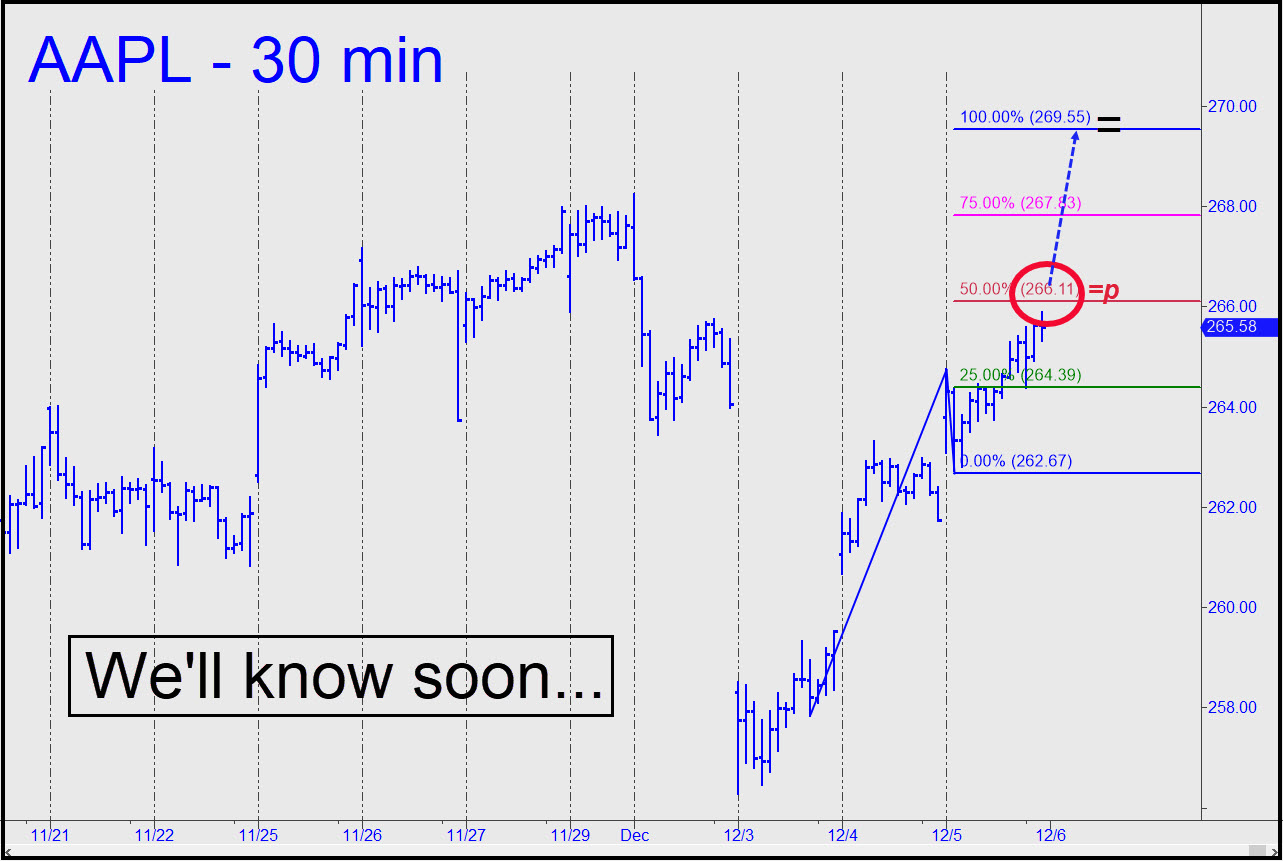

AAPL remains an excellent proxy for the bull market, so perhaps it’s a good time to look at its intraday charts, the better to judge whether December’s shaky start portends more trouble. My gut feeling is that the weakness will pass, if it hasn’t already, and that both the stock and the broad averages will soon be banging out new record highs. This scenario will become more likely if AAPL blows past the 266.11 midpoint Hidden Pivot shown in the chart to end the week. That would put it on track for a shot at D=269.55 next week, and, presumably, generate corresponding strength in the broad averages. A rendezvous with D could provide us with more information, but I expect sufficient resistance there to set up a potential ‘reverse-ABC’ short. Stay tuned to the Trading Room for timely guidance. _______ UPDATE (Dec 6, 1:49 p.m. EST): Short-covering at the opening sent AAPL into a lunatic spasm that not only demolished the 266.11 midpoint resistance, but continued higher, eventually reaching and then surpassing the 269.55 target. When it did, I put out a new target at 270.94 (“not rocket science”) in the Trading Room that appears to have stopped the rally cold. AAPL has since fallen $1.04 (!) after peaking at 271.00, six cents above my target. _______ UPDATE (Dec 8, 5:10 p.m.): We still hold eight 280 calls with a cost basis of 0.16 that expire on Friday. Offer half of them to close for 0.62, good through Tuesday. _______ UPDATE (Dec 11, 11:14 p.m.): The uptrend has been steady but not steep enough to revive our calls. We’ll play the hand we’ve got rather than speculate on more expiring options. Use 274.18 (60-min, A=261.74 on 12/4) for a target — not quite enough to make 272.50 calls @ 1.00 pay.

AAPL remains an excellent proxy for the bull market, so perhaps it’s a good time to look at its intraday charts, the better to judge whether December’s shaky start portends more trouble. My gut feeling is that the weakness will pass, if it hasn’t already, and that both the stock and the broad averages will soon be banging out new record highs. This scenario will become more likely if AAPL blows past the 266.11 midpoint Hidden Pivot shown in the chart to end the week. That would put it on track for a shot at D=269.55 next week, and, presumably, generate corresponding strength in the broad averages. A rendezvous with D could provide us with more information, but I expect sufficient resistance there to set up a potential ‘reverse-ABC’ short. Stay tuned to the Trading Room for timely guidance. _______ UPDATE (Dec 6, 1:49 p.m. EST): Short-covering at the opening sent AAPL into a lunatic spasm that not only demolished the 266.11 midpoint resistance, but continued higher, eventually reaching and then surpassing the 269.55 target. When it did, I put out a new target at 270.94 (“not rocket science”) in the Trading Room that appears to have stopped the rally cold. AAPL has since fallen $1.04 (!) after peaking at 271.00, six cents above my target. _______ UPDATE (Dec 8, 5:10 p.m.): We still hold eight 280 calls with a cost basis of 0.16 that expire on Friday. Offer half of them to close for 0.62, good through Tuesday. _______ UPDATE (Dec 11, 11:14 p.m.): The uptrend has been steady but not steep enough to revive our calls. We’ll play the hand we’ve got rather than speculate on more expiring options. Use 274.18 (60-min, A=261.74 on 12/4) for a target — not quite enough to make 272.50 calls @ 1.00 pay.

AAPL – Apple Computer (Last:270.74)

Posted on December 8, 2019, 5:02 pm EST

Last Updated December 11, 2019, 11:13 pm EST

Posted on December 8, 2019, 5:02 pm EST

Last Updated December 11, 2019, 11:13 pm EST