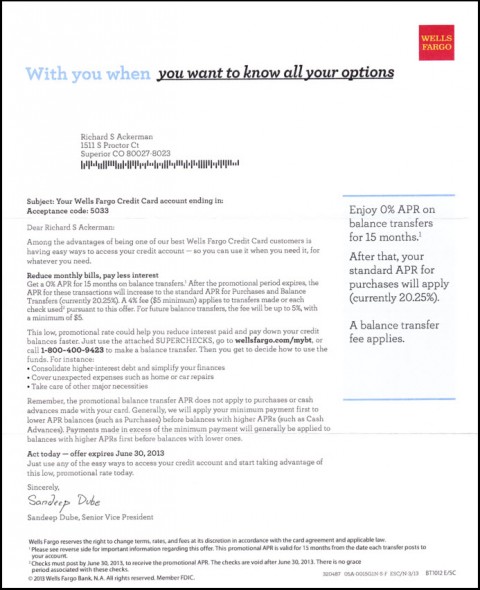

We wrote here recently that Wall Street seems to be revving up for The Mother of All Blowoffs. The banks are evidently trying to stoke a mania of their own, judging from the mail we get each day. A typical batch now includes no fewer than three or four teaser offers to borrow money for practically nothing. Just today we heard from Wells Fargo (“Enjoy 0% APR on balance transfers for 15 months…”); Discovery (“Get a fresh start on your home loan. Refinance and lock into a rate as low as 3.09% APR today!”); AT&T Universal Card (“0% Promotional APR on transferred balances until 6/01/2014”); and Chase Freedom (two fabulous offers: “0% promotional APR through your billing cycle that ends in 08/2014’; or, “1.74% promotional APR through your billing cycle that ends in 01/2015”). And that’s just a single day’s worth. Add up all of the offers we’ve received in the last month and they tally more than a half-a-million dollars’ worth of instant borrowing power – all at interest rates ranging from zero to 3.09%.

It’s tempting to imagine all of the things we could do with the money. For starters, we could trade in a 13-year-old Lexus for a new model. Buy new ski equipment while it’s on sale. Build a new patio in the back yard. Take the family to Europe this summer. And there’s plenty of room in the basement for a home entertainment center and a billiard table. What’s left could help defray the awesome after-tax expense of having two boys in college. Maybe the best play would be to parlay the entire sum in the stock market. With 11,000 stocks to pick from, surely there is at least one surefire winner in the bunch.

When Rates Turn Lethal

Alas, the banks, more desperate than ever to have me borrow promiscuously, will have to take their business elsewhere. We don’t even open their letters any more, since we’ve been down that road before. As we all know, the teaser rate will turn lethal after the promotional period ends. What that means is that zero percent loans will be adjusted upward to something like 20 percent. Judging from the rampant aggressiveness of their promotional offers these days, it is all too predictable that millions of borrowers will be caught in a squeeze when the teaser rates expire. Will this occur in the throes of a financial crisis like the one that nearly toppled the banking system a few years ago? We’d be shocked, actually, if it were otherwise.

Yes, Cam, Japan has let their currency slide %30 so an American 5,000 miles away can smoke another 1. That’s as dumb of a story as shorting 400 tons. Not sure why Cam and Gar are so intent on gold going down to $1000. A price increase wouldn’t reflect that more than 500 million people (Asia alone) have been buying gold recently? It will be interesting to see how a certain few once again rob people blind.