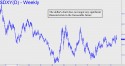

The thing to notice about the U.S. dollar right now is that there is not much to notice (see inset). It would be accurate to say that it has gone nowhere in more than eight years, notwithstanding some whipsaws in either direction. More recently — meaning the last four years — it has been mostly treading water and currently sits around the middle of the range. That is not to say it couldn’t break out of the range on the next big move; however, whatever is coming, there is nothing in the charts that suggests a dollar cataclysm.

The thing to notice about the U.S. dollar right now is that there is not much to notice (see inset). It would be accurate to say that it has gone nowhere in more than eight years, notwithstanding some whipsaws in either direction. More recently — meaning the last four years — it has been mostly treading water and currently sits around the middle of the range. That is not to say it couldn’t break out of the range on the next big move; however, whatever is coming, there is nothing in the charts that suggests a dollar cataclysm.

I mention this only because it has always been a given that when the financial system collapses — as it eventually must, due to the yet-to-be-actualized implosionary force of a quadrillion dollar derivatives edifice — the greenback will be in the thick of it at ground zero. The central banks may be able to control interest rates and other variables in the financial system, but there are far too many dollars to control if market forces should take hold someday, impelled by the epiphany of America’s bankruptcy.