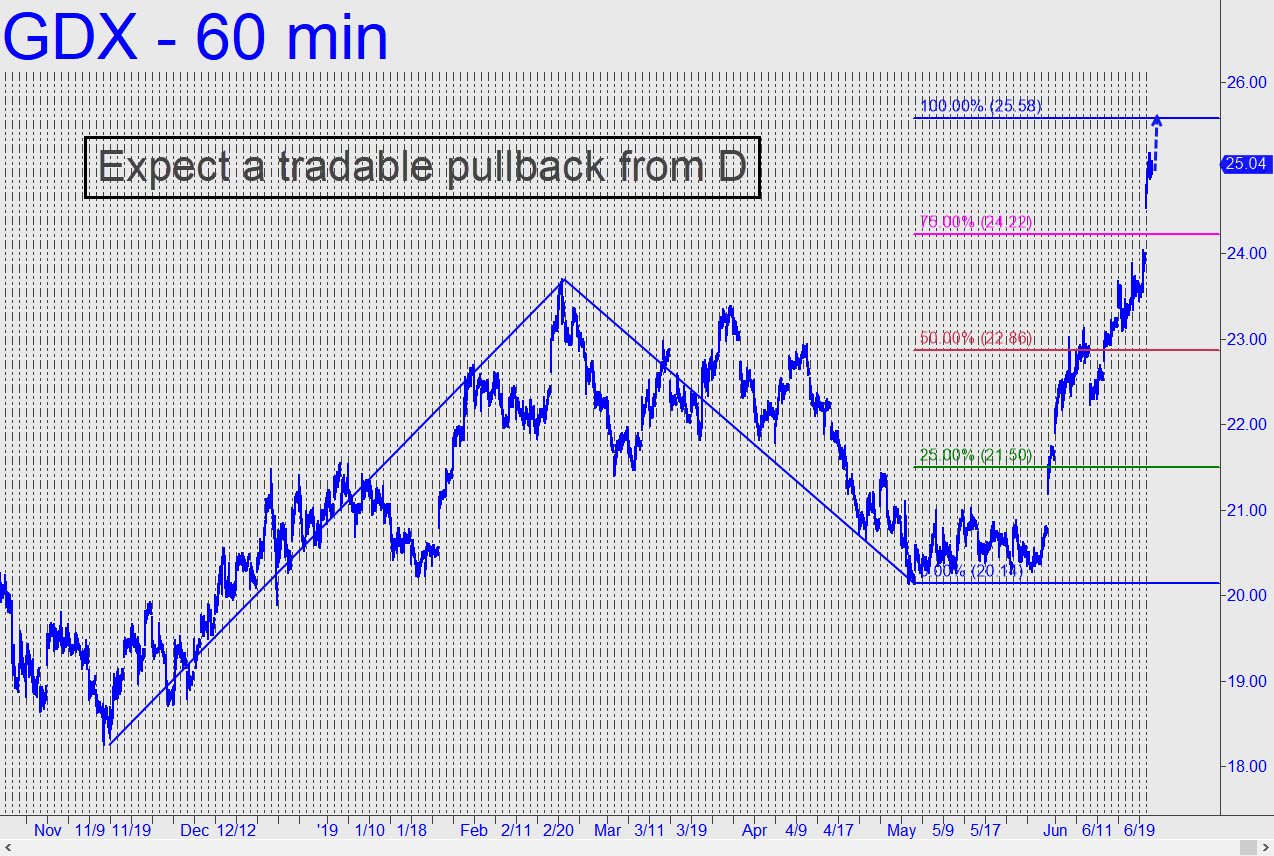

Bullion’s powerful rally this week has kicked this popular mining-stock vehicle into high gear. I haven’t tracked it in quite a while but aim to do so now, provided it remains feisty and interesting. In that regard, GDX looks like it’s about to ratchet up the interest-level, although not in a way we might have preferred. Notice that Thursday’s energetic short-squeeze brought the ETF within inches of a target at 25.58. This Hidden Pivot resistance can be used as a minimum upside objective for now, but don’t expect GDX to pop through it on the first try. More likely is a pullback of sufficient magnitude that you should consider taking a partial profit or doing covered writes in the range 25.42 – 25.70 if you are long. Please note that if buyers should blow past D=25.58 with ease, that would imply that the target of a bigger pattern is in play. In this case, it would be 36.67 (!), a Hidden Pivot whose provenance goes back to a low at 12.40 recorded early in 2016. The lower target corresponds to one at 1412 for Comex August Gold that I disseminated to subscribers several weeks ago._______ UPDATE (Jun 24, 8:52 p.m.): Buyers shredded the 25.58 pivot, leaving little doubt about the underlying strength and potential of this move. _______ UPDATE (Jun 25, 8:28 p.m.): I neglected to mention an important Hidden Pivot resistance at 26.98 that can serve as a minimum upside target for the near term (i.e., the next 3-5 days). It is the C-D midpoint tied to the 36.67 target noted above. Here’s a chart that shows it. _______ UPDATE (Jun 26, 9:42 p.m.): GDX tripped a theoretical sell signal at 25.47 that implies it will fall to at least 25.21, or possibly to 24.67, if it slips today. _______ UPDATE (Jun 27, 5:59 p.m.): GDX fell to 25.14, slightly exceeding the midpoint support noted above. Its modest recovery over the course of the day did not alter the short-term picture, which remains bearish. Indeed, if the rally touches 25.47 today (i.e., the green line shown in the chart), GDX would become a ‘mechanical’ short, stop 25.75._______ UPDATE (June 28, 10:40 a.m.): GDXJ was a ‘conventional’ short on Wednesday when it fell to x=25.47, and half would have been covered the next day on the drop to p=25.21. The ‘mechanical’ short advised in the June 27 update is erroneous, however, since GDX STILL hasn’t fallen to our sweet spot between p and p2. As such, I am NOT recommending a mechanical short here. The remaining portion of the original short is still ‘live’, though, to be covered at will (but presumably for better-than-break-even).

