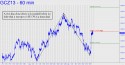

In an update to Wednesday’s tout, I said the December contract is bound for at least 1453.70. This Hidden Pivot target (see inset) would become an all-but-certain short-term bet if buyers can ram this vehicle past the 1372.60 midpoint resistance shown. They’ve made fabulous progress so far, with a war-whoop rally in after-hours trading that has hit 1367.80. Clearly, the weasels who love to bet against gold are on the ropes, short up the wazoo and wont to grow even more desperate. However, we should never count them out, since they are indeed very clever guys with friends in the highest places. That is why we should assess the further potential of this rally one leg at a time, using purely mechanical tools, instead of tuning to the likes of Jim Sinclair for pie-in-the-sky numbers and false hopes. Keep in mind that gold is a trade, not a religion.

In an update to Wednesday’s tout, I said the December contract is bound for at least 1453.70. This Hidden Pivot target (see inset) would become an all-but-certain short-term bet if buyers can ram this vehicle past the 1372.60 midpoint resistance shown. They’ve made fabulous progress so far, with a war-whoop rally in after-hours trading that has hit 1367.80. Clearly, the weasels who love to bet against gold are on the ropes, short up the wazoo and wont to grow even more desperate. However, we should never count them out, since they are indeed very clever guys with friends in the highest places. That is why we should assess the further potential of this rally one leg at a time, using purely mechanical tools, instead of tuning to the likes of Jim Sinclair for pie-in-the-sky numbers and false hopes. Keep in mind that gold is a trade, not a religion.

On the daily chart (not shown), if the 1453.70 target is achieved, that would exceed a small ‘external’ peak at 1447.10 recorded on May 14. That in turn would effectively refresh the bullish energy of the hourly chart, creating even more pain for the weasels — and therefore even higher prices for gold. Traders looking to get long at any point along the way should watch for impulse legs on the hourly chart, but on charts of 5-minute degree or less for ‘camouflage’ entry signals. Catching a ride on this projectile would become increasingly tricky as the rally draws in more short covering and more bulls, but there is surely enough talent in the chat room to spot the opportunities, and so that’s where you should hang. _______ UPDATE (6:24 p.m.): Gold traced out a tight flag Thursday (see inset), presumably consolidating the powerful run-up from a day earlier. Although it slightly bettered the 1372.60 midpoint noted above, let’s stipulate that the December contract must close above it for two consecutive days before we infer that a follow-through to 1453.70 is likely.