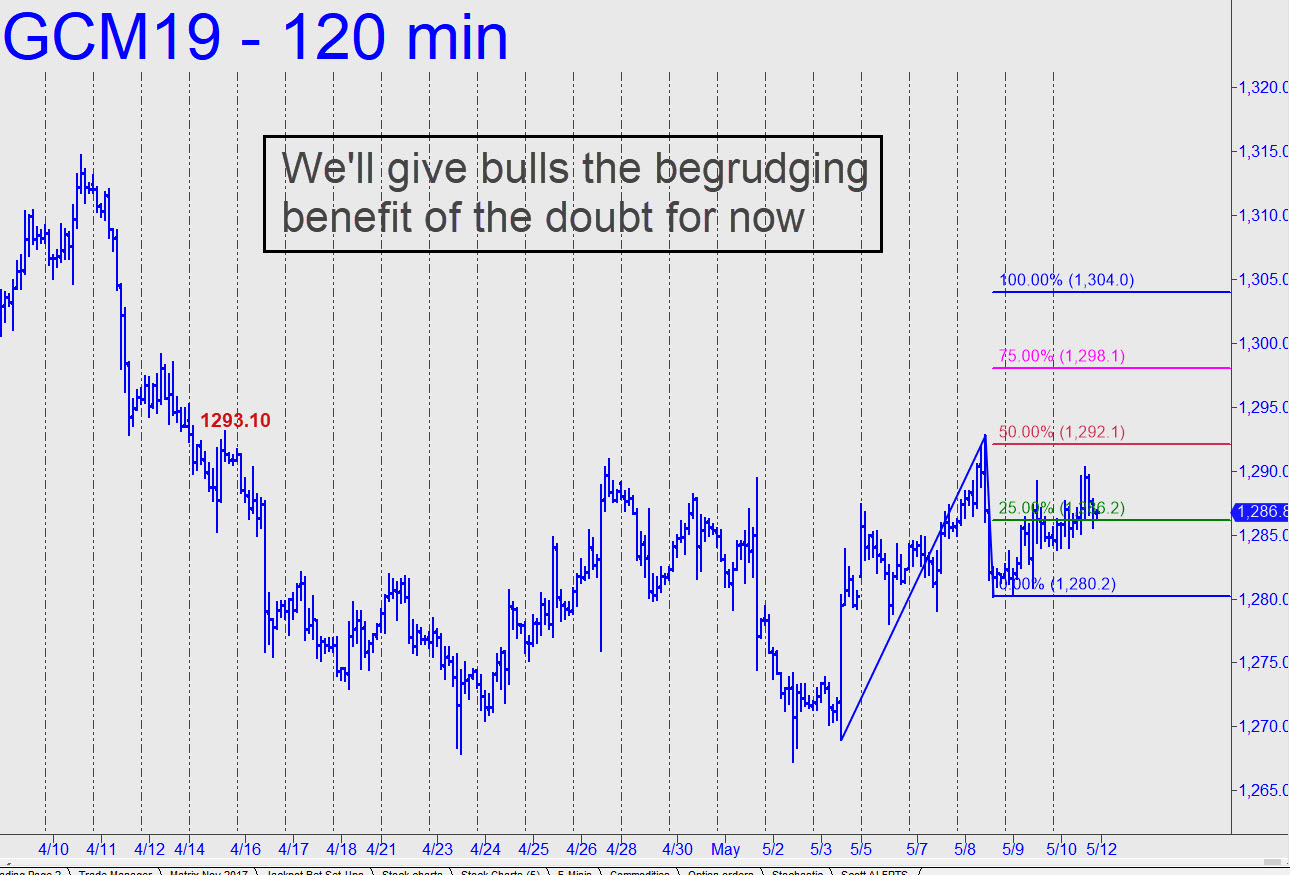

Bulls failed on the last upthrust to take out a 1293.10 ‘external’ peak recorded in mid-April, but we’ll give them the begrudging benefit of the doubt anyway because bears seem even more enfeebled right now. A push above p=1292.10 in the early going on Monday would put the futures on track to hit D=1304.00. We’ll watch for a ‘mechanical’ buy set-up to develop in the meantime, since such opportunities are few and far between in this oft-leaden trading vehicle. _______ UPDATE (May 13, 11:34 a.m. ET): The futures have popped to 1300.70 today, making them an even better bet to hit the 1304.00 target. They did so, however, without having pulled back to a mechanical bid that would have triggered at 1286.20. For the record, I regard the so-far $13 rally as pretty weak, considering that the Dow is down nearly 600 points at the moment.______ UPDATE (May 13, 9:40 p.m.): The futures topped at 1304.20 tonight, two ticks above the rally target provided above, before pulling back by $4 [and now $29!]. The next thrust would need to exceed 1314.70, equal to an ‘external’ peak recorded on April 10, to refresh the bullish energy of the hourly chart. _______ UPDATE (May 19, 10:39 p.m.) Selloffs are as unconvincing as rallies, so we should be surprised if this one takes out lows near 1268 recorded within the last month. If it does, use 1256.80 as a target. Here’s the chart. ______ UPDATE (May 23, 2019): I love this rally — to get short, that is! You can do so mechanically at 1292.40, stop 1304.20. The chart linked in the May 19 update is still relevant. ________ UPDATE (May 29, 10:06 a.m.): Cancel the short. I’m hating gold as usual, but somewhat less so at the moment because it could head-fake viciously in response to a hard selloff in the stock market. _______ UPDATE (May 31, 12:01 a.m.): Gold tripped a mechanical short at 1292.40, stop 1304.20. I am not recommending the trade because I am too down on gold at the moment to short it. But you should monitor this one anyway to further acclimate yourselves to mechanical set-ups, and to keep score if that’s your thing. I will switch to the August contract on Monday.

