Here we go again. The Fed evidently has begun “conditioning” our “expectations” for a new season of quantitative easing. Fed Would Consider Interest-Rate Cuts if Growth Outlook Darkens is the headline atop a news story concerning a NYC panel discussion moderated by the central bank’s vice-chairman. This is just what Wall Street and other promiscuous abusers of credit have been praying for lately, along with the Trumpster. We’ve come a long way policy-wise, baby! How many months ago was it that some Fed party pooper was dropping hints about another round or two of tightening in 2019?

Here we go again. The Fed evidently has begun “conditioning” our “expectations” for a new season of quantitative easing. Fed Would Consider Interest-Rate Cuts if Growth Outlook Darkens is the headline atop a news story concerning a NYC panel discussion moderated by the central bank’s vice-chairman. This is just what Wall Street and other promiscuous abusers of credit have been praying for lately, along with the Trumpster. We’ve come a long way policy-wise, baby! How many months ago was it that some Fed party pooper was dropping hints about another round or two of tightening in 2019?

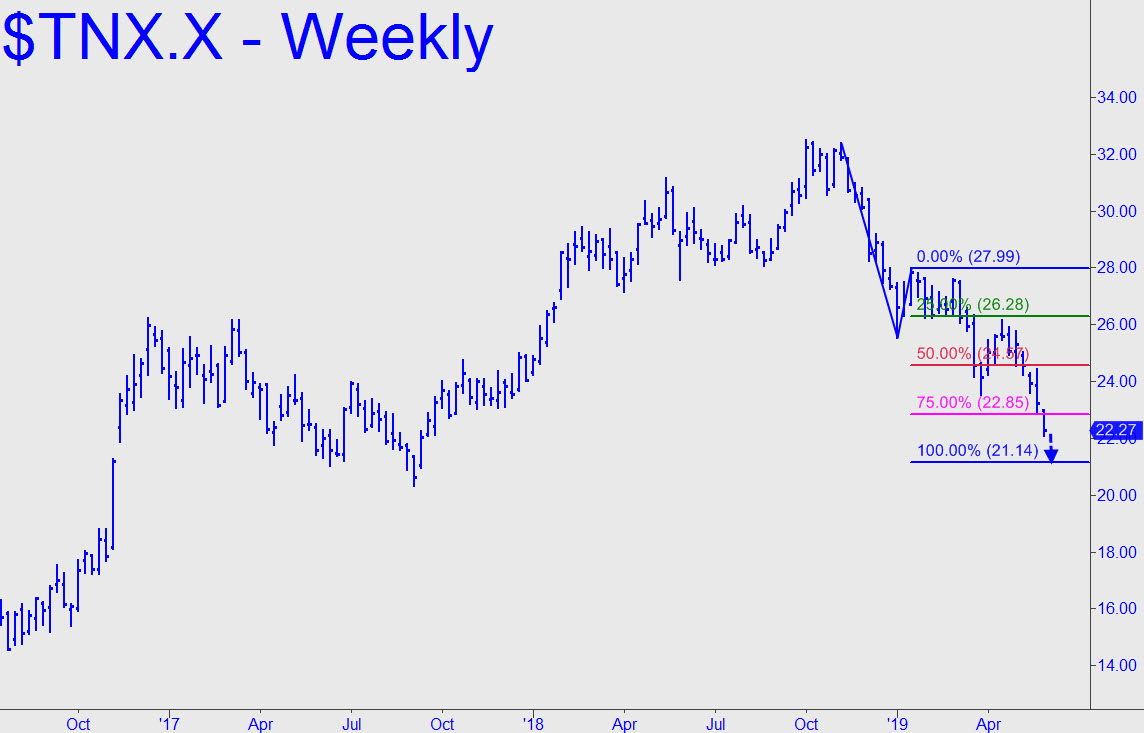

The stock market’s reaction was feeble, but only because DaBoyz are already pacing themselves to milk every inch of upside they can from the central bank’s new spin. Perhaps this is what will push the S&P 500 index to 3095, a Hidden Pivot target of mine that has seemed a little farfetched. I still have my doubts it will be reached, but I’ll stick with it unless my technical runes take a turn for the worse. In the weeks ahead, we’ll surely be hearing plenty about how easing will re-invigorate the housing market. I am predicting otherwise, since this particular gas bag has already begun to deflate. But who knows? Perhaps Southern Californians who live in dumpy little, million-dollar Eichlers will trade up? My forecast calls for 10-Year rates to decline to at least 2.11% from a current 2.22%. That may not be enough to launch stocks into the sort of parabola they achieved in Q1, but it’ll probably hold them buoyant for a while. _______ UPDATE (May 31, 8:34 a.m. ET): So much for buoyancy. Trump has taken the tariff war to Mexico with a tweeted threat, and stocks are getting pasted as a result. My forecast for lower rates can stand, however, as can my expectation that they will do nothing for the housing sector or the economy. The Fed will be pushing on a string, as the saying goes. _______ UPDATE (Jun 3, 7:02 p.m.): The 10-Year Note has fallen below my 2.11% target, but we should see some support near 2.03%, where rates bottomed in 2017. That would be a logical place for a bounce if one is coming.