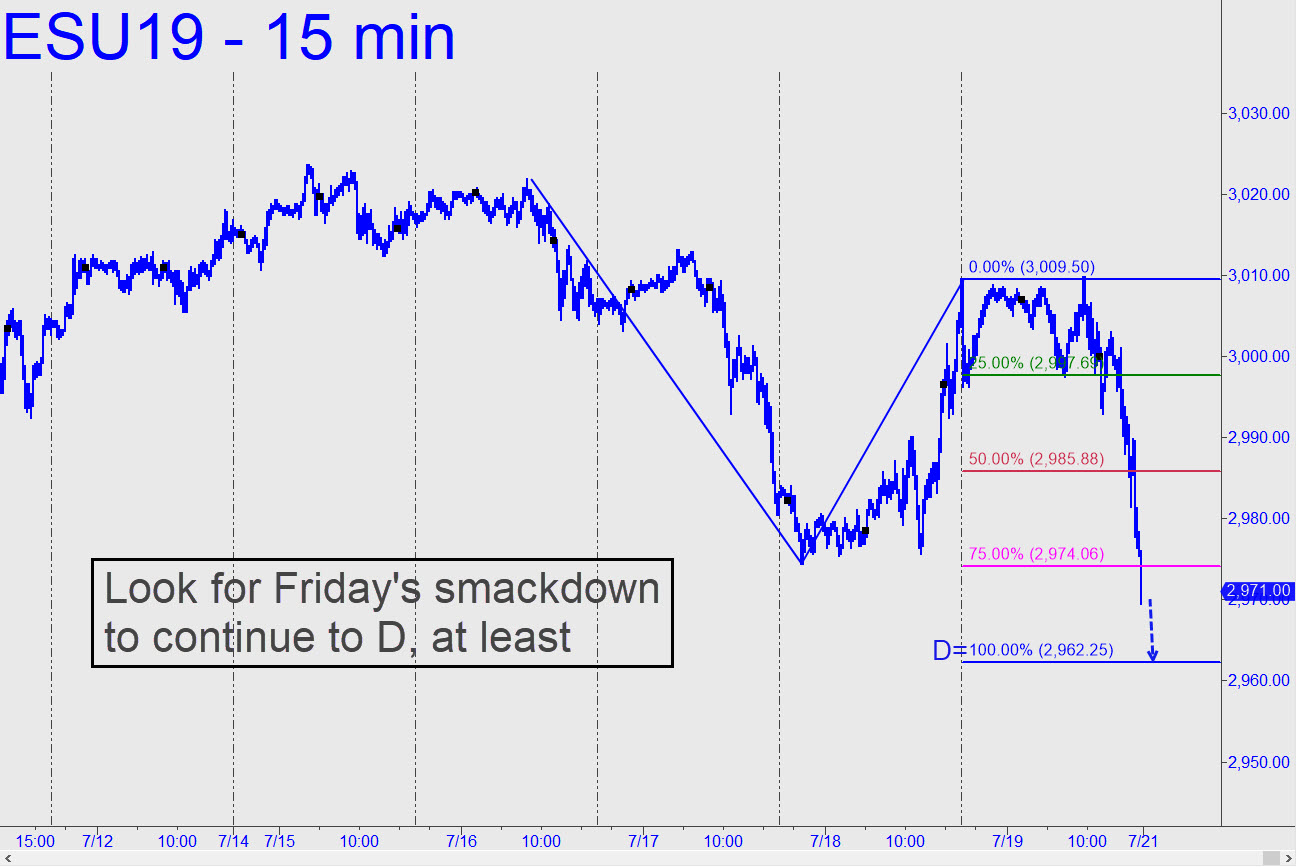

You should be out of the long position initiated last Thursday at 2985.50. Numerous subscribers reported doing the trade, which was showing a theoretical profit of around $4900 at Friday’s highs. The nasty selloff into the close would have reduced your gains by as much as $2,000, since I’d advised a wide stop-loss at 2971.00 in order to swing for the fences with the contract that remained. Please let me know in the chat room how you fared, since Rick’s Picks P&L performance is based solely on what subscribers report, not on hypothetical trades. Looking just ahead, use the 2962.25 Hidden Pivot shown as a minimum downside target. The stock market looked like hell all day, and it is not an encouraging sign that it was unable to deliver on a swing-for-the-fences play that just a couple of weeks ago would have been a shoe-in. But before we assume stocks are entering a weak phase (or worse), let’s see how well the 2962.25 Hidden Pivot support fares. _______ UPDATE (Jul 23, 6:25 p.m. ET): So much for that bearish target at 2962.25. The futures reversed after having gone no lower than 2969 and now appear bound for 3028.75. A pullback to 2984.25 on Wednesday would trigger a mechanical ‘buy’, stop 2969.25. _______ UPDATE (Jul 30, 10:31 p.m.): The futures have traded no higher than 3029.50 so far, so the Hidden Pivot resistance worked, and precisely. Some subscribers evidently got short, but I will need to hear from a few of you before I establish a tracking position. In any event, partial-profit-taking would have been warranted on the 28-point plunge that followed the high. _______ UPDATE (Jul 31, 9:58 p.m.): The bounce into the close tripped a ‘mechanical’ short to 2939.50 at x=2983. I’d suggest spectating, since the low of the pattern’s C-D leg did not quite reach our sweet spot. Here’s the chart. ______ UPDATE (Aug 1, 6:40 p.m.): Good thing we held off on the trade, since DaBoyz gutted shorts before pulling the plug.

You should be out of the long position initiated last Thursday at 2985.50. Numerous subscribers reported doing the trade, which was showing a theoretical profit of around $4900 at Friday’s highs. The nasty selloff into the close would have reduced your gains by as much as $2,000, since I’d advised a wide stop-loss at 2971.00 in order to swing for the fences with the contract that remained. Please let me know in the chat room how you fared, since Rick’s Picks P&L performance is based solely on what subscribers report, not on hypothetical trades. Looking just ahead, use the 2962.25 Hidden Pivot shown as a minimum downside target. The stock market looked like hell all day, and it is not an encouraging sign that it was unable to deliver on a swing-for-the-fences play that just a couple of weeks ago would have been a shoe-in. But before we assume stocks are entering a weak phase (or worse), let’s see how well the 2962.25 Hidden Pivot support fares. _______ UPDATE (Jul 23, 6:25 p.m. ET): So much for that bearish target at 2962.25. The futures reversed after having gone no lower than 2969 and now appear bound for 3028.75. A pullback to 2984.25 on Wednesday would trigger a mechanical ‘buy’, stop 2969.25. _______ UPDATE (Jul 30, 10:31 p.m.): The futures have traded no higher than 3029.50 so far, so the Hidden Pivot resistance worked, and precisely. Some subscribers evidently got short, but I will need to hear from a few of you before I establish a tracking position. In any event, partial-profit-taking would have been warranted on the 28-point plunge that followed the high. _______ UPDATE (Jul 31, 9:58 p.m.): The bounce into the close tripped a ‘mechanical’ short to 2939.50 at x=2983. I’d suggest spectating, since the low of the pattern’s C-D leg did not quite reach our sweet spot. Here’s the chart. ______ UPDATE (Aug 1, 6:40 p.m.): Good thing we held off on the trade, since DaBoyz gutted shorts before pulling the plug.

ESU19 – Sep E-Mini S&P (Last:2944.25)

Posted on July 21, 2019, 5:15 pm EDT

Last Updated August 1, 2019, 6:39 pm EDT

Posted on July 21, 2019, 5:15 pm EDT

Last Updated August 1, 2019, 6:39 pm EDT