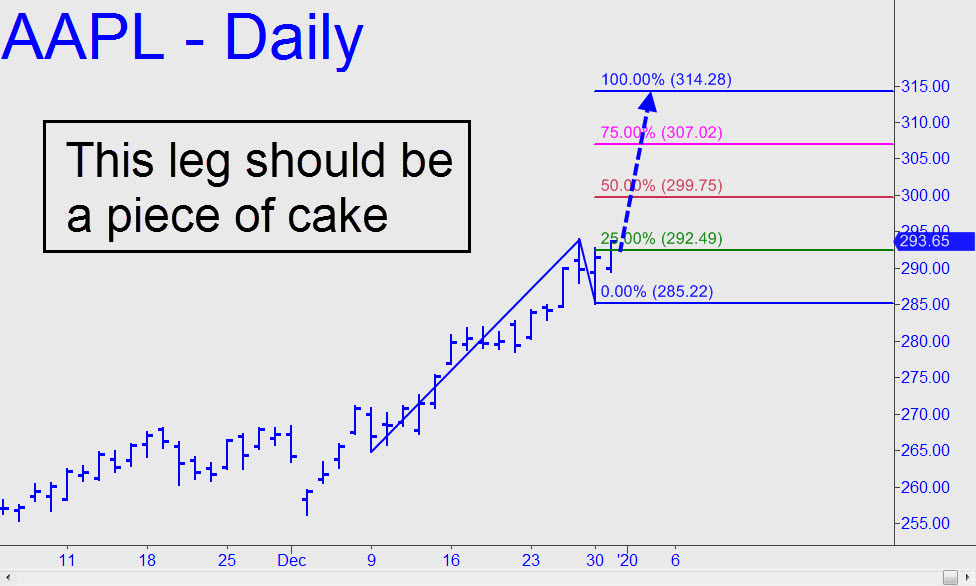

We continue to focus on AAPL’s short-to-intermediate-term prospects, since, as long as it is headed higher, the broad averages will be moving in the same direction. It is the most popular stock in the world right now, and all of the “experts” seem quite certain that it is going to the moon in 2020. These geniuses will get no argument from me, since even the most daunting Hidden Pivot resistances have failed to slow the stock down for more than a day or two. At the moment, having chomped through granite around $294, AAPL looks bound for the 314.28 target shown. The midpoint pivot at 299.75 is all but guaranteed to effect tradeable resistance, but don’t expect it to last for long. _______ UPDATE (Jan 2, 1:20 p.m. EST): The trade-desk chimpanzees are out in force today, kicking off the New Year with the only trick they know: buying AAPL hand-over-fist. How courageous! The stock’s stall at exactly p=298.50 implies that this pattern, with a 311.77 target, is the one to use to trade this lunatic-powered gas-bag. Earlier, I’d suggested calendar spreading the 315 strike, and that’s still not a bad way to go. If anyone puts up an rABC in the Trading Room to get aboard, I’d be happy to vet it. _______ UPDATE (Jan 2, 6:42 p.m.): Check my 14:10 post in the Trading Room for details of a butterfly spread I’ve recommended. ______ UPDATE (Jan 5, 10:09 p.m.): AAPL has opened firm Sunday night, barely dipping beneath Friday’s closing price so far. Even so, we should expect DaBoyz to take the stock down at least a point or two, since they have a good opportunity to buy it at a discount. I’ll post a new strategy for playing a rally to 311.97 when the stock appears to be bottoming. I’ll also mention an alternative target at 309.16 that could alter our strategy. On the 60-minute chart, it has these coordinates: A=215.13 on 10/3; B=268.00 on 11/19; p=282.73. ______ UPDATE (Jan 6, 10:41 p.m.): AAPL behaved as expected, dipping fully five points on the opening bar. It turned out to be a bear trap orchestrated by the world-class sleazeballs who handle this stock. I now like the 309.16 target even more than the ones at 311.97 and 314.28. (They both remain viable nonetheless.) I would encourage shorts, using near-term, just-out-of-the-money puts, with the stock trading 0.10 to 0.20 below the target. It can also be used to short the S&Ps or DIA. Here’s the chart. _______ UPDATE (Jan 7, 10:21 p.m.): Tonight’s avalanche has caused little technical damage so far, having failed to push AAPL beneath any external lows. The first important one lies at 285.22, so let’s set an alert there. ______ UPDATE (Jan 8, 9:40 p.m.): AAPL has rebounded as expected. Use the 309.16 target to get short as described in the Jan 6 update above. ______ UPDATE (Jan 9, 11:06 a.m.): Su-prize su-suprize. A ferocious short-squeeze has gapped AAPL up to the 309.16 target this morning, and some subscribers evidently were able to make hay with it. The stock has exceeded the pivot by just 30 cents so far, and I expect a correction imminently, but treat it as you would a rabid badger if shorting. The steepness of the uptrend reflects the institutional mindset that has converged on the world’s most lucrative one-way trade. They are geniuses, of course. _______ UPDATE (Jan 9, 9:32 p.m.): I’ve flagged a 314.28 target in The Morning Line that buyers are unlikely to chomp through as easily as they did 309.16, a Hidden Pivot resistance that has produced only a shallow pullback so far. _______ UPDATE (Jan 15, 5:24 p.m.): Turns out a subscriber actually did manage to get short at the top, buying 20 June 250 puts for 3.05. I won’t record this as an official position, since he did not follow my explicit recommendation. However, I will provide tracking guidance as follows: Offer 20 June 245 puts short for 3.55, good through Friday.

