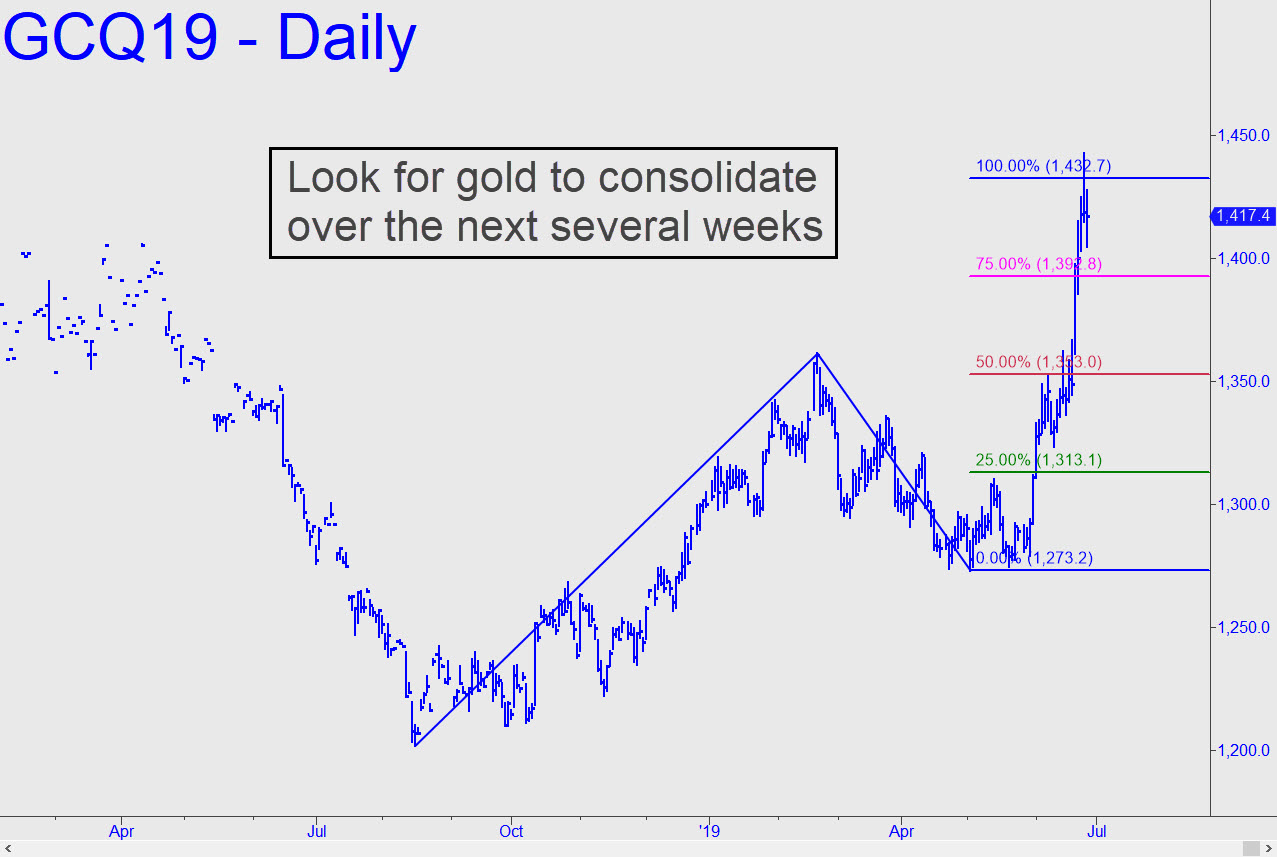

August Gold’s attempt to reverse from a morning sell-off prompted a subscriber to ask in the Rick’s Picks trading room whether bullion is already getting second wind. I doubt it, since June’s sensational run-up was too steep to sustain and will likely require a breather of perhaps 2-3 weeks to recharge. But I do expect the uptrend to resume after a proper pullback because this month’s surge decisively exceeded clear Hidden Pivot resistances at 1412 and 1432. This is usually a reliable sign that the dominant trend will continue, and it is quite clear in this instance. Because the pattern took ten months to play out, it would be surprising — and quite bullish — if the futures do a ‘180’ and blow past the 1432.70 peak within the next few days. Anything’s possible, so we’ll simply wait for gold to do its thing and to tell us what’s on its mind. _______ UPDATE (Jul 1, 7:16 p.m. ET): Expect more weakness, since the futures failed to get airborne after tripping a ‘counterintuitive’ buy signal. Most immediately they could fall to around 1340.00 before picking up structural support from some prior lows recorded in mid-June. But if you want a precise Hidden Pivot target where a tradeable low is possible, use 1356.30 (60-minute, a=1427.80 on 6/27; b=1384.70).

August Gold’s attempt to reverse from a morning sell-off prompted a subscriber to ask in the Rick’s Picks trading room whether bullion is already getting second wind. I doubt it, since June’s sensational run-up was too steep to sustain and will likely require a breather of perhaps 2-3 weeks to recharge. But I do expect the uptrend to resume after a proper pullback because this month’s surge decisively exceeded clear Hidden Pivot resistances at 1412 and 1432. This is usually a reliable sign that the dominant trend will continue, and it is quite clear in this instance. Because the pattern took ten months to play out, it would be surprising — and quite bullish — if the futures do a ‘180’ and blow past the 1432.70 peak within the next few days. Anything’s possible, so we’ll simply wait for gold to do its thing and to tell us what’s on its mind. _______ UPDATE (Jul 1, 7:16 p.m. ET): Expect more weakness, since the futures failed to get airborne after tripping a ‘counterintuitive’ buy signal. Most immediately they could fall to around 1340.00 before picking up structural support from some prior lows recorded in mid-June. But if you want a precise Hidden Pivot target where a tradeable low is possible, use 1356.30 (60-minute, a=1427.80 on 6/27; b=1384.70).

GCQ19 – August Gold (Last:1390.30)

Posted on June 26, 2019, 7:43 pm EDT

Last Updated July 5, 2019, 10:14 am EDT

Posted on June 26, 2019, 7:43 pm EDT

Last Updated July 5, 2019, 10:14 am EDT