets Drop Amid Euro-Crisis Fears over Cyprus Bailout, led Google’s news page for a couple of hours, but it was already yesterday’s news when the NYSE opened for business Monday morning; for in fact, U.S. stocks were not falling most of the day, but rallying back to unchanged. Although the blithe pitch of the rally proved unsustainable, the Dow surely would have surrendered more than 62 points of it if had there been any real concerns on Wall Street. NCBC trotted out the Fed’s gray eminence, Alan Greenspan, to cast his radiance on the current scene. Without using the phrase “irrational exuberance,” Greenspan said the market’s ebullience in recent weeks was fueled by diminished concerns about euro-zone and other tail risks. All is right with the world, it would seem.

When it comes to Yawns, check out this Yawning gap:

http://stockcharts.com/h-sc/ui?s=HYG:LQD&p=D&yr=1&mn=3&dy=0&id=p73067932381:

talk about RISK-ON!