Refreshing. Exhilarating, even! But will it last? Our gut feeling is that this is not The Big One – that investors will soon be throwing money at stocks again with the same reckless abandon they’ve shown since 2009. But it never hurts to dream. Imagine what a whole month of days like yesterday would do to clear the fetid, toxic air from Wall Street. The effect would be positively cathartic if the capitulation phase were to lop, say, 2000 points from the Dow in just a few days. From that point forward, even the most churlish permabears would recognize that the stock market was in recovery mode, too devastated to attract the quasi-criminal element that has controlled price action in recent years. High frequency trading circuitry would be fried, yields on dividend stocks would fatten and interest rates could seek their own level. Who knows? Perhaps even the $3 trillion-plus in dubious assets carried by the Fed would come available at market prices?

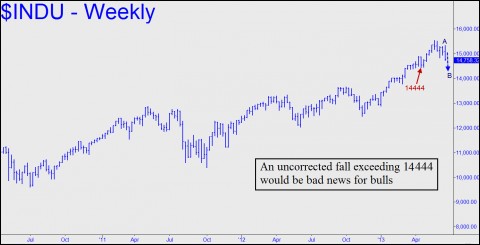

Meanwhile, although our very bullish Dow target at 16800 remains theoretically valid, the burden of proof has shifted to bulls for a rare change. From a technical standpoint, we can see in retrospect that late May’s record high at 15542 was precisely predictable and therefore shortable. The reason is shown in the weekly chart accompanying today’s DJIA tout, which can be accessed by non-subscribers via a free trial subscription. Those familiar with Hidden Pivot Analysis, including your editor, might want to kick themselves for missing the opportunity. Less easy to miss in the days ahead would be the creation of a bearish “impulse leg” on the weekly chart. The last time this occurred was in July 2011, and it signaled the onset of a 2147-point decline, or 17.6%. If a selloff of similar magnitude were to occur now, the Dow would sell for 12807, a 1925-point discount from the current price. What would it take to generate a bearish impulse leg? The chart shows that sellers would need to drive the Dow beneath the 14444 low without an intervening upward correction of significance. Were this to occur, bulls would likely be on the defensive till at least September. What a welcome change that would be!

Meanwhile, although our very bullish Dow target at 16800 remains theoretically valid, the burden of proof has shifted to bulls for a rare change. From a technical standpoint, we can see in retrospect that late May’s record high at 15542 was precisely predictable and therefore shortable. The reason is shown in the weekly chart accompanying today’s DJIA tout, which can be accessed by non-subscribers via a free trial subscription. Those familiar with Hidden Pivot Analysis, including your editor, might want to kick themselves for missing the opportunity. Less easy to miss in the days ahead would be the creation of a bearish “impulse leg” on the weekly chart. The last time this occurred was in July 2011, and it signaled the onset of a 2147-point decline, or 17.6%. If a selloff of similar magnitude were to occur now, the Dow would sell for 12807, a 1925-point discount from the current price. What would it take to generate a bearish impulse leg? The chart shows that sellers would need to drive the Dow beneath the 14444 low without an intervening upward correction of significance. Were this to occur, bulls would likely be on the defensive till at least September. What a welcome change that would be!

shopping, agreed.

But don’t forget to read the label, much change there too, and of course not for the better;