Bulls failed on the last upthrust to take out a 1293.10 ‘external’ peak recorded in mid-April, but we’ll give them the begrudging benefit of the doubt anyway because bears seem even more enfeebled right now. A push above p=1292.10 in the early going on Monday would put the futures on track to hit D=1304.00. We’ll watch for a ‘mechanical’ buy set-up to develop in the meantime, since such opportunities are few and far between in this oft-leaden trading vehicle. _______ UPDATE (May 13, 11:34 a.m. ET): The futures have popped to 1300.70 today, making them an even better bet to hit the 1304.00 target. They did so, however, without having pulled back to a mechanical bid that would have triggered at 1286.20. For the record, I regard the so-far $13 rally as pretty weak, considering that the Dow is down nearly 600 points at the moment.______ UPDATE (May 13, 9:40 p.m.): The futures topped at 1304.20 tonight, two ticks above the rally target provided above, before pulling back by $4 [and now $29!]. The next thrust would need to exceed 1314.70, equal to an ‘external’ peak recorded on April 10, to refresh the bullish energy of the hourly chart. _______ UPDATE (May 19, 10:39 p.m.) Selloffs are as unconvincing as rallies, so we should be surprised if this one takes out lows near 1268 recorded within the last month. If it does, use 1256.80 as a target. Here’s the chart. ______ UPDATE (May 23, 2019): I love this rally — to get short, that is! You can do so mechanically at 1292.40, stop 1304.20. The chart linked in the May 19 update is still relevant. ________ UPDATE (May 29, 10:06 a.m.): Cancel the short. I’m hating gold as usual, but somewhat less so at the moment because it could head-fake viciously in response to a hard selloff in the stock market. _______ UPDATE (May 31, 12:01 a.m.): Gold tripped a mechanical short at 1292.40, stop 1304.20. I am not recommending the trade because I am too down on gold at the moment to short it. But you should monitor this one anyway to further acclimate yourselves to mechanical set-ups, and to keep score if that’s your thing. I will switch to the August contract on Monday.

GCM19 – June Gold (Last:1291.70)

Posted on May 12, 2019, 5:04 pm EDT

Last Updated June 7, 2019, 11:18 am EDT

Posted on May 12, 2019, 5:04 pm EDT

Last Updated June 7, 2019, 11:18 am EDT