Bullion’s powerful rally this week has kicked this popular mining-stock vehicle into high gear. I haven’t tracked it in quite a while but aim to do so now, provided it remains feisty and interesting. In that regard, GDX looks like it’s about to ratchet up the interest-level, although not in a way we might have preferred. Notice that Thursday’s energetic short-squeeze brought the ETF within inches of a target at 25.58. This Hidden Pivot resistance can be used as a minimum upside objective for now, but don’t expect GDX to pop through it on the first try. More likely is a pullback of sufficient magnitude that you should consider taking a partial profit or doing covered writes in the range 25.42 – 25.70 if you are long. Please note that if buyers should blow past D=25.58 with ease, that would imply that the target of a bigger pattern is in play. In this case, it would be 36.67 (!), a Hidden Pivot whose provenance goes back to a low at 12.40 recorded early in 2016. The lower target corresponds to one at 1412 for Comex August Gold that I disseminated to subscribers several weeks ago._______ UPDATE (Jun 24, 8:52 p.m.): Buyers shredded the 25.58 pivot, leaving little doubt about the underlying strength and potential of this move. _______ UPDATE (Jun 25, 8:28 p.m.): I neglected to mention an important Hidden Pivot resistance at 26.98 that can serve as a minimum upside target for the near term (i.e., the next 3-5 days). It is the C-D midpoint tied to the 36.67 target noted above. Here’s a chart that shows it. _______ UPDATE (Jun 26, 9:42 p.m.): GDX tripped a theoretical sell signal at 25.47 that implies it will fall to at least 25.21, or possibly to 24.67, if it slips today. _______ UPDATE (Jun 27, 5:59 p.m.): GDX fell to 25.14, slightly exceeding the midpoint support noted above. Its modest recovery over the course of the day did not alter the short-term picture, which remains bearish. Indeed, if the rally touches 25.47 today (i.e., the green line shown in the chart), GDX would become a ‘mechanical’ short, stop 25.75._______ UPDATE (June 28, 10:40 a.m.): GDXJ was a ‘conventional’ short on Wednesday when it fell to x=25.47, and half would have been covered the next day on the drop to p=25.21. The ‘mechanical’ short advised in the June 27 update is erroneous, however, since GDX STILL hasn’t fallen to our sweet spot between p and p2. As such, I am NOT recommending a mechanical short here. The remaining portion of the original short is still ‘live’, though, to be covered at will (but presumably for better-than-break-even).

GDX – Gold Miners ETF (Last:25.53)

Posted on June 20, 2019, 10:08 pm EDT

Last Updated June 28, 2019, 10:43 am EDT

Posted on June 20, 2019, 10:08 pm EDT

Last Updated June 28, 2019, 10:43 am EDT