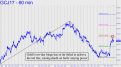

Buyers extended Wednesday’s perplexing rally — perplexing because if gold were acting normally, it would be falling on Wednesday’s headline news of a 25-basis-point rate hike by the Fed. Rising returns on risk-free paper are supposed to attract money away from bullion, right? Whatever the case, day two of gold’s surge conspicuously failed to reach the midpoint Hidden Pivot at 1236.00, never mind punch through it. A decisive move past the pivot would all but guarantee a further push to the 1277.10 target, but there’s no point in guessing about whether this will occur. We’ll give it another day or two, but the longer it takes for the April contract to move above the red line, assuming it does, the greater the suspicion that this so-far spirited rally is not headed for greatness. It may in fact turn out to be yet one more bull tease/trap. _______ UPDATE (Mar 19, 6:00 p.m. EDT): Gold disappointed us for the umpteenth time on Friday, going no higher than 1231.50 while oscillating all day long in a tedious, five-point range. Granted, it looks like a consolidation when viewed on the intraday charts. Regardless, buyers will need to rip through 1236.00 to persuade me they’re serious.

Buyers extended Wednesday’s perplexing rally — perplexing because if gold were acting normally, it would be falling on Wednesday’s headline news of a 25-basis-point rate hike by the Fed. Rising returns on risk-free paper are supposed to attract money away from bullion, right? Whatever the case, day two of gold’s surge conspicuously failed to reach the midpoint Hidden Pivot at 1236.00, never mind punch through it. A decisive move past the pivot would all but guarantee a further push to the 1277.10 target, but there’s no point in guessing about whether this will occur. We’ll give it another day or two, but the longer it takes for the April contract to move above the red line, assuming it does, the greater the suspicion that this so-far spirited rally is not headed for greatness. It may in fact turn out to be yet one more bull tease/trap. _______ UPDATE (Mar 19, 6:00 p.m. EDT): Gold disappointed us for the umpteenth time on Friday, going no higher than 1231.50 while oscillating all day long in a tedious, five-point range. Granted, it looks like a consolidation when viewed on the intraday charts. Regardless, buyers will need to rip through 1236.00 to persuade me they’re serious.