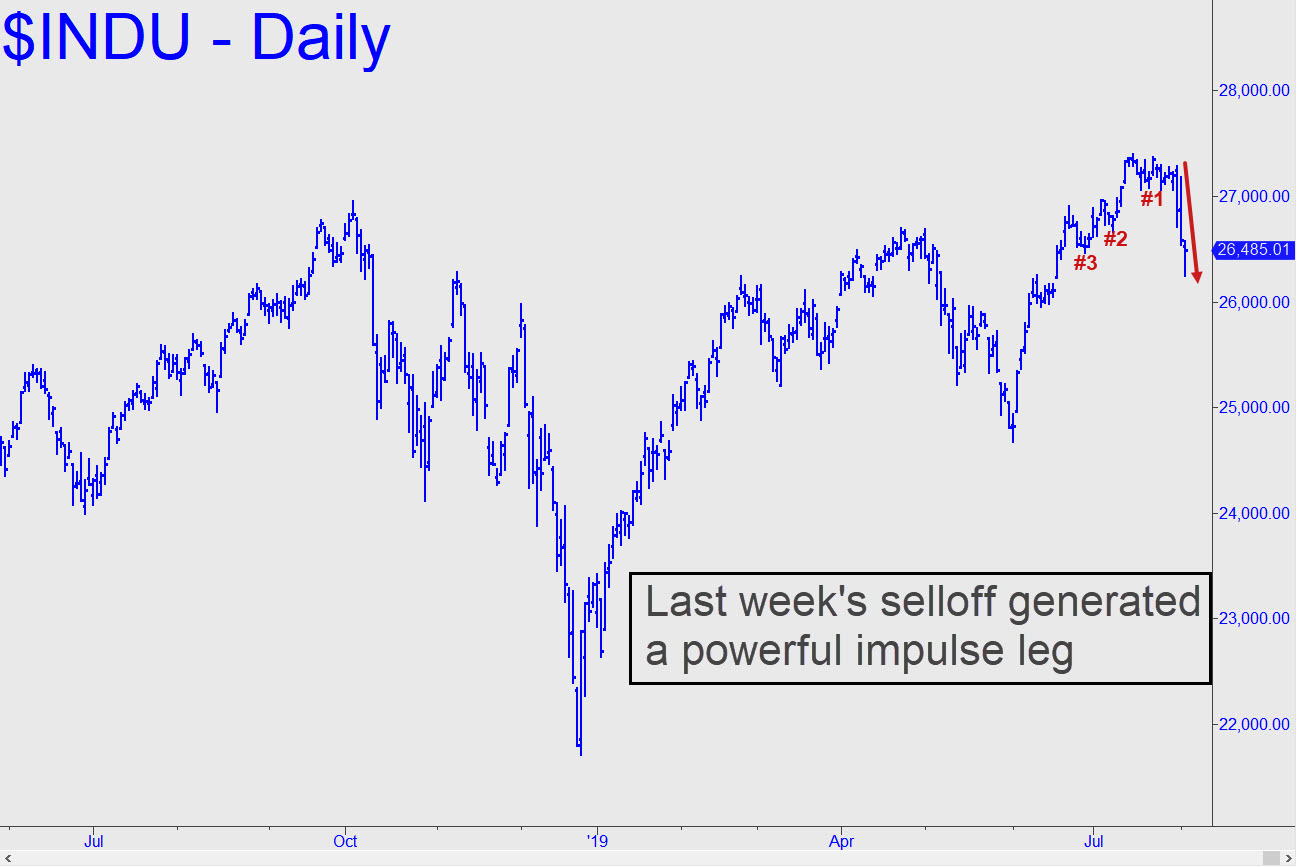

The Indoos have come down hard after rallying to within an inch of an important Hidden Pivot rally target at 28,463 three weeks ago. There were two targets above it, but they should be put aside for now, until the correction — assuming that’s what it is — has run its course. Elsewhere on the page, in The Morning Line, I’ve implied that the selloff could be the beginning of the end for the ten-year-old bull market. That is my gut feeling, but I will continue as always to let the charts speak for themselves. For now, we’ll need to see a rally and then a second leg down before we can draw useful conclusions about the health of the bull market. A 0.618 correction of the massive rally leg begun in early June would bring the Dow down to 25,719. _______ UPDATE (Aug 5, 9:08 p.m.): Don’t look now, but today’s nasty plunge triggered a nice-looking ‘mechanical’ buy at 25,694, stop 24,680. You can spectate if you’d like, and that is what I am recommending. But if you interpolate the trade with real money using, say, DIA calls, be aware that the nominal theoretical risk for the cash index is a whopping 1038 points. A ‘camouflage’ set-up could provide a much cheaper way to get aboard, but you’re on your own if that is the path you choose. _______ UPDATE (Aug 6, 9:52 p.m.): The mechanical trade worked exactly as it is supposed to work, getting us long at a time and price when most traders would have been frozen with fear. The position showed a theoretical profit of $1885 per contract at the intraday high and a current gain of around $1500. No subscribers reported doing the trade, nor did I explicitly recommend it, so I am not establishing a tracking position.

The Indoos have come down hard after rallying to within an inch of an important Hidden Pivot rally target at 28,463 three weeks ago. There were two targets above it, but they should be put aside for now, until the correction — assuming that’s what it is — has run its course. Elsewhere on the page, in The Morning Line, I’ve implied that the selloff could be the beginning of the end for the ten-year-old bull market. That is my gut feeling, but I will continue as always to let the charts speak for themselves. For now, we’ll need to see a rally and then a second leg down before we can draw useful conclusions about the health of the bull market. A 0.618 correction of the massive rally leg begun in early June would bring the Dow down to 25,719. _______ UPDATE (Aug 5, 9:08 p.m.): Don’t look now, but today’s nasty plunge triggered a nice-looking ‘mechanical’ buy at 25,694, stop 24,680. You can spectate if you’d like, and that is what I am recommending. But if you interpolate the trade with real money using, say, DIA calls, be aware that the nominal theoretical risk for the cash index is a whopping 1038 points. A ‘camouflage’ set-up could provide a much cheaper way to get aboard, but you’re on your own if that is the path you choose. _______ UPDATE (Aug 6, 9:52 p.m.): The mechanical trade worked exactly as it is supposed to work, getting us long at a time and price when most traders would have been frozen with fear. The position showed a theoretical profit of $1885 per contract at the intraday high and a current gain of around $1500. No subscribers reported doing the trade, nor did I explicitly recommend it, so I am not establishing a tracking position.

DJIA – Dow Industrial Average (Last:25,820)

Posted on August 4, 2019, 5:05 pm EDT

Last Updated August 7, 2019, 9:14 pm EDT

Posted on August 4, 2019, 5:05 pm EDT

Last Updated August 7, 2019, 9:14 pm EDT