Where do you think the broad averages will be trading at the end of 2014? Will stocks be in the throes of a devastating bear market? Or will the Dow be galloping blithely higher, on its way to 20000 and beyond? Clearly, Wall Street doesn’t seem to care whether the economy remains in a wallow. Shares have moved relentlessly higher despite the fact that GDP growth is stuck in a rut, wages are stagnant, and deflation has come to rule the budgets of states and cities, if not yet Washington. We had thought Obamacare would be the straw the breaks the camel’s back, since it represents the biggest new tax ever imposed on the American Middle class. It also comes at a time when the average American household can ill afford the 25%-or-more annual rate increases that have become a regular feature of the private insurance market.

Incredibly, however, the stock market has continued to ascend, borne aloft by strong corporate profits that have in no way benefited the labor force. Equally astounding is that consumer spending has not collapsed. We attribute this to a shadow economy that exists and flourishes beyond the range of the tax collector. Professor Edgar Feige, using estimates of currency in circulation both in and outside of the U.S., has estimated its size at $2 trillion. If so, it would help account for the resilience of retail sales, including autos and other big-ticket items, as The Great Recession drags on.

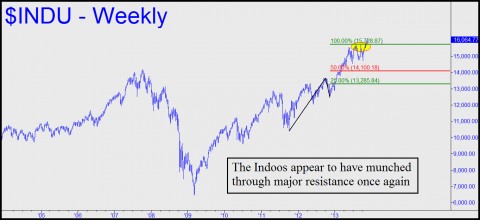

For our part, we’ve grown tired of playing games with the bull. It has been our practice to attempt getting short at Hidden Pivot rally targets of significance. Although these targets have generally worked, accurately catching tradable tops, both pleasure and profits have been short-lived. Indeed, targets that have taken months to reach give way not in weeks or even days, but in mere hours. This suggests that the bull market begun in March of 2009, far from tiring, is actually picking up strength. In that regard, please note that Rick’s Picks is on record with a minimum upside projection of 17056 for the Dow — a thousand points above current levels.

Readers?

The world governments controlled by banksters, and the elite few have devastated our life for centuries. This must stop! How utterly absurd to listen to this drivel. You see a world in chaos, while I see fabulous inventive minds expanding our knowledge of everything. So much so that the last 50 years has accelerated our growth 1000 times more than the combined growth from the last 100,000 years. The next 50 will grow 10,000 times more than all of history combined.

Life expectancy will double, than double from that, will have almost total control of our brains function and be able to expand its capability far beyond anything imaginable today. Will have more leisurely time, with tasks being done by artificial intelligence. More time to absorb and enjoy what life has to offer. Hunger, pain, suffering will eventually be gone. All this in a dysfunctional political environment. It is ALREADY happening. How can you explain it? Surely we are doomed to revert back to serfdom.

Does anyone dispute the constant progress towards a more humane society? A capitalist society encourages the expansion of power and with it greed, but it also encourages compassion and empathy. When one peaks the other troughs. And so it goes. You want a perfect world with perfect people? What time period, society, theory, proposal, would have such a thing. Impossible.

Never mind! Image we had a crash of such proportions that the world markets were reeling from the impact. This took place 5 years ago. You currently carry the sign that says the “End Is Here”, while most pick themselves up and strive to improve and survive. You call that cowardly and dishonest not to concede that we are weak corrupt minded people. Look what our people have done to each and every one of us. Yes we should look but do what we have always done, focus on the future, and never concede defeat. A sorry lot you people are. You will never win. By your nature you can’t win.

We live in a time and place that all of prior history would deem a naïve impossible dream. We have such comforts, that we can spend vast amounts of time contemplating the world around us. So what do we do with that privilege? Beg for its total destruction. Complain it isn’t already here. Make elaborate suppositions as to how it will end. Not one argument that it is worth fighting for. Not one.