Friday’s subdued rally had more than a faint whiff of distribution about it. DaBoyz had shorts on the run in the early going, with the Dow up about 230 points in the first hour. But instead of reaming bears a new orifice as we might have expected, the erstwhile Masters of the Universe struggled merely to maintain altitude and eventually had to close the broad averages well off their intraday highs.

Friday’s subdued rally had more than a faint whiff of distribution about it. DaBoyz had shorts on the run in the early going, with the Dow up about 230 points in the first hour. But instead of reaming bears a new orifice as we might have expected, the erstwhile Masters of the Universe struggled merely to maintain altitude and eventually had to close the broad averages well off their intraday highs.

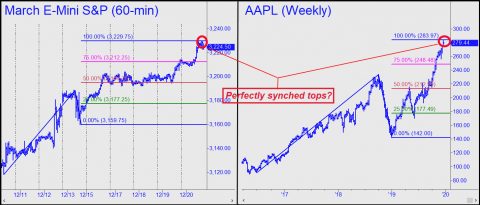

If you took a short position over the weekend there were some encouraging signs. For one, AAPL hit a 283.97 rally target that Rick’s Picks has been drum-rolling since March, when the stock was selling for around 180. The actual high at 283.54 occurred on a dubious spike just ahead of the opening bell. The upthrust turned into a bull trap when AAPL sold off $5 intraday and never recovered. The high stands to be a potentially important one for the bull market, since AAPL is the most popular stock in institutional portfolios. If it has hit a ceiling, then so has the stock market.

Rally Outrunning Earnings

The second encouraging sign for those who faded the rally was a top in the E-Mini S&Ps at 3229.50 that missed the Hidden Pivot rally target shown in the chart by a single tick. It had been sent out to subscribers the night before. Will these coinciding, fleeting peaks mark an important top? We could find out soon if shares head south on Monday and the decline gains momentum as the holiday-shortened week wears on. But even if new record highs are coming, a correction at this point would be constructive, since it would quell feverish buying that has driven equity prices much higher without any corresponding growth in earnings. _______ UPDATE (Dec 23, 6:30 p.m.): The rally is stuck in a quantum warp recalling Heisenberg’s uncertainty principle: the more exactly the position is determined, the less known the momentum. We have some beautifully precise Hidden Pivot targets, particularly in bellwether AAPL, and a compelling trendline in the Indoos, to provide theoretical stopping power at these levels. Unfortunately, buyers are not showing much respect for our “technicals,” let alone fear. On balance, the small put position in AAPL that some subscribers have taken will have to suffice to hold our interest and attention as the holiday-shortened week slogs on. If the week ends with stocks having done nothing, it is only because the herd confidently expected “something” to happen.

LOL!

The stock market action is just the .01% using the Federal Reserve that they own (through the member banks) to take all the public corporations worth owning private.

The concentration of wealth is not going to stop until they own or control everything.

So for right now, the Oligarch Orcas that are devouring everything in sight, are nice enough to let we, the deplorable seagulls, pick up a few scraps from their feast!

Who knows how long that will last for us!

In a more interesting political development, it remains to be seen if POTUS Trump will be nimble enough to Huey Long the hapless Dimocrats for their Impeachment farce.

It seems to have put some iron in the backbones of the RINOS in the Senate and the House, especially after the Dims “Members Only” secret tribunal in the basement of the Capitol building.

And now an even bigger opportunity has presented itself in Virginia with just about all the County Sheriffs championing the Second Amendment Sanctuary revolt against the loose cannon State government.

The NRA types in the Old Dominion State have their heads down, and their blood up over all this.

And they are getting a lot of support from like thinking folks in other States!

If Trump can resist his usual shooting from the hip Tweets, he can sew up the 2020 election by continuing with his Impeachment meme of “They aren’t after me, they are after you!”, and present himself as the Champion of the Bill of Rights, especially the 2nd Amendment.

I hope he can calm down for once and channel Richard Nixon’s Silent Majority well thought out campaign!

To be continued!