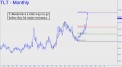

I’ve been hell-of-bullish on Treasury Bonds for quite a while, but a subscriber asked me yesterday whether there was a price at which I would short them. In fact, there are some major targets above where both T-Bond futures and this ETF vehicle would become enticing shorts. Specifically, I am using a 164^08 projection for T-Bond futures that lies 8.6% above the current 151^04; and in TLT, a 145.25 target that is 6.8% above current levels. Despite the discrepancy, I will treat each separately for trading purposes. and I’m also sticking with a 1.74% forecast for long-term interest rates. That projection is based on the long-term T-Bond chart itself, not on a derivative instrument such as TLT or TLH. For your further trading guidance, let me repeat that I expect both TLT and TLH to pull back when the former hits 138.42, a Hidden Pivot resistance of intermediate importance that could be achieved within the next few days. _______ UPDATE (1:07 p.m. EST): A very powerful, 2.56-point spike topped at 138.43, a penny from the target I’d drum-rolled. Based on a report in the chat room from a subscriber who got short at the target as I’d advised, I’ll track ten Feb 20 132.50 puts @ 0.40. For now, on a good-till-canceled basis, offer ten Feb 20 130 puts short for 0.40. Against this order use a stop-loss on the calls held at 0.19. If successful, we’ll have legged into a ‘free’ $2.50 vertical put spread with no risk and $2500 of profit potential. _______ UPDATE (3:17 p.m.): We’ll stick with the put position until tomorrow, but only because the coincident rally targets in TLT and USH are both ostensible heavyweights. This was therefore a logical place to try shorting, but today’s rebound is a reminder that the more rewarding challenge in TLT will be to get long at the lows of all-too-fleeting corrections.

I’ve been hell-of-bullish on Treasury Bonds for quite a while, but a subscriber asked me yesterday whether there was a price at which I would short them. In fact, there are some major targets above where both T-Bond futures and this ETF vehicle would become enticing shorts. Specifically, I am using a 164^08 projection for T-Bond futures that lies 8.6% above the current 151^04; and in TLT, a 145.25 target that is 6.8% above current levels. Despite the discrepancy, I will treat each separately for trading purposes. and I’m also sticking with a 1.74% forecast for long-term interest rates. That projection is based on the long-term T-Bond chart itself, not on a derivative instrument such as TLT or TLH. For your further trading guidance, let me repeat that I expect both TLT and TLH to pull back when the former hits 138.42, a Hidden Pivot resistance of intermediate importance that could be achieved within the next few days. _______ UPDATE (1:07 p.m. EST): A very powerful, 2.56-point spike topped at 138.43, a penny from the target I’d drum-rolled. Based on a report in the chat room from a subscriber who got short at the target as I’d advised, I’ll track ten Feb 20 132.50 puts @ 0.40. For now, on a good-till-canceled basis, offer ten Feb 20 130 puts short for 0.40. Against this order use a stop-loss on the calls held at 0.19. If successful, we’ll have legged into a ‘free’ $2.50 vertical put spread with no risk and $2500 of profit potential. _______ UPDATE (3:17 p.m.): We’ll stick with the put position until tomorrow, but only because the coincident rally targets in TLT and USH are both ostensible heavyweights. This was therefore a logical place to try shorting, but today’s rebound is a reminder that the more rewarding challenge in TLT will be to get long at the lows of all-too-fleeting corrections.