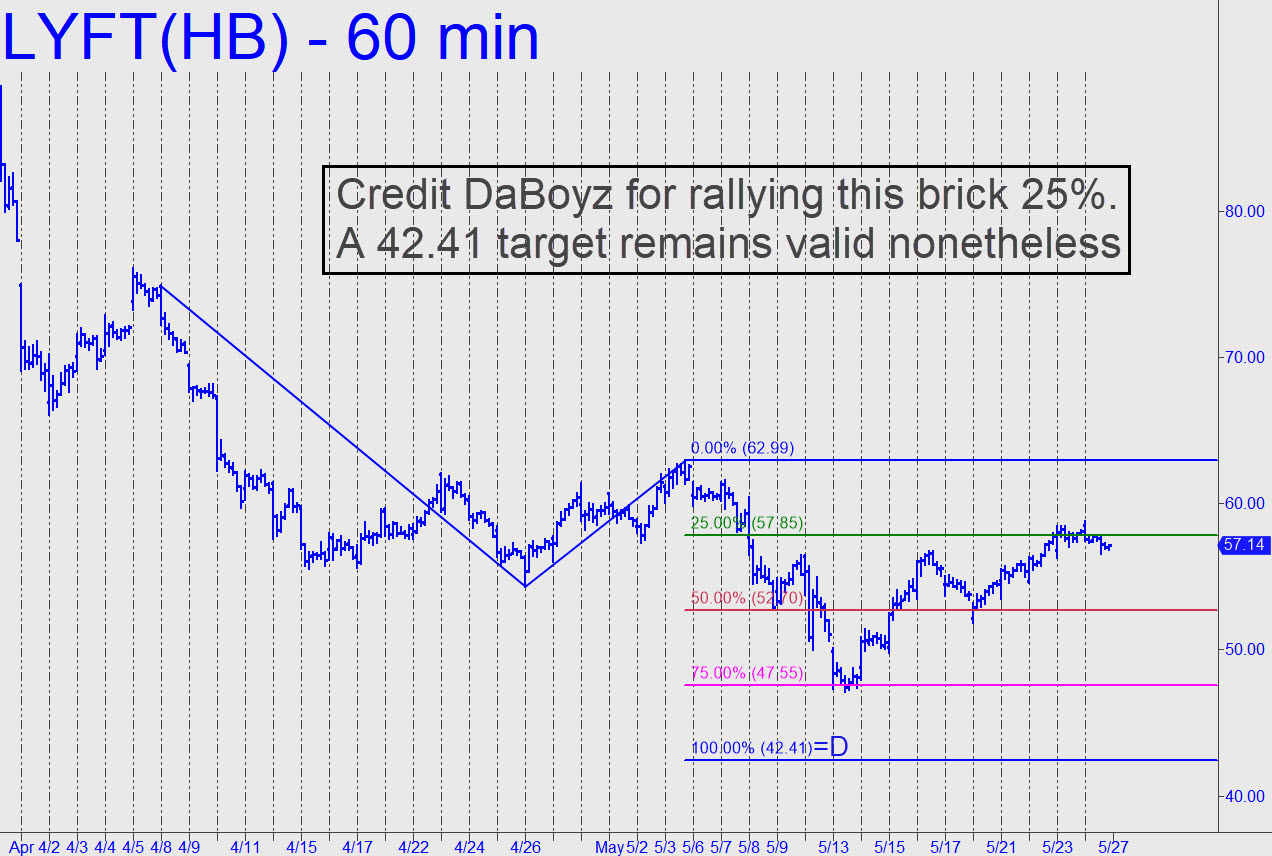

Lyft’s 25% rally off a post-IPO low of 47.17 demonstrates that there really is a sucker born every minute. They evidently have been lining up in droves to purchase shares of Lyft, which at best faces a long, treacherous path to profitability. A key hurdle is whether drivers for the digital ride-sharing companies are to be classified by the IRS as employees rather than contractors. If the former, the firms are fated to get trounced by independent operators banding together to provide all of the services that Lyft and Uber currently provide and a few more. For your information, LYFT triggered an old-style ‘mechanical’ short Thursday at 57.85, stop 62.99, for a shot at 42.41. This is a riskier set-up than we usually trade, so I am advising it only for experienced Pivoteers. ______ UPDATE (Jun 3, 7:18 p.m.) Shorts are getting squeezed hard and would invalidate the 42.41 target if 62.99 is exceeded. That would not change my bearish outlook for the stock, although we would need to establish a new short position at a higher level. _______ UPDATE (Jun 5, 5:46 p.m.): Short-covering drove this gas-bag slightly above 62.99. Now, we can use the 62.99 peak recorded on May 3 to short the stock ‘counterintuitively’. If it goes no higher than Wednesday’s 63.24 top, the short would be signaled at 59.29._______ UPDATE (Jun 9, 6:15 p.m.): A two-day plunge triggered the short at 59.29 for a presumptive ride down to at least 55.33. I will track the position if I hear from at least two subscribers who did the trade._______ UPDATE (June 10, 5:04 p.m.): The ‘counterintuitive’ short is showing a $1000 theoretical profit at the moment on 400 shares. It has the potential to produce an additional $550 at p=55.33, and nearly $1600 more at D. I’ve heard from just one person who did the trade. Any others? In any case, half should be covered near 55.33. ______ UPDATE (June 11, 2:50 p.m.) Cover half the position here, around 57.80, and use a 58.61 stop-loss for the rest. It should be worked o-c-o with orders to cover an additional 25% at 57.35, and the final 25% near 55.44. _______ UPDATE (Jun 13, 5:06 p.m): A 400-share position would have produced a gain of $554 if you followed my instructions exactly. You covered 200 shares at 57.80 for a $288 gain; 100 shares (6/12 on the opening) at 57.35 for a $188 gain; and the last 100 shares at 58.61 for a $68 gain. Have a good last look, since it could be a while before the stock turns up on this list again.

Lyft’s 25% rally off a post-IPO low of 47.17 demonstrates that there really is a sucker born every minute. They evidently have been lining up in droves to purchase shares of Lyft, which at best faces a long, treacherous path to profitability. A key hurdle is whether drivers for the digital ride-sharing companies are to be classified by the IRS as employees rather than contractors. If the former, the firms are fated to get trounced by independent operators banding together to provide all of the services that Lyft and Uber currently provide and a few more. For your information, LYFT triggered an old-style ‘mechanical’ short Thursday at 57.85, stop 62.99, for a shot at 42.41. This is a riskier set-up than we usually trade, so I am advising it only for experienced Pivoteers. ______ UPDATE (Jun 3, 7:18 p.m.) Shorts are getting squeezed hard and would invalidate the 42.41 target if 62.99 is exceeded. That would not change my bearish outlook for the stock, although we would need to establish a new short position at a higher level. _______ UPDATE (Jun 5, 5:46 p.m.): Short-covering drove this gas-bag slightly above 62.99. Now, we can use the 62.99 peak recorded on May 3 to short the stock ‘counterintuitively’. If it goes no higher than Wednesday’s 63.24 top, the short would be signaled at 59.29._______ UPDATE (Jun 9, 6:15 p.m.): A two-day plunge triggered the short at 59.29 for a presumptive ride down to at least 55.33. I will track the position if I hear from at least two subscribers who did the trade._______ UPDATE (June 10, 5:04 p.m.): The ‘counterintuitive’ short is showing a $1000 theoretical profit at the moment on 400 shares. It has the potential to produce an additional $550 at p=55.33, and nearly $1600 more at D. I’ve heard from just one person who did the trade. Any others? In any case, half should be covered near 55.33. ______ UPDATE (June 11, 2:50 p.m.) Cover half the position here, around 57.80, and use a 58.61 stop-loss for the rest. It should be worked o-c-o with orders to cover an additional 25% at 57.35, and the final 25% near 55.44. _______ UPDATE (Jun 13, 5:06 p.m): A 400-share position would have produced a gain of $554 if you followed my instructions exactly. You covered 200 shares at 57.80 for a $288 gain; 100 shares (6/12 on the opening) at 57.35 for a $188 gain; and the last 100 shares at 58.61 for a $68 gain. Have a good last look, since it could be a while before the stock turns up on this list again.

LYFT – Lyft Inc. (Last:61.21)

Posted on June 9, 2019, 5:02 pm EDT

Last Updated June 16, 2019, 1:51 pm EDT

Posted on June 9, 2019, 5:02 pm EDT

Last Updated June 16, 2019, 1:51 pm EDT