We continue to focus on AAPL’s short-to-intermediate-term prospects, since, as long as it is headed higher, the broad averages will be moving in the same direction. It is the most popular stock in the world right now, and all of the “experts” seem quite certain that it is going to the moon in 2020. These geniuses will get no argument from me, since even the most daunting Hidden Pivot resistances have failed to slow the stock down for more than a day or two. At the moment, having chomped through granite around $294, AAPL looks bound for the 314.28 target shown. The midpoint pivot at 299.75 is all but guaranteed to effect tradeable resistance, but don’t expect it to last for long. _______ UPDATE (Jan 2, 1:20 p.m. EST): The trade-desk chimpanzees are out in force today, kicking off the New Year with the only trick they know: buying AAPL hand-over-fist. How courageous! The stock’s stall at exactly p=298.50 implies that this pattern, with a 311.77 target, is the one to use to trade this lunatic-powered gas-bag. Earlier, I’d suggested calendar spreading the 315 strike, and that’s still not a bad way to go. If anyone puts up an rABC in the Trading Room to get aboard, I’d be happy to vet it. _______ UPDATE (Jan 2, 6:42 p.m.): Check my 14:10 post in the Trading Room for details of a butterfly spread I’ve recommended. ______ UPDATE (Jan 5, 10:09 p.m.): AAPL has opened firm Sunday night, barely dipping beneath Friday’s closing price so far. Even so, we should expect DaBoyz to take the stock down at least a point or two, since they have a good opportunity to buy it at a discount. I’ll post a new strategy for playing a rally to 311.97 when the stock appears to be bottoming. I’ll also mention an alternative target at 309.16 that could alter our strategy. On the 60-minute chart, it has these coordinates: A=215.13 on 10/3; B=268.00 on 11/19; p=282.73. ______ UPDATE (Jan 6, 10:41 p.m.): AAPL behaved as expected, dipping fully five points on the opening bar. It turned out to be a bear trap orchestrated by the world-class sleazeballs who handle this stock. I now like the 309.16 target even more than the ones at 311.97 and 314.28. (They both remain viable nonetheless.) I would encourage shorts, using near-term, just-out-of-the-money puts, with the stock trading 0.10 to 0.20 below the target. It can also be used to short the S&Ps or DIA. Here’s the chart. _______ UPDATE (Jan 7, 10:21 p.m.): Tonight’s avalanche has caused little technical damage so far, having failed to push AAPL beneath any external lows. The first important one lies at 285.22, so let’s set an alert there. ______ UPDATE (Jan 8, 9:40 p.m.): AAPL has rebounded as expected. Use the 309.16 target to get short as described in the Jan 6 update above. ______ UPDATE (Jan 9, 11:06 a.m.): Su-prize su-suprize. A ferocious short-squeeze has gapped AAPL up to the 309.16 target this morning, and some subscribers evidently were able to make hay with it. The stock has exceeded the pivot by just 30 cents so far, and I expect a correction imminently, but treat it as you would a rabid badger if shorting. The steepness of the uptrend reflects the institutional mindset that has converged on the world’s most lucrative one-way trade. They are geniuses, of course. _______ UPDATE (Jan 9, 9:32 p.m.): I’ve flagged a 314.28 target in The Morning Line that buyers are unlikely to chomp through as easily as they did 309.16, a Hidden Pivot resistance that has produced only a shallow pullback so far. _______ UPDATE (Jan 15, 5:24 p.m.): Turns out a subscriber actually did manage to get short at the top, buying 20 June 250 puts for 3.05. I won’t record this as an official position, since he did not follow my explicit recommendation. However, I will provide tracking guidance as follows: Offer 20 June 245 puts short for 3.55, good through Friday.

AAPL – Apple Computer (Last:311.48)

Posted on January 1, 2020, 6:45 pm EST

Last Updated January 15, 2020, 5:25 pm EST

Posted on January 1, 2020, 6:45 pm EST

Last Updated January 15, 2020, 5:25 pm EST