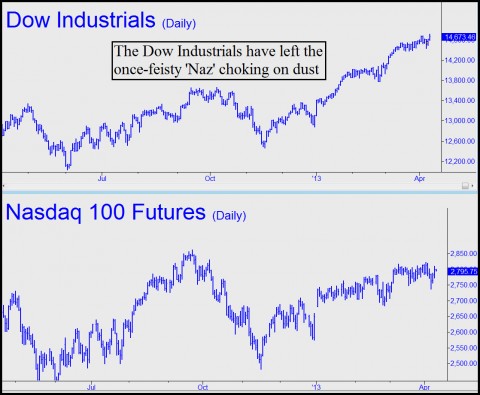

We used to pay closer attention to the charts of Google, Apple, Amazon and other world-beaters because for years their shares led the stock market higher. No longer, though. The charts below show how the Dow Industrial Average has left the formerly unstoppable Nasdaq Index choking on dust. Few would have imagined that Wall Street could go on a bullish rampage without the participation of stocks that represent the very best that America has to offer. And yet, that is exactly what has occurred. The “Naz” heavyweights have stalled or fallen while the Dow’s rally has gone vertical.

The first inkling that such a startling divergence was possible was the Dow’s resilience in the face of a devastating bear market in Apple that has reduced its share price by 40% since September. This represents an enormous loss to investors, most of them institutional, since Apple was the most valuable company in the world before it fell from grace. But investors simply shrugged off the loss, throwing Apple to the wolves before training their still-considerable buying power on the 30 Dow stocks. This damn-the-torpedoes attitude has continued even amidst concerns that Q1 earnings about to be reported will be less than stellar. Under the circumstances, the bold stewards of Other People’s Money would seem to have abandoned the pretense that earnings even matter.

‘Don’t Fight the Fed!’

Undoubtedly, what has made them so cocksure is the prospect of more Fed easing until…forever? “Don’t fight the Fed!” is one of the most time-honored rules in the investment world. With the Fed easing more aggressively than at any other time in its ruinous history, going with the flow is not exactly rocket science. The result is that every Dow stock except Caterpillar and Exxon is showing a gain for the year. Most are up around 15%, but it is the standout gainer, Hewlett-Packard, which has appreciated by 56%, that hints of reckless gambling, rather than mere optimism, on the part of buyers. Hewlett has been attempting a turnaround after nearly flatlining, and although it’s possible the company will succeed, it is by no means assured.

As much could be said of Best Buy, an NYSE stock that has rocketed from $11 to $27 since January. Earlier in the year, we were quite bullish on the big-box retailer ourselves when a hotshot from Starbucks was brought in to try a hail Mary pass. We remained bullish even after he quit two months later. Last week, however, the stock turned an already steep rally into a moon shot on word of a deal with Samsung to create mini-stores within stores. This is good news, to be sure, since Samsung’s smart phones have been hot enough to give iPhone a run for the money. But will it boost profits sufficiently to compensate for lackluster sales across the rest of Best Buy’s extensive product line? Perhaps. But Wall Street has left no room for doubt, having marked up BBY shares by 130% in a little more than three months.

The divergence between the Dow Industrials and indexes heavy on tech stocks is surely not a healthy sign, especially with the former headed into an already apparent earnings slowdown. Although it’s impossible to predict how long the divergence might persist, we’d rather not travel with the herd right now. When the stampede out of stocks begins, even for those who have stayed just a day too long there will be no escape.

One can use monetary expansion to solve a debt overhang problem, but it takes an insane amount of printing to dilute the debt away. Moreover, the new printed money goes to the bankers first and they waste it on malinvestment. Our debt overhang is about $50 trillion. Diluting the debt in half (not enough IMO) means printing another $50T into circulation as borrowed money or deficit spending $50T non borrowed “green backs” into the economy which would extinguish the debt. Either way the real economy will collapse during this process. This helps put the current $2T print rate into perspective.