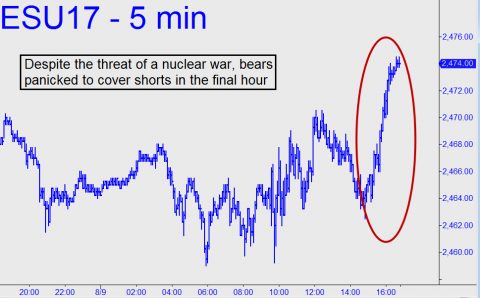

I once joked here that it would take an outbreak of nuclear war to slow down the buying that has impelled this bull market relentlessly higher since 2009. We now know that even a credible threat of a nuclear attack on U.S. soil is not sufficient to deter buyers for long. Late in Wednesday’s session, short-covering bears couldn’t wait to get ’em back. Their panicky buying, even as Kim Il Un was threatening to nuke U.S. air bases in Guam, turned what had been a badly losing day for the S&Ps into a small winner. It also stopped subscribers out of a short position in the E-Mini S&Ps that had precisely caught Tuesday’s top moments before war talk on the tape sent the S&Ps plummeting. Fortunately, I’d recommended tightening the stop-loss on the position in an update disseminated to subscribers early in Wednesday’s session, allowing them to exit with solid gains. Going by-the-book, the theoretical profit on the four-contract trade would have been around $3500. Not bad for two days’ worth of desk work.

I once joked here that it would take an outbreak of nuclear war to slow down the buying that has impelled this bull market relentlessly higher since 2009. We now know that even a credible threat of a nuclear attack on U.S. soil is not sufficient to deter buyers for long. Late in Wednesday’s session, short-covering bears couldn’t wait to get ’em back. Their panicky buying, even as Kim Il Un was threatening to nuke U.S. air bases in Guam, turned what had been a badly losing day for the S&Ps into a small winner. It also stopped subscribers out of a short position in the E-Mini S&Ps that had precisely caught Tuesday’s top moments before war talk on the tape sent the S&Ps plummeting. Fortunately, I’d recommended tightening the stop-loss on the position in an update disseminated to subscribers early in Wednesday’s session, allowing them to exit with solid gains. Going by-the-book, the theoretical profit on the four-contract trade would have been around $3500. Not bad for two days’ worth of desk work.

A Dangerous Stalemate

Will the short-covering panic continue? I have my doubts stocks can go much higher unless the conflict with North Korea is resolved peacefully, and soon. But neither do I expect the broad averages to plunge anew unless the threat of war escalates. That can happen in two foreseeable ways: movement of troops into battle positions, or the launching of a nuclear warhead by North Korea. The U.S. seems unlikely to strike pre-emptively because that could provoke a retaliation that would put millions of lives at risk in Seoul. Even so, Trump will have to respond to Kim forcefully because no leader, even those of China or Russia at their most menacing, has ever made such pointed threats before. Iran is surely watching closely, and a soft response from the U.S. could leave the world in even greater jeopardy than it faces solely from the sociopath who rules North Korea.