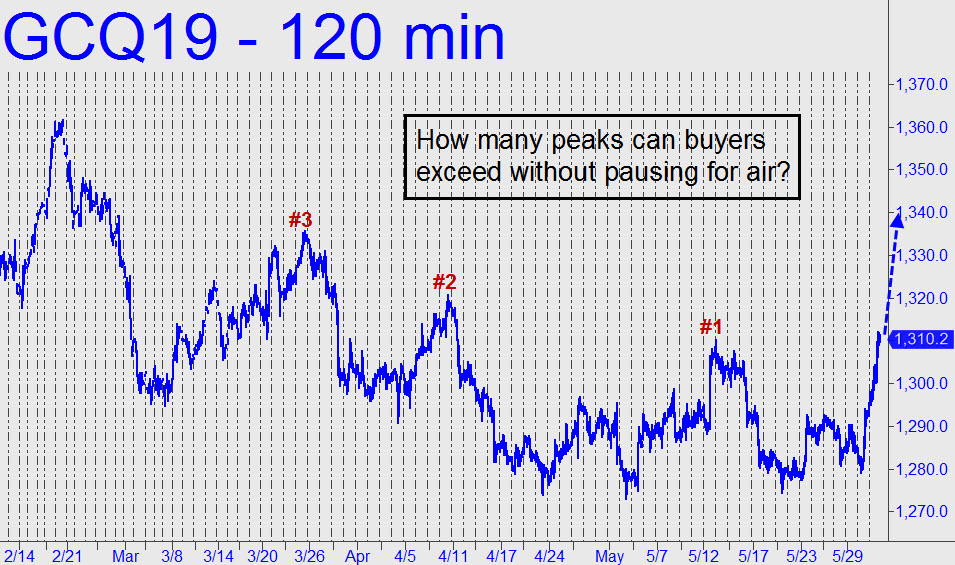

Gold’s $30 run-up over the last two sessions is the sharpest we’ve seen in a while. Was it just a knee-jerk reaction to continuing weakness in U.S. stocks? Probably. But we’ll keep a close eye on it nevertheless, since gold sentiment is so negative, sometimes verging on despair. Many investors who have followed bullion’s bear market closely since prices peaked eight years ago just above $1900 seem to get their hopes up every time gold rallies moderately. Disappointment has invariably followed, and then something worse as prices receded back into a rut. And yet, quotes have been too stubbornly buoyant for bears to triumph. Gold has been in a holding pattern for six years, defying predictions of a plunge below $1000 to shake out weak hands once and for all. It is a consolidation to be endured — but also closely watched, so that we do not mistake the start of a bull market for yet another tiresome and vexatious head fake. In practice, for now, that will mean focusing on the three ‘external’ peaks shown in the chart (inset). If this move exceeds all of them without much of a pullback on the intraday charts, that could be a sign that we are witnessing something more than just a tease. ______ UPDATE (Jun 3, 6:42 p.m.): This is the steepest three-day rally we’ve seen in a long while. It would exceed 1335.70, the last of the three peaks mentioned above with just one more modest push. If it can get past a fourth ‘external’ peal at 1347.90 recorded in February that isn’t labeled in the chart, that would raise the odds that this rally is about to get legs. Specifically, it would put into play the 1412.20 target shown in this chart. Note that our minimum target at present is p=1342.70, a very key resistance. _______ UPDATE (Jun 5, 5:42 p.m.): Buyers exceeded the 1342.70 pivot and the external peak noted above, raising the odds of a rally to 1412.20. The picture would brighten still more if they can close the futures above 1342.70 for two consecutive days.

Gold’s $30 run-up over the last two sessions is the sharpest we’ve seen in a while. Was it just a knee-jerk reaction to continuing weakness in U.S. stocks? Probably. But we’ll keep a close eye on it nevertheless, since gold sentiment is so negative, sometimes verging on despair. Many investors who have followed bullion’s bear market closely since prices peaked eight years ago just above $1900 seem to get their hopes up every time gold rallies moderately. Disappointment has invariably followed, and then something worse as prices receded back into a rut. And yet, quotes have been too stubbornly buoyant for bears to triumph. Gold has been in a holding pattern for six years, defying predictions of a plunge below $1000 to shake out weak hands once and for all. It is a consolidation to be endured — but also closely watched, so that we do not mistake the start of a bull market for yet another tiresome and vexatious head fake. In practice, for now, that will mean focusing on the three ‘external’ peaks shown in the chart (inset). If this move exceeds all of them without much of a pullback on the intraday charts, that could be a sign that we are witnessing something more than just a tease. ______ UPDATE (Jun 3, 6:42 p.m.): This is the steepest three-day rally we’ve seen in a long while. It would exceed 1335.70, the last of the three peaks mentioned above with just one more modest push. If it can get past a fourth ‘external’ peal at 1347.90 recorded in February that isn’t labeled in the chart, that would raise the odds that this rally is about to get legs. Specifically, it would put into play the 1412.20 target shown in this chart. Note that our minimum target at present is p=1342.70, a very key resistance. _______ UPDATE (Jun 5, 5:42 p.m.): Buyers exceeded the 1342.70 pivot and the external peak noted above, raising the odds of a rally to 1412.20. The picture would brighten still more if they can close the futures above 1342.70 for two consecutive days.

GCQ19 – August Gold (Last:1334.70)

Posted on June 2, 2019, 12:11 am EDT

Last Updated June 9, 2019, 11:50 pm EDT

Posted on June 2, 2019, 12:11 am EDT

Last Updated June 9, 2019, 11:50 pm EDT