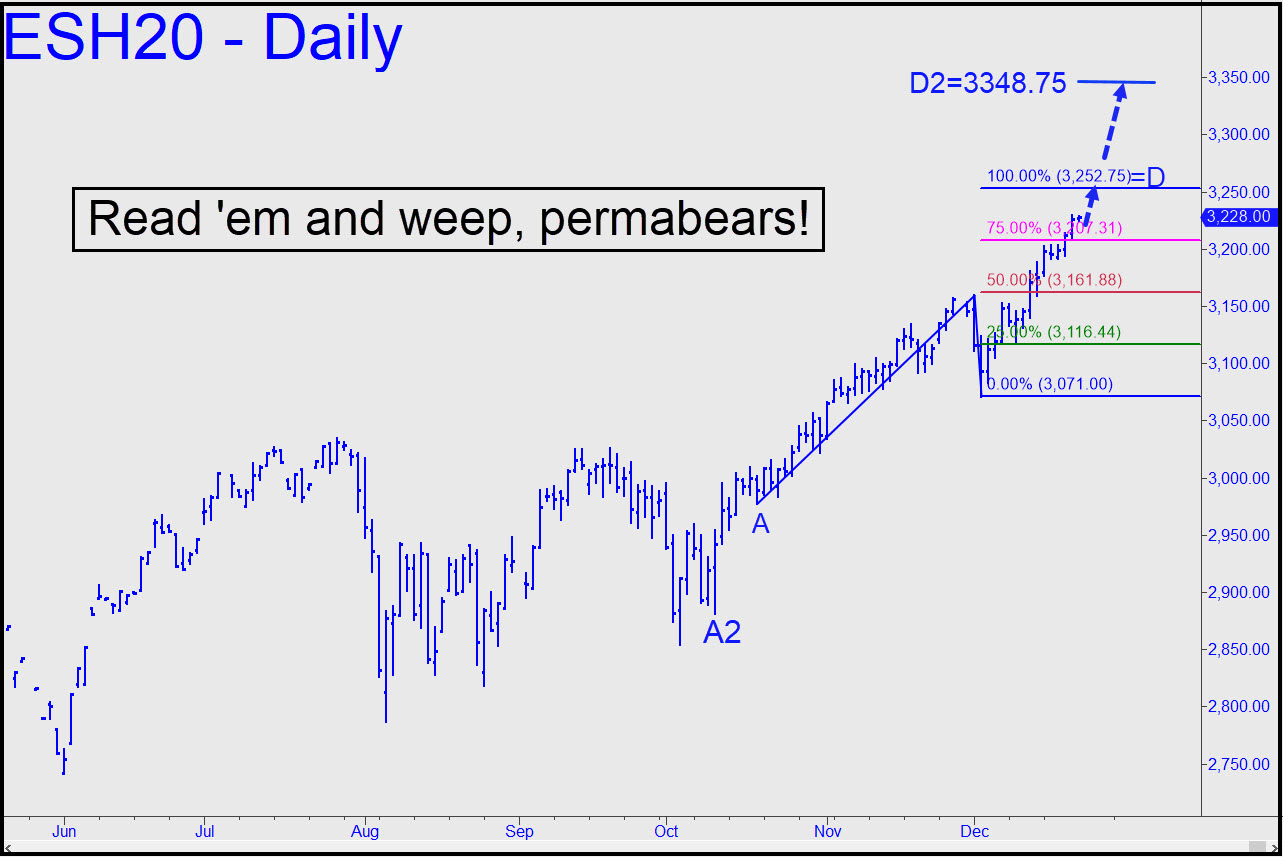

My 3229.75 target precisely contained last week’s rally, but we shouldn’t kid ourselves that it will turn out to be the Mother of All Tops. Assuming buyers make short work of this Hidden Pivot resistance, the next stop on the path to infinity would be the 3252.75 target shown. Notice that the pattern’s point ‘A’ low is just a little pisher and therefore unlikely to produce an important ‘D’ high. Sliding ‘A’ down to the much more compelling A2 would yield a weightier 3348.75 with a midpoint resistance at 3209.88 that was decisively exceeded last week. I mention it just to be on record with a seemingly absurd — at least for this permabear — prediction. My gut feeling is that we’ll eventually see the E-Minis trading at those levels, implying Trump actually is a shoe-in for reelection. Paradoxically, the only thing that could derail him would be a bear market. Even then, it’s difficult to imagine any of the Democrats, including Hillary, beating him. _______ UPDATE (Dec 26, 12:38 a.m. EST): I expect the 3252.75 resistance noted above to show stopping power, potentially short-able, but if the futures slide past it the next resistance, unnoted above, would be at 3260.50. This is the secondary (p2) Hidden Pivot of a major ABCD pattern where 0n the daily chart A=2882.00 on 10/10. _______ UPDATE (Dec 29, 8:55 p.m.): The 3252.75 target was exceeded, but only by 1.25 points. A short from my number with a tight stop could have been worth as much as $800 per contract so far. Anyone on board? I haven’t established a tracking position because no subscriber mentioned it. _______ UPDATE (Dec 30, 5:21 p.m.): This pattern produced an rABC trade Monday from p=3128.88 that could have been worth as much as $350 per contract. The 3205.75 target remains viable for whatever purpose you might choose as the markets slow down to a year-ending crawl.

My 3229.75 target precisely contained last week’s rally, but we shouldn’t kid ourselves that it will turn out to be the Mother of All Tops. Assuming buyers make short work of this Hidden Pivot resistance, the next stop on the path to infinity would be the 3252.75 target shown. Notice that the pattern’s point ‘A’ low is just a little pisher and therefore unlikely to produce an important ‘D’ high. Sliding ‘A’ down to the much more compelling A2 would yield a weightier 3348.75 with a midpoint resistance at 3209.88 that was decisively exceeded last week. I mention it just to be on record with a seemingly absurd — at least for this permabear — prediction. My gut feeling is that we’ll eventually see the E-Minis trading at those levels, implying Trump actually is a shoe-in for reelection. Paradoxically, the only thing that could derail him would be a bear market. Even then, it’s difficult to imagine any of the Democrats, including Hillary, beating him. _______ UPDATE (Dec 26, 12:38 a.m. EST): I expect the 3252.75 resistance noted above to show stopping power, potentially short-able, but if the futures slide past it the next resistance, unnoted above, would be at 3260.50. This is the secondary (p2) Hidden Pivot of a major ABCD pattern where 0n the daily chart A=2882.00 on 10/10. _______ UPDATE (Dec 29, 8:55 p.m.): The 3252.75 target was exceeded, but only by 1.25 points. A short from my number with a tight stop could have been worth as much as $800 per contract so far. Anyone on board? I haven’t established a tracking position because no subscriber mentioned it. _______ UPDATE (Dec 30, 5:21 p.m.): This pattern produced an rABC trade Monday from p=3128.88 that could have been worth as much as $350 per contract. The 3205.75 target remains viable for whatever purpose you might choose as the markets slow down to a year-ending crawl.

ESH20 – March E-Mini S&P (Last:3223.25)

Posted on December 22, 2019, 6:58 pm EST

Last Updated December 30, 2019, 5:26 pm EST

Posted on December 22, 2019, 6:58 pm EST

Last Updated December 30, 2019, 5:26 pm EST