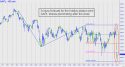

Shares of Apple, the most valuable company in the world, were getting hit hard Thursday night after the company predicted weak holiday sales. I’d spotlighted the stock here yesterday, noting that as long as AAPL continues to move higher, it would keep the U.S. bull market alive. At the time, it looked as though buyers were ready to push it at least $28 higher, or about 12%, over the near term. Now, even with relentless share buybacks and stalwart support from institutional sponsors, bulls will have to build a base for at least 2-3 weeks if they’re going to make a run at new all-time highs. We shouldn’t doubt that this is what DaBoyz intend, since they were caught flat-footed by the stock’s dive after the close. Don’t bet too heavily against them, since they are as clever as they are desperate. But considering the latest sales forecast, it’s going to be a tough slog, even for the big-time carnys who manipulate this gas-bag.

Shares of Apple, the most valuable company in the world, were getting hit hard Thursday night after the company predicted weak holiday sales. I’d spotlighted the stock here yesterday, noting that as long as AAPL continues to move higher, it would keep the U.S. bull market alive. At the time, it looked as though buyers were ready to push it at least $28 higher, or about 12%, over the near term. Now, even with relentless share buybacks and stalwart support from institutional sponsors, bulls will have to build a base for at least 2-3 weeks if they’re going to make a run at new all-time highs. We shouldn’t doubt that this is what DaBoyz intend, since they were caught flat-footed by the stock’s dive after the close. Don’t bet too heavily against them, since they are as clever as they are desperate. But considering the latest sales forecast, it’s going to be a tough slog, even for the big-time carnys who manipulate this gas-bag.

AAPL Plunges, Adding to the Bull Market’s Woes

- November 2, 2018, 6:03 am

The SPX is 31 trading days from an all time high, a 20 and 40 trading day high. It is in the counter trend sell zone as the INDU is today 23 trading days from its all time high, its 20 and 40 trading day high point. The rising ledge in the MSI breathe process is totally crack wide open and at its -1300 level, a level where stock issue move in ‘points’ not fractions. The Trump Low continues to be a major ‘Stop Loss Point’, but the ‘3 Year Ago Low Point’ under the 2015/16 trading range is observe as a capitulation period towards pricing that completes an ending phase of a major turn in stock prices.

The turning downward of the 200 dma a few trading days ago and its test yesterday and today is a place of interest of failure price action. The NYA Stocks over 200 DMA is now as mention in its ‘slide’ period towards ‘extreme’ negative levels. It has hit the 25% level, this is related to the early 2008 time period a larger liquidation time period not just the turning time period of 2007. This level was hit in Jan 2008 a period of stock values towards the -20% decline level. This level today is a level towards caution as this is a level which markets may break apart over news events, as latter in Mar 2008 that year this support level over time lead to a crisis event.

There have been few times in stock market history where a monthly turning point such as Oct 2018 had taken place (A Bearish Engulfing Pattern) suggesting and rating this turn in the top 5 of the last 100 years.

The master date of 11 11 2018 (11 11 11 = 33) is to be observe as an important date going forward.