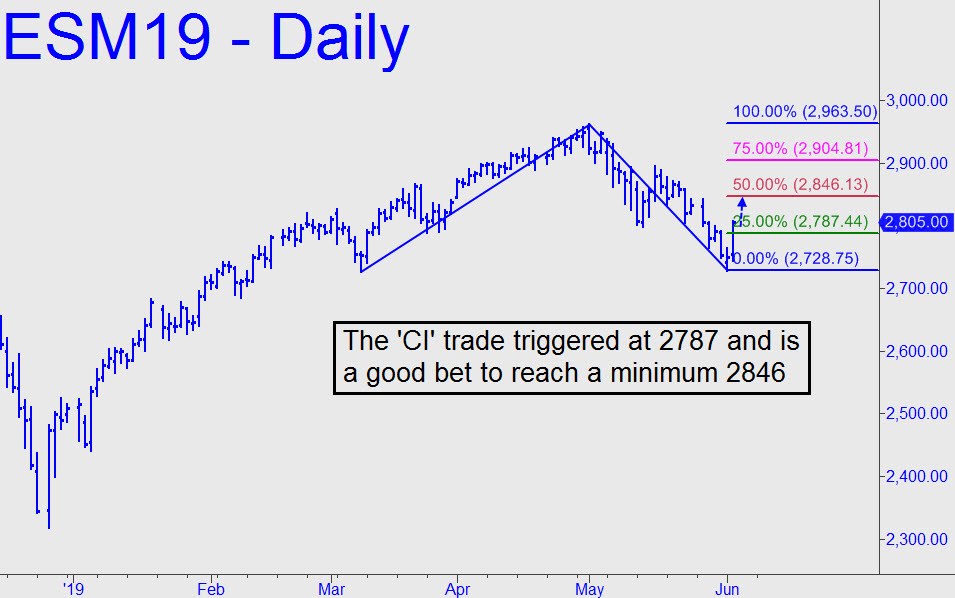

The ‘counterintuitive’ trade recommended for Tuesday triggered at 2787 and was showing a theoretical gain of $900 per contract shortly after the close. Because of the way the rally blew past the green line, it is an excellent bet to achieve a minimum 2846, the midpoint Hidden Pivot of the pattern shown. If you did the trade, I would recommend taking a profit on half of your position at these levels and using a break-even stop for what remains. Exit an additional 25% at 2846, then keep 25% for a potential moon shot to as high as 2963. At that price, the gain on any contracts still held would be $8800. Subscribers who hold a position should let me know in the trading room. I will provide tracking guidance if I hear from at least two of you who followed my recommendation. (Note: I also advised using the micro contract as an alternative during an impromptu online session held Tuesday morning.) ________ UPDATE (Jun 5, 9:18 p.m.): In the chat room just now, I have advised exiting any remaining contracts at a current 2817. The additional theoretical gain would be about $1500 per contract. I am skeptical that this rally will get much further, or that desperate hints of easing from the fraudsters at the Fed will carry the day. ________ UPDATE (June 5, 5:33 p.m.): A weekly close above 2846 would bolster the bullish case, which I’ve pegged to a 3095 target for the S&P cash index.

The ‘counterintuitive’ trade recommended for Tuesday triggered at 2787 and was showing a theoretical gain of $900 per contract shortly after the close. Because of the way the rally blew past the green line, it is an excellent bet to achieve a minimum 2846, the midpoint Hidden Pivot of the pattern shown. If you did the trade, I would recommend taking a profit on half of your position at these levels and using a break-even stop for what remains. Exit an additional 25% at 2846, then keep 25% for a potential moon shot to as high as 2963. At that price, the gain on any contracts still held would be $8800. Subscribers who hold a position should let me know in the trading room. I will provide tracking guidance if I hear from at least two of you who followed my recommendation. (Note: I also advised using the micro contract as an alternative during an impromptu online session held Tuesday morning.) ________ UPDATE (Jun 5, 9:18 p.m.): In the chat room just now, I have advised exiting any remaining contracts at a current 2817. The additional theoretical gain would be about $1500 per contract. I am skeptical that this rally will get much further, or that desperate hints of easing from the fraudsters at the Fed will carry the day. ________ UPDATE (June 5, 5:33 p.m.): A weekly close above 2846 would bolster the bullish case, which I’ve pegged to a 3095 target for the S&P cash index.

ESM19 – June E-Mini S&P (Last:2828.25)

Posted on June 4, 2019, 5:24 pm EDT

Last Updated June 6, 2019, 3:49 pm EDT

Posted on June 4, 2019, 5:24 pm EDT

Last Updated June 6, 2019, 3:49 pm EDT