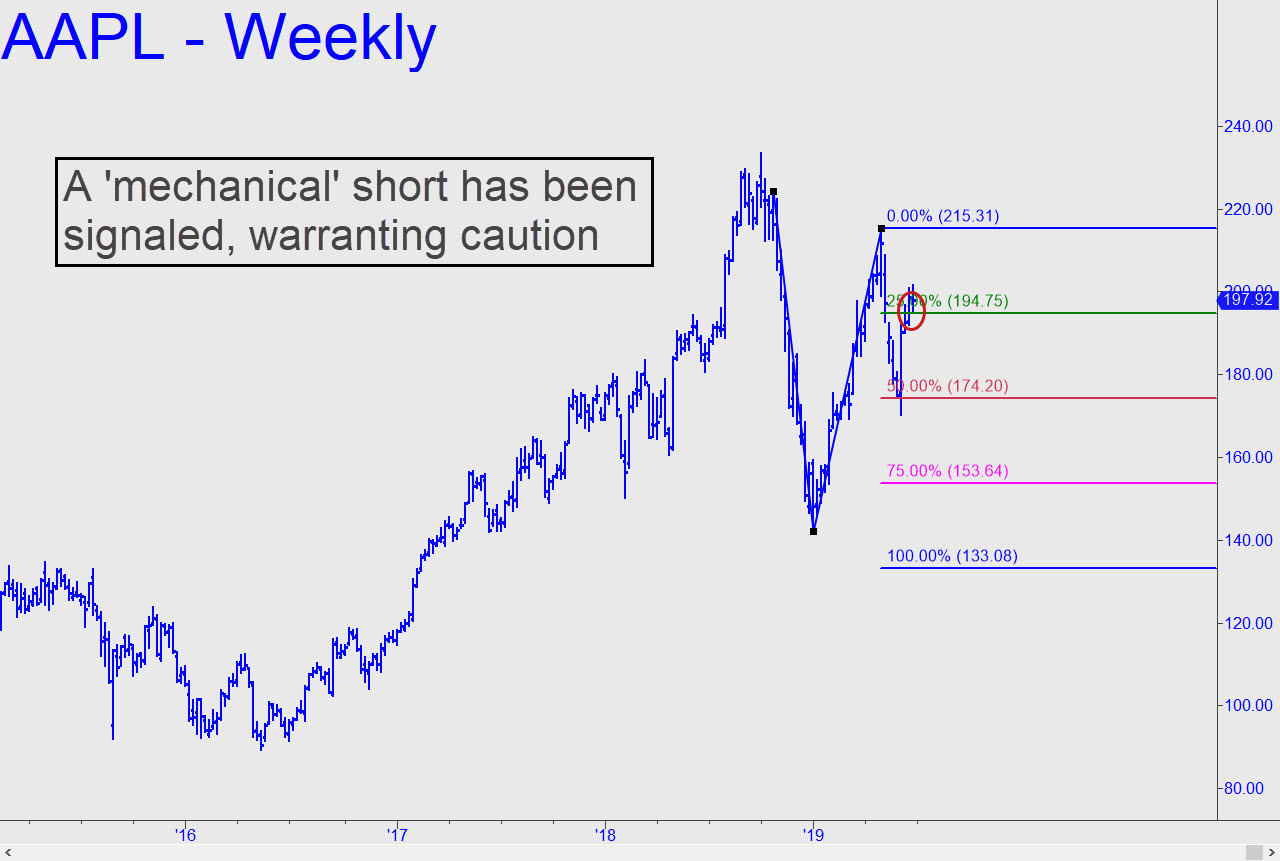

We have a sequence of rally targets at 205.51, 209.18 and 216.08 to keep us in stride with the bullish herd, but there’s an alternative picture that deserves caution. Notice that AAPL has rallied back to the green line after falling beneath the midpoint Hidden Pivot support at 174.20, producing a valid signal to get short ‘mechanically’ at 194.75 (stop 215.31). The signal is weak, however, because the dip to around 170 did not quite get down to our sweet spot near 164, and that’s why I am not recommending the trade. Regardless, the signal itself is reason not to get too comfortable with the idea that a push toward 2018’s record high at 233 is inevitable. _______ UPDATE (Jul 8, 3:44 p.m. ET): Friday’s 205.08 high came within a millimeter of the first of our three targets, 205.51, so consider it fulfilled. AAPL underscored the accuracy and importance of the target by plummeting $7 since. _______ UPDATE (Jul 22, 6:30 p.m.): A short-squeeze popped the stock above a tedious accumulation range, and it should now be presumed bound for at least 209.18, the second target in the sequence identified here more than three weeks ago. Keep in mind the each can be used to initiate a tightly stopped short. _______ UPDATE (Jul 30, 10:38 p.m.): DaBoyz have outdone themselves tonight, goosing the stock senseless with a short squeeze that has easily surpassed an otherwise impenetrable peak at 215.31 made on May 1. Give them lots of credit, since this is a task that mere bulls could never have accomplished, and it has cleared the path to eventual new-record highs.

We have a sequence of rally targets at 205.51, 209.18 and 216.08 to keep us in stride with the bullish herd, but there’s an alternative picture that deserves caution. Notice that AAPL has rallied back to the green line after falling beneath the midpoint Hidden Pivot support at 174.20, producing a valid signal to get short ‘mechanically’ at 194.75 (stop 215.31). The signal is weak, however, because the dip to around 170 did not quite get down to our sweet spot near 164, and that’s why I am not recommending the trade. Regardless, the signal itself is reason not to get too comfortable with the idea that a push toward 2018’s record high at 233 is inevitable. _______ UPDATE (Jul 8, 3:44 p.m. ET): Friday’s 205.08 high came within a millimeter of the first of our three targets, 205.51, so consider it fulfilled. AAPL underscored the accuracy and importance of the target by plummeting $7 since. _______ UPDATE (Jul 22, 6:30 p.m.): A short-squeeze popped the stock above a tedious accumulation range, and it should now be presumed bound for at least 209.18, the second target in the sequence identified here more than three weeks ago. Keep in mind the each can be used to initiate a tightly stopped short. _______ UPDATE (Jul 30, 10:38 p.m.): DaBoyz have outdone themselves tonight, goosing the stock senseless with a short squeeze that has easily surpassed an otherwise impenetrable peak at 215.31 made on May 1. Give them lots of credit, since this is a task that mere bulls could never have accomplished, and it has cleared the path to eventual new-record highs.

AAPL – Apple Computer (Last:218.13)

Posted on June 30, 2019, 5:09 pm EDT

Last Updated August 3, 2019, 2:52 pm EDT

Posted on June 30, 2019, 5:09 pm EDT

Last Updated August 3, 2019, 2:52 pm EDT