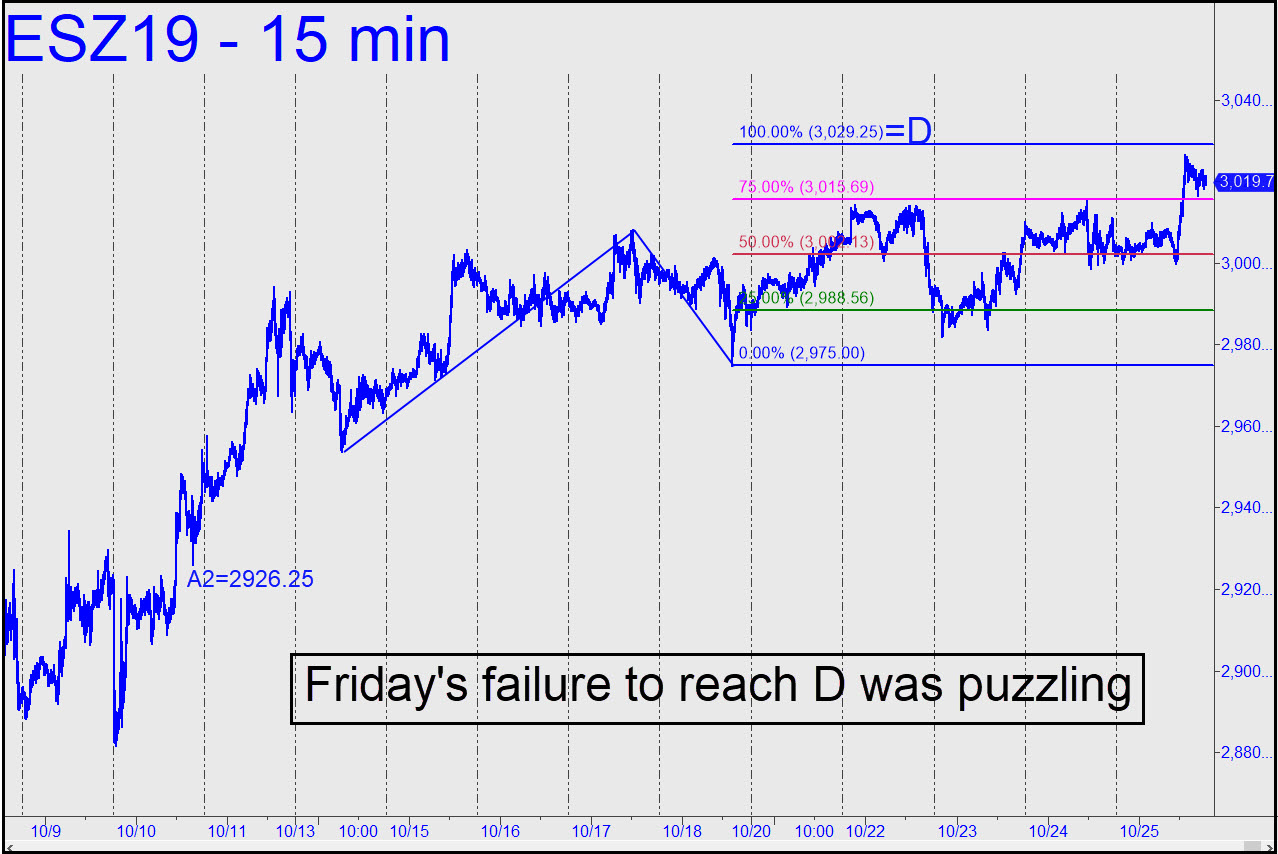

The failure of Friday’s short-squeeze to achieve the 3029.25 target we’d set for it is puzzling, especially considering how easily buyers shredded the p2 ‘secondary’ resistance at 3015.69. It still looks like an enticing spot to try shorting, especially if you’ve made money on the way up. Check the trading room for rABC coordinates, since this vehicle has attracted an active following lately. If the target gets shoved aside, look for more upside to 3056.75, a Hidden Pivot resistance calculated by sliding the point ‘A’ low down to 2926.25. The resulting pattern racked up enough precise hits last week to suggest it and its D target will not only work, but work precisely. _______ UPDATE (Oct 28, 8:21 p.m.): Buyers easily exceeded 3029.25, putting the 3056.75 target in play. _______ UPDATE (Oct 29, 4:59 p.m.): The 3056.75 target can be shorted with a stop-loss as tight as 3058.25. If it’s hit, however, you should shift your sights upward to the 3069.75 target shown here. The sharp pullback from within a millimeter of p=2962.38 lends authority to the pattern and the target. _______ UPDATE (Oct 30, 8:54 p.m.): The little wind-bag has wafted as high as 3055.00 in after-hours trading. Let’s see how long it takes for buyers to chew through the 3056.75 target, since that will determine the odds for further upside to 3069.75. Note: If 3056.75 gives way easily, that does not necessarily mean that 3069.75 will be a pushover. _______ UPDATE (Oct 31, 6:06 p.m.): Sellers swarmed the opening, carving out a low at 3020 an hour later that may or may not survive Friday nuttiness. In retrospect, a short from the 3055.00 high that would have been worth as much as $1700 per contract was possible, but only if you were glued to your trading screen an hour after the regular session ended Wednesday and used an rABC set-up like this one: 15-min, a=3035.25 at 1:00 p.m.; b=3025.00 at 2:30; ‘x’ trigger at 3052.25.

The failure of Friday’s short-squeeze to achieve the 3029.25 target we’d set for it is puzzling, especially considering how easily buyers shredded the p2 ‘secondary’ resistance at 3015.69. It still looks like an enticing spot to try shorting, especially if you’ve made money on the way up. Check the trading room for rABC coordinates, since this vehicle has attracted an active following lately. If the target gets shoved aside, look for more upside to 3056.75, a Hidden Pivot resistance calculated by sliding the point ‘A’ low down to 2926.25. The resulting pattern racked up enough precise hits last week to suggest it and its D target will not only work, but work precisely. _______ UPDATE (Oct 28, 8:21 p.m.): Buyers easily exceeded 3029.25, putting the 3056.75 target in play. _______ UPDATE (Oct 29, 4:59 p.m.): The 3056.75 target can be shorted with a stop-loss as tight as 3058.25. If it’s hit, however, you should shift your sights upward to the 3069.75 target shown here. The sharp pullback from within a millimeter of p=2962.38 lends authority to the pattern and the target. _______ UPDATE (Oct 30, 8:54 p.m.): The little wind-bag has wafted as high as 3055.00 in after-hours trading. Let’s see how long it takes for buyers to chew through the 3056.75 target, since that will determine the odds for further upside to 3069.75. Note: If 3056.75 gives way easily, that does not necessarily mean that 3069.75 will be a pushover. _______ UPDATE (Oct 31, 6:06 p.m.): Sellers swarmed the opening, carving out a low at 3020 an hour later that may or may not survive Friday nuttiness. In retrospect, a short from the 3055.00 high that would have been worth as much as $1700 per contract was possible, but only if you were glued to your trading screen an hour after the regular session ended Wednesday and used an rABC set-up like this one: 15-min, a=3035.25 at 1:00 p.m.; b=3025.00 at 2:30; ‘x’ trigger at 3052.25.

ESZ19 – December E-Mini S&P (Last:3035.50)

Posted on October 27, 2019, 5:07 pm EDT

Last Updated December 9, 2019, 12:07 pm EST

Posted on October 27, 2019, 5:07 pm EDT

Last Updated December 9, 2019, 12:07 pm EST