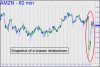

One could not ask for a more vivid picture of sleazeballs at work than the AMZN chart accompanying this tout. Thursday’s melodramatic swoon recalled Oscar Wilde’s quip, “One must have a heart of stone to read the death of little Nell without laughing.” And so it was with Amazon; for only an imbecile could have regarded the stock’s swift, 165-point dive as bearish. News out after the close fretted about the impact on Q3 earnings of Amazon’s aggressive efforts to ramp up one-day deliveries. Cutthroat play is exactly how the accompany has come to dominate the retail landscape, and plowing revenues back into operations rather than bringing them down to the bottom line is how Jeff Bezos rolls — how he got to be the richest man in the world.

One could not ask for a more vivid picture of sleazeballs at work than the AMZN chart accompanying this tout. Thursday’s melodramatic swoon recalled Oscar Wilde’s quip, “One must have a heart of stone to read the death of little Nell without laughing.” And so it was with Amazon; for only an imbecile could have regarded the stock’s swift, 165-point dive as bearish. News out after the close fretted about the impact on Q3 earnings of Amazon’s aggressive efforts to ramp up one-day deliveries. Cutthroat play is exactly how the accompany has come to dominate the retail landscape, and plowing revenues back into operations rather than bringing them down to the bottom line is how Jeff Bezos rolls — how he got to be the richest man in the world.

This method of growing a business was a supposed sore spot for years with institutional investors, who never stopped whining about the huge sums of erstwhile profits Amazon was re-investing in itself from one quarter to the next. The results speak for themselves. And yet, are investors’ memories so short that they can’t recall how DaBoyz used the phony ‘over-investing’ story to shake down the stock so that they could buy it at fire-sale prices from widows and pensioners they’d scared half to death?

Bears Will Think Twice

When the dust settled on Friday, AMZN had recouped nearly all of its losses, as any sentient observer might have predicted. The short-squeeze bounce was so vicious that bears will think twice about piling onto the stock. This is bullish, and it will help keep AMZN buoyant for the foreseeable future no matter what the news. The running start may even be sufficient to propel the stock to new record-highs above $2000. Some of those who got shaken out near Friday’s panic-stricken lows will undoubtedly be among the most eager buyers. _______ UPDATE (Oct 28, 8:25 p.m. EDT): The stock has trampolined $161, quickly recouping nearly the entire stage-managed selloff. Bears remain on the ropes and will furnish most of the buying power in the days ahead. ______ UPDATE (Oct 31, 6:15 p.m.): Although DaBoyz sandbagged buyers on the opening bar, the subsequent selloff was pretty feeble. DaBoyz evidently are unwilling to give back any of the ground they gained with the vicious short-squeeze begun off last Friday’s low. Bottom line: Bulls are obviously in control at the moment.