[The Sunday night massacre has exceeded my worst-case Hidden Pivot target, with the June Comex contract hitting a so-far low of 1385.00. Switching to conventional technical analysis, there are now two numbers we should keep in mind as possible bear-market lows: 1) 1341, representing a 50% retracement of the rally from 2008’s watershed low of 732; and 1188, a 0.618 retracement. RA]

Gold fell hard on Friday, pushed to its worst loss in more than a year. The Comex June contract settled at $1501, down $63, after having traded as low as $1476 intraday. Adding insult to injury, Goldman Sachs – aka the Bad Guys – had seen it coming and told investors to get short two days earlier. We’d seen it coming ourselves, having projected a decline to at least $1487.90 when the futures were trading $80 higher. A headline here a week ago noted that Gold Has Trashed a Key Support. As indeed it had. Our plan was to bottom-fish near the target with a very tight stop-loss, and although gold took a promising bounce from $1491 that lasted four hours, our implied long position from there didn’t survive the second wave of selling.

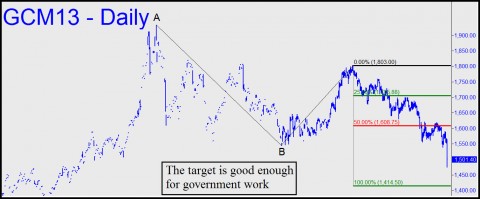

Goldman is still bearish on gold — and so are we, because of the ease with which sellers demolished our “Hidden Pivot” support at $1488. Because of this, we are now projecting further downside to at least $1414.50. That would represent a 7% fall from these levels and a 28% correction from the $1933 all-time high recorded in September of 2011. The target is not of the highest quality according to the proprietary technical system we use, but, as we told subscribers, it is “good enough for government work.” What that means in practice is that it can serve as a reliable minimum downside target from these levels, but also as a place to attempt bottom-fishing if and when it is closely approached.

Still Bullish

We remain long-term bullish on gold simply because the central banks of the world seem hell-bent on destroying their currencies. Because of this, it is our practice to buy gold on weakness, usually at Hidden Pivot correction targets, but always using tight stop losses or a risk-averse trading tactic that we call “camouflage.” We’re aware that some are forecasting much worse for gold than $1414. In a discussion thread at The Korelin Economic Report, where forecasts from Rick’s Picks are featured regularly, one investor saw gold falling to $800. We are skeptical about the usefulness of such predictions, much as we are skeptical about ultra-bullish seers who have predicted that gold will trade $5000 or higher. Either prediction, or perhaps even both, could be right, but we’d rather focus on a more immediate picture that can be predicted with a very high degree of confidence. From a trading standpoint, our goal is to make money for subscribers even when our forecasts fail to pan out. If you’d like to know more about “camouflage” trading, which aims to put this goal within your grasp, click here for details concerning the upcoming webinar on April 24-25.

For Rick Ackerman.

Leibowitz said he bought 8000 spxu for 26.84. Unless I missed something, thats about $20 million, no? (8000*2684). Are my calculations correct? If so, is he for real? Doesnt sound right to me.

Thanks,

A Giles

&&&&&&

I don’t recall the quantity, but his timing has not been too bad, and he may have exited the long position earlier. RA