Aren’t stocks supposed to rally on “bad” payroll news? If so, the Dow should have soared Friday on word that our allegedly recovering economy generated a sickly 88,000 jobs in March. If that weren’t good/bad enough to inspire a psychotic buying spree on Wall Street, there was further news that a drop in the unemployment rate to 7.6% had been caused entirely by a huge exodus of workers from the job market. This stampede of the despairing pushed the labor participation rate to 63.3%, its lowest level since 1979, undermining whatever brazen claims the spinmeisters are making these days concerning the economy’s supposed re-awakening.

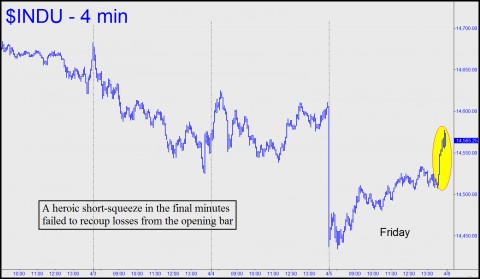

Until just a few months ago, rotten news like Friday’s would have sent stocks soaring, since it meant, according to the popular wisdom, that the Fed was likely to ease even more, and for longer. Instead, the Dow Industrials spent the entire day struggling to recoup a 170-point loss registered on the opening bar. Alas, the effort failed, leaving the Indoos 41 points shy of unchanged even after a last-ditch attempt to short-squeeze stocks in the final 30 minutes of the session.

Stimulus Has Failed

Is it possible the stock market’s glumness on Friday was due to a growing recognition that stimulus has accomplished little or nothing to create jobs? Sure, the banks are awash in funny money that has no place to go besides stocks and bonds. And home prices have temporarily stopped falling, cushioned by untold trillions of dollars in monetary stimulus. But as should be increasingly clear to all, even to Obama’s cheerleaders and spinmeisters, these trends have manifestly failed to lift the working man, and therefore the U.S. economy, in a way that is meaningful, much less sustainable.

Meanwhile, the news media continue to propagate the destructive lie, absurd on its face, that the sole path back to prosperity for the U.S. lies in reckless fiscal tactics, financed by unlimited Fed purchases of Treasury debt. Of course, with BRIC countries no longer buying U.S. paper, and the revolt spreading to other countries, it’s only a matter of time before the Fed becomes the sole participant at Treasury auctions. Uncle Sam already effectively owns 100% of the mortgage market via Fannie and Freddie, and that’s why real estate – the primary source of collateral for a quadrillion-dollar derivatives edifice – is in a dead-cat bounce.

End QE3? Get Real!

How long can this go on? The news media continue to evade the question. Instead, the Wall Street Journal gave us this headline over the weekend: Jobs Report Reinforces Fed Wariness About Premature End to QE3. Here’s the lowdown, you economic imbeciles: QE3 CANNOT END WITHOUT PLUNGING THE WORLD INTO DEPRESSION! With a quadrillion dollars’ worth of unredeemable paper swirling in the financial cosmos, even a mere uptick in lending rates would have trillions of dollars of deflationary consequences. Under the circumstances, it is virtually inconceivable that the central banks of the world will stop easing. They won’t because they can’t. And so The Big Lie will continue to sustain the global financial system…until the moment when it no longer does.

By now it should have occurred to you that the strict rules you desire are always inneffective. The people that make those rules are corrupt Gary, as are the people that pull the strings of those that make the rules. The rules only pen in the masses so the few are free to abuse, which is really the intention.

Since no governments ever have clean hands, the less government the better the, eh Gary?