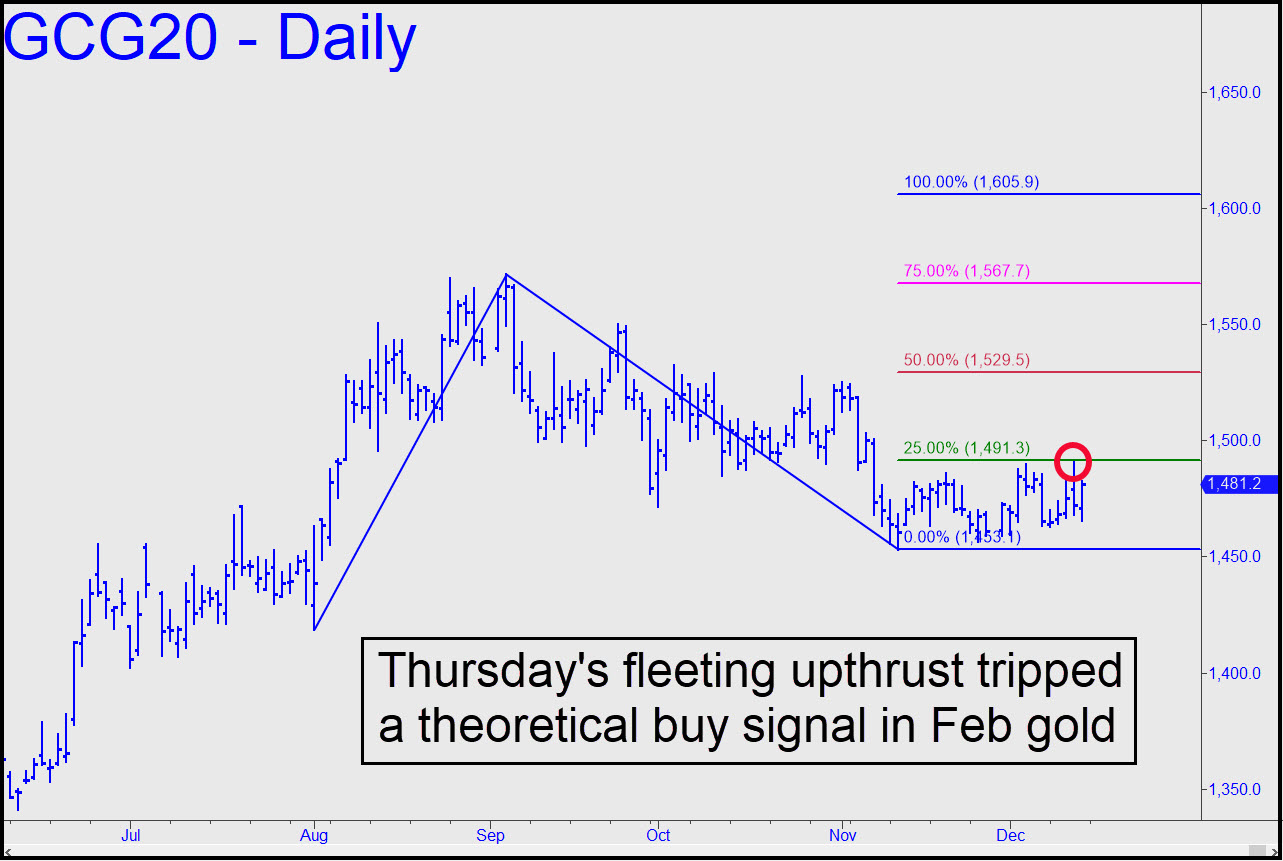

Thursday’s fleeting upthrust tripped a theoretical buy signal at the green line. Ordinarily it would be easy to overlook or ignore it, since buy signals since late August have come to naught. However, gold’s price action has been so tedious and frustrating in the interim that we should take extra care to avoid missing the turn when it comes, especially since the impulsive thrust that occurred last summer was so powerful and promising. Most immediately, we’ll use p=1529.50 as a minimum upside objective and trade it aggressively. In practice, this will mean looking for rABC and ‘mechanical’ setups in charts of small degree. Stay tuned to the Trading Room if you’re interested. _______ UPDATE (Dec 23, 6:22 p.m. EST): The futures are headed most immediately to 1497.30 (60-min, A=1459.80 in 12/2 at 4:00 a.m.; B=1491.60 (12/12). I expect a stall, possibly tradeable, within two ticks of the target. But if buyers blow past it, that would shorten the odds of reaching p=1529.50, my current minimum objective in a larger pattern. ________ UPDATE (Dec 26, 12:45 a.m.): Buyers handled the 1497.30 resistance with ease, all but clinching more upside to the p=1529.50 target noted above. It was first broached here 11 days ago with Feb Gold trading nearly $40 lower. An easy push through it would shift our attention to the pattern’s ‘D’ target at 1605.90. This number seemed like pie-in-the-sky when the buy signal triggered on December 12, but it is growing less farfetched by the day. ________ UPDATE (Dec 31, 4:43 a.m.): The futures have hit 1529.00 tonight, effectively fulfilling the target given above. A two-day close above this Hidden Pivot resistance, or an intraday spike to around 1538, would shorten the odds of a further rally to 1605.90. ______ UPDATE (Jan 5, 10:24 p.m.): Tensions with Iran have spiked gold to 1590.90 tonight. The 1605.90 target remains theoretically viable, but if you’ve been long and are playing it by the book, a ‘dynamic’ (i.e., shrinking) trailing stop would have taken you out of your position at 1585.90. This type of stop-loss is designed to keep risk:reward constant at 1:3 as a target is approached. Thus, when the futures were peaking at 1590.90, with exactly $15 of theoretical upside potential remaining, a dynamic stop equal to a third of that, or $5, would have obtained, putting the stop automatically at 1585.90 (and, to further the example, with the stock at 1596.90 — implying $9 of remaining, theoretical profit potential — your stop-loss would have migrated upward by $3, to 1593.90). _______ UPDATE (Jan 6, 10:52 p.m.): Expect bullion to remain under pressure as Wall Street continues to flout Iran’s threats of revenge. Relief for precious metals will come when the short-squeeze on stocks has strangled the last bear, perhaps later this week. _______ UPDATE (Jan 7, 10/27 p.m.): Pushed by news of an Iranian attack on a U.S. airbase in Iraq, the futures have spiked to 1613.90 tonight, then receded sharply to a so-far retracement low at 1585.30. Exceeding so clear a target was bullish, and any pullback, however long it lasts, should be treated as a consolidation and a buying opportunity. The next Hidden Pivot resistance above lies at 1622.50, but if it too is exceeded we could see 1683.90. These numbers are derived from successively lower points ‘A’ on the daily chart at, respectively, 1402.30 (7/1) and 1341.20 (6/11).

Thursday’s fleeting upthrust tripped a theoretical buy signal at the green line. Ordinarily it would be easy to overlook or ignore it, since buy signals since late August have come to naught. However, gold’s price action has been so tedious and frustrating in the interim that we should take extra care to avoid missing the turn when it comes, especially since the impulsive thrust that occurred last summer was so powerful and promising. Most immediately, we’ll use p=1529.50 as a minimum upside objective and trade it aggressively. In practice, this will mean looking for rABC and ‘mechanical’ setups in charts of small degree. Stay tuned to the Trading Room if you’re interested. _______ UPDATE (Dec 23, 6:22 p.m. EST): The futures are headed most immediately to 1497.30 (60-min, A=1459.80 in 12/2 at 4:00 a.m.; B=1491.60 (12/12). I expect a stall, possibly tradeable, within two ticks of the target. But if buyers blow past it, that would shorten the odds of reaching p=1529.50, my current minimum objective in a larger pattern. ________ UPDATE (Dec 26, 12:45 a.m.): Buyers handled the 1497.30 resistance with ease, all but clinching more upside to the p=1529.50 target noted above. It was first broached here 11 days ago with Feb Gold trading nearly $40 lower. An easy push through it would shift our attention to the pattern’s ‘D’ target at 1605.90. This number seemed like pie-in-the-sky when the buy signal triggered on December 12, but it is growing less farfetched by the day. ________ UPDATE (Dec 31, 4:43 a.m.): The futures have hit 1529.00 tonight, effectively fulfilling the target given above. A two-day close above this Hidden Pivot resistance, or an intraday spike to around 1538, would shorten the odds of a further rally to 1605.90. ______ UPDATE (Jan 5, 10:24 p.m.): Tensions with Iran have spiked gold to 1590.90 tonight. The 1605.90 target remains theoretically viable, but if you’ve been long and are playing it by the book, a ‘dynamic’ (i.e., shrinking) trailing stop would have taken you out of your position at 1585.90. This type of stop-loss is designed to keep risk:reward constant at 1:3 as a target is approached. Thus, when the futures were peaking at 1590.90, with exactly $15 of theoretical upside potential remaining, a dynamic stop equal to a third of that, or $5, would have obtained, putting the stop automatically at 1585.90 (and, to further the example, with the stock at 1596.90 — implying $9 of remaining, theoretical profit potential — your stop-loss would have migrated upward by $3, to 1593.90). _______ UPDATE (Jan 6, 10:52 p.m.): Expect bullion to remain under pressure as Wall Street continues to flout Iran’s threats of revenge. Relief for precious metals will come when the short-squeeze on stocks has strangled the last bear, perhaps later this week. _______ UPDATE (Jan 7, 10/27 p.m.): Pushed by news of an Iranian attack on a U.S. airbase in Iraq, the futures have spiked to 1613.90 tonight, then receded sharply to a so-far retracement low at 1585.30. Exceeding so clear a target was bullish, and any pullback, however long it lasts, should be treated as a consolidation and a buying opportunity. The next Hidden Pivot resistance above lies at 1622.50, but if it too is exceeded we could see 1683.90. These numbers are derived from successively lower points ‘A’ on the daily chart at, respectively, 1402.30 (7/1) and 1341.20 (6/11).

GCG20 – February Gold (Last:1593.40)

Posted on December 15, 2019, 5:09 pm EST

Last Updated January 7, 2020, 10:34 pm EST

Posted on December 15, 2019, 5:09 pm EST

Last Updated January 7, 2020, 10:34 pm EST