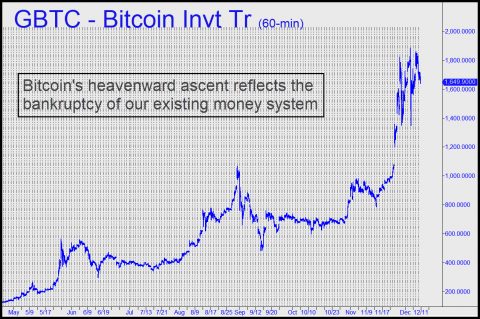

[The fact that bitcoin has no intrinsic value should trouble anyone — particularly gold bugs — who advocates honest money. Can a currency that can be created out of thin air, even if requiring huge amounts of computer processing power to do so, be considered a trustworthy store of value? When I raised this question in the Rick’s Picks forum the other day, it elicited a spirited defense of bitcoin from a forum regular who posts using the handle ‘BTDR’. His defense of cryptocurrencies (immediately below), even as their valuations continue to rise parabolically, is one of the best I’ve come across. Realize first of all, says BTDR, that the existing money system is just a Ponzi scheme that has crippled price discovery and untethered nearly all classes of assets from economic reality. RA]

“I now see BTC as the revolutionary technology that it is. Revolutionary not merely as novel, but as the perfect weapon to segregate and protect capital. It’s untouchable by derivative schemes and while it may be officially banned somewhere or everywhere, it’s demonstrating excesses not of nominal $ BTC price, but the insane $ inflation propping bonds, equities, real estate and irredeemable student, consumer and government debt. Those are the real bubbles; BTC is but the reflecting barometer now of those hyperinflationary excesses that was once gold’s prime function.

“Just as an ounce of gold will remain so irrespective of FED policies, BTC is finite, yet divisible, un-hackable and global money independent of all central banks. Since liquid monetary wealth has no prospect of value preservation in the current diseased monetary milieu, BTC is good money driving out the bad.

“The response from the government may come as a shock, and very soon, according to golden-boy carney barker Jim Rickards, who contends with due urgency that we’re about to see the long awaited return to $ gold backing. It’s forced both by the death of the petro $cheme, death of the Saudi regime, and with a BTC nail in the coffin to shelter massive $ wealth during monetary reset volatility back to global gold backing of all major currencies.

“So, for bugs the long wait may soon be over, just at another forced nadir. Hard holdings are to find reset @ $10k Au oz. — and we won’t have long to wait, says Rickards with career ending confidence if he’s wrong. Sixty days, tops. Likely sooner. Bitcoin is the future, gold is hard insurance. Bitcoin forces this move to salvage the ruin of America by failed globalists. BTC does have intrinsic value as safe store of mined energy. It may not be tangible in an elemental or aesthetic sense, but if it successfully brings down and spanks kleptocrats, that’s intrinsic value enough, in my opinion.

If you got in early on Bitcoin and held on, you are” In Like Flynn”

And now?

Well,at 20 grand and moving up and down multiple thousands of dollars, I’d pass on it.

Twenty grand gets you 10 ZB contracts, more or less, and one ZB moves at least $500, even on a slow day.

And you can get in and out in a heartbeat with 20 contracts.

Just my take on it.

The moral of the Bitcoin story to me?

If you see anything crazy in the markets that is parabolic, up and down, AND, it gets constant press coverage, good and bad……..

Put a thousand bucks on the nose and see what happens.

I have seen a lot of stocks like Bre-x, Z-best, LKQ, CME at it’s inception that provided huge returns.

Some were scams, some were not, but they all got constant press coverage, up and down.

That seems to be the key to success, does it get constant press coverage?

If it does, $1000 across the board!

Because, you just never can tell what will pay